Amazon’s earnings report is due to come out today after the market close, and the world’s third largest company by market capitalization (drifting from the second place which now belongs to Apple which is recording a value of US $1.012T in the third quarter (Q3) of 2019), is expected to experience a near quarter decline of its Earnings Per Share (EPS), compared to last year. Amazon’s market Capitalization as of October 23 is $871.67 B.

The Street consensus is $68.8 billion in revenue, with profits of $4.60 a share for the fiscal Quarter ending September 2019.

Amazon’s revenue stream is impressive: more than half of US homes have a Prime membership, while cloud and e-commerce businesses are growing. However, for this quarter the company is facing few risks that could assist in taking its profits lower. Hence, despite the fact that Amazon posted a $63,404 million revenue in the second quarter of the year, its share price declined as a result of worse than expected revenue back in July.

Unfortunately for the company, the biggest part of Amazon’s income is derived from its cloud segment. Hence, despite that Amazon Web Services (AWS), which provides cloud-computing services, posted a significant increase in both sales and operating income year after year, we have seen that it faces a slowdown of its growth. The AWS missed estimates last quarter, so it will be a key metric for investors on today’s report.

The introduction of Amazon’s One-day delivery in US and globally as well, which revolutionized the retail shopping experience, has proven costly for the company, which is currently struggling with the near term costs. In the long term however, gains are expected to beat short-term’s costs, as the number of Prime members have been spiked higher due to this. Even though Amazon’s profitability soften recently, the one-day Prime shipping along with its continuous strengthening in the cloud business, are keeping the company in a very competitive and promising position.

While Amazon appears to have a large potential for growth in the coming years, the question which begs an answer is whether, and how much incremental margin pressure Amazon will suffer from its push for same-day delivery. Also, whether these risks have already priced in on Amazon’s share price.

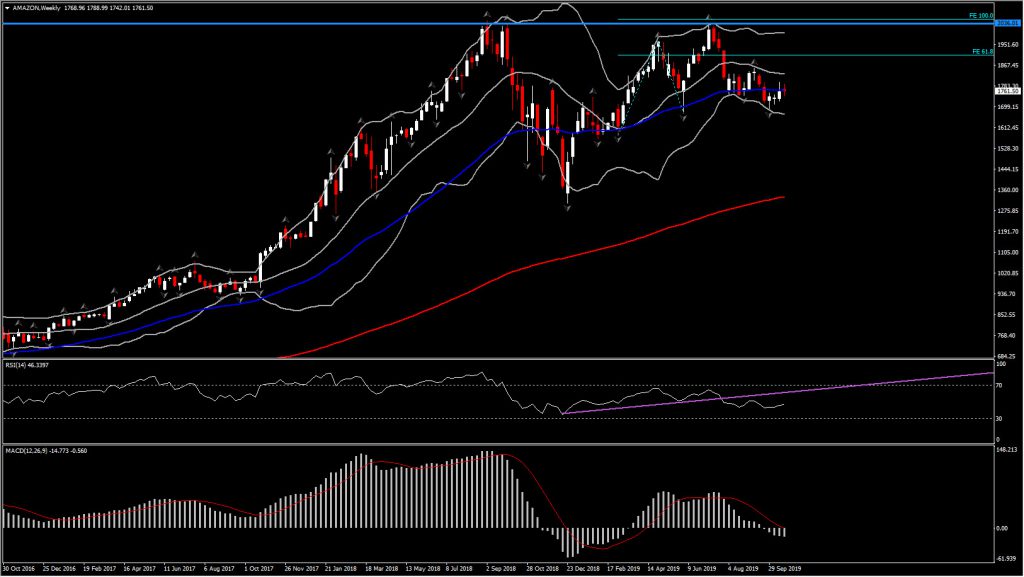

Amazon share price appears to have stalled below the $1800s the past week, ahead of the Q3 earnings report. It is currently traded 13.5% lower than record highs.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.