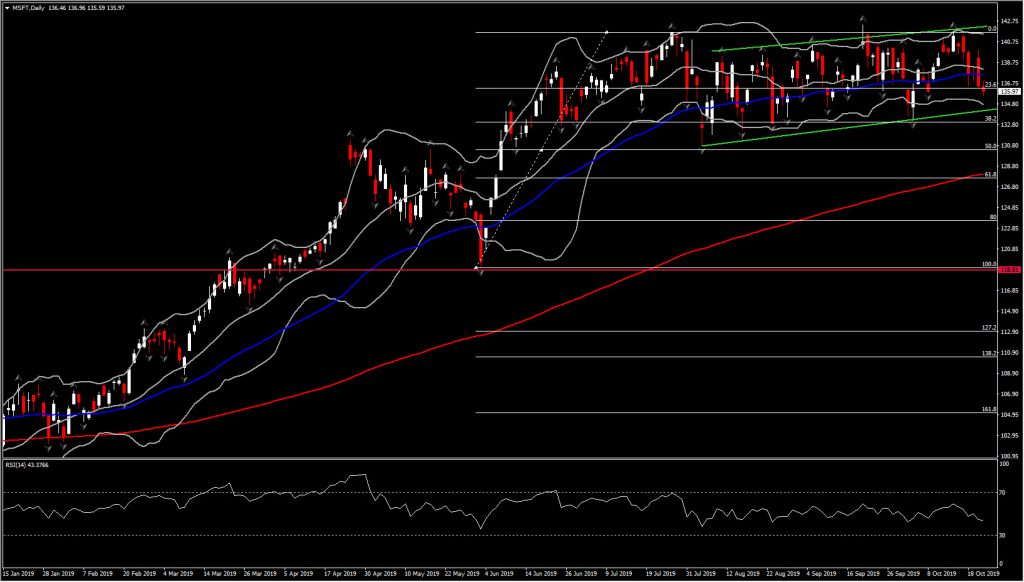

Microsoft and ebay will be the first to release their third quarter earnings for 2019 after today’s closing bell on Wall Street. Microsoft shares, found ground in August at around $130.70-$142.00 area, after moving lower from record highs in July.

Will the world’s largest company by market cap manage to reach analysts’ expectations for its fiscal quarter ending September 2019?

The key figures to be reviewed today will be growth in commercial cloud revenue, as the trillion company transitioned successfully its Office and Windows franchises to a subscription model, while getting stronger on its Cloud business. Microsoft’s new cloud computing technology, Azure (competitor to Amazon’s AWS), has seen a remarkable growth, as in Q4 Azure revenue surged 64%, affirming its position as the company’s fastest-growing segment. Azure along with Office 365 Commercial, and Dynamics 365, represents the company’s most important catalysts for Microsoft’s revenue growth. Hence investors will take a closer look on Microsoft’s cloud growth and whether it will continue or has started moderating.

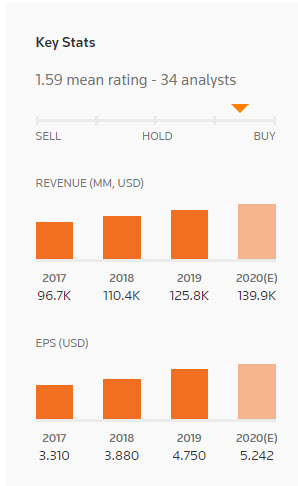

Microsoft’s consensus recommendation is “buy to strong buy”, corresponding to the majority of the consensus recommendation from Reuters, out of 34 analyst. According to Zacks Investment Research, the social network giant is expected to have $1.25 in earnings per share for the third quarter of 2019. The reported EPS for the same quarter last year was $1.14. This represents an incline over the year of 9% and an 8.7% decline since the reported EPS for the fiscal quarter ending June 2019.

Revenue is expected to be released at $32,230 million, slightly lower than the revenue for fiscal quarter ending June 2019, at $33,717 millions.

Microsoft shares are nearly $7 lower this week, as market participants are looking ahead of the fiscal Quarter ending September 2019. Markets remain cautious, waiting to see whether the global trade tensions will keep having an impact on the company’s growth and forecasts and whether Azure, which is now the leader in the cloud computing business models, will have the ability to turn a profit.

Turning to the technical side, if the company achieves accuracy with its forecast, then a positive earnings outcome without any negative surprises could attract more bulls back into the market. This could boost price action higher and hence be a small recovery of the drop so far in October. The long term outlook however remains positive, as the pair is trading in an ascending triangle and above the 38.2% Fib. level from its 6-month bottom.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.