Treasury yields corrected overnight, amid fresh caution on US-Sino trade talks and Brexit developments, while JGBs moved higher as Japanese markets caught up with developments following a long weekend.

US futures are cautiously moving higher after they declined overnight, amid the trade news that China wants to hold more talks before signing even a partial trade deal with the US and developments in the Middle East. Turkey’s offensive also remains in focus as the US administration imposed sanctions and sharply increased tariffs on steel while calling for an immediate end to moves. Vice President Pence is being dispatched to the Middle East and there is concern over US nuclear bombs stationed at a Turkish airbase.

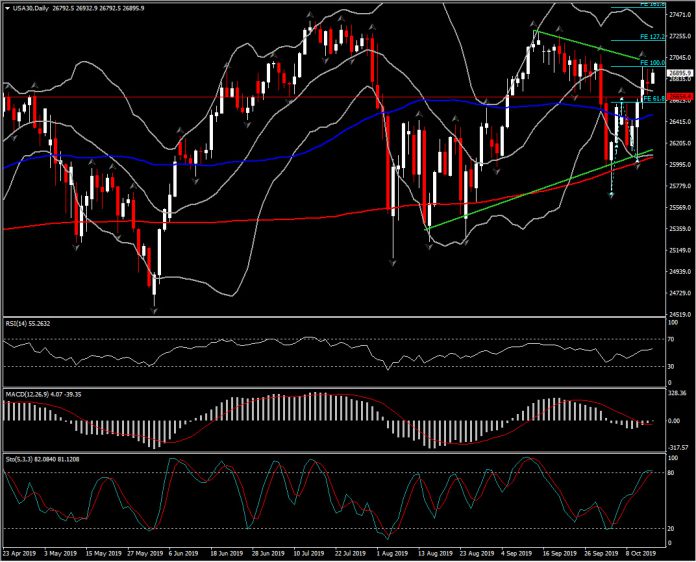

So far, US futures are up 0.3-0.5% ahead of the first batch of big bank earnings reports that will start to roll in today. USA500 is up above the Pivot 2,975 level, USA100 posts gains for a fifth consecutive day, while USA30 retests Friday’s key resistance above 26,938.

The USA30 holds for a third day above an old Support range (seen also from September’s supply), i.e. 26,654-26,715 (20-day SMA). The decisive incline seen since last week, after the rebound from 26,000 low, and currently the northwards move above 20-day SMA could turn DOW’s outlook into a bullish one. However, the asset needs to break the upper line of the descending triangle seen since September 12 (i.e. 27,000-27,014 area), in order to confirm the shift of wheel to bulls. This comes with indicators presenting improvement as well, with RSI above neutral, Stochastic moving higher looking ready to post a bullish cross and MACD lines reading to turn positive. On the break of the above resistance band, asset could retest July’s peak and up to 161.8 Fib. extension, i.e. at 27,400- 27,530 area. Immediate Support could be found in the bullish cross of 20- and 200-period SMA in the 4-hour chart, at 26,716. For now any weakness suggest a correction of the nearly 2-week rally.

Elsewhere, European futures also moving higher in tandem with US futures, after a mixed session in Asia. A BBC report suggesting that the EU is contemplating another special EU summit to ‘get a deal done’ helped to lift Brexit optimism. Whether any deal will get backing in the still divided parliament in Westminster remains to be seen, but at least there still seems to be movement in the talks and GER30 and UK100 futures have post gains of currently 0.4% and 0.3% respectively.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.