GBPUSD

The Dollar has found its feet after coming under pressure yesterday, although the AUDUSD still managed to eke out a fresh one-month high, at 0.6838, despite an ongoing sputtering price action in risk-wary global stock markets. EURUSD has been holding a narrow range around 1.1120-30, below the seven-week high that was seen yesterday at 1.1139, and USDJPY has settled above yesterday’s two-day low at 108.45.

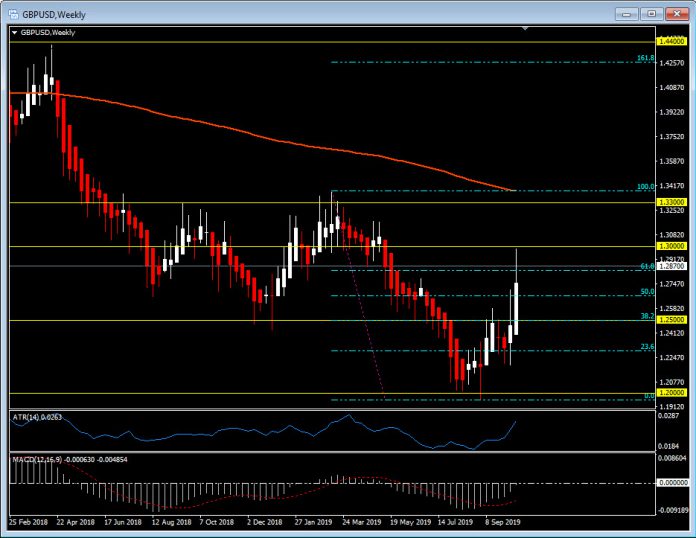

The Pound has been lodged in narrow ranges so far today after some high volatility in recent days. Regarding Brexit, the major focus in the UK now is on Saturday’s parliamentary vote on PM Johnson’s deal with the EU on divorcing terms. It’s a tough call as some of the key members that Johnson will be relying on, including from the the ERG faction of his Conservative Party, have not indicated which way they will vote. It’s also clear that Johnson will be needing some Labour members to vote for his deal. EU states didn’t do Johnson any favours by leaving the door open to a further Brexit delay (overruling Juncker’s call for no further extension). Cable yesterday hit a five-month high at 1.2990 before dropping back sharply to a 1.2757 low, subsequently settling in the 1.2800s.

A win for Johnson and Cable could rally to beyond the 2019 high at 1.3300, through the 200-week moving average at 1.3500 towards 1.4000 and the 2018 high of 1.4400. A defeat and 1.2500 and 1.2200 could be tested quickly too, as uncertainty increases. The Brexit deal is a “harder” version of Mrs May’s deal that was rejected three times by UK MPs. However, a mixed bag of hard line Brexiteers, expelled Tories and Labour rebels hold the key and could see the PM over the line. Although the DUP leadership said yesterday, they would be voting against the deal, a lot can change in 24 hours.

A defeat for Johnson would trigger a letter being sent to Brussels for an extension of the Brexit deadline process to January 31 2020, something the PM has consequently said he does not want to and will not do, but at the same time he has also said he will comply with the law. The UK Parliament sits on a Saturday for only the fifth time, previous Saturday sittings involved the outbreak of World War II, the Suez Crisis and the last time in 1982 to debate the invasion of the Falkland Islands.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.