Money markets are showing some month-end pressures, even after the FOMC eased rates yesterday. Stocks have given back yesterday’s gains after the weak Chicago PMI report, and as the focus has shifted back to trade following a Bloomberg report that China might be balking on the trade deal, not trusting President Trump. But Trump has indicated that “China and the USA are working on selecting a new site for the signing of Phase One of the Trade Agreement, about 60% of the total deal, after APEC in Chile was canceled due to unrelated circumstances.”

That’s being ignored to some extent, though. Month-end flows are likely impacting both bonds and stocks.

USA500

The USA500 reverted 3-day gains from its 3,056 all-time high, while it has currently slipped below the 3,020 level which had been a strong Resistance in 2019, an unbreakable one for 5 months. The asset is certainly driven by negative bias in the near term outlook, however the bears will be keeping an eye on today’s close but more precisely on the week’s close, and whether that will be below the 3,000 handle. Momentum indicators are with the upside breakout, as RSI holds above neutral and MACD confirms the 2-week rally. The intraday picture, however, suggests strengthening of the negative bias as MACD turns below signal line and RSI is at 46.

XAUUSD

Gold, meanwhile, outperformed amid a safe-haven driven rally. Safe haven demand dragged gold above the $1500 barrier. All the Resistance levels we set at the start of the week have been broken, while the asset has decisively rejected the descending trendline from the August peak. The importance of a sustainable move above this trendline is that it will bring back in focus a potential spike to August highs, if it becomes real. However for now this cannot be confirmed. Intraday indicators are giving overbought signals with RSI above the overbought barrier and the actual price being outside the Bollinger bands. Daily, meanwhile, the asset is also above upper BB, so a pullback could be seen sooner or later. Next resistance is set at the latest 3 consecutive up fractals at $1,518, while Support remains at the low of the day which coincides with the 20-day SMA at $1,494.

USDJPY

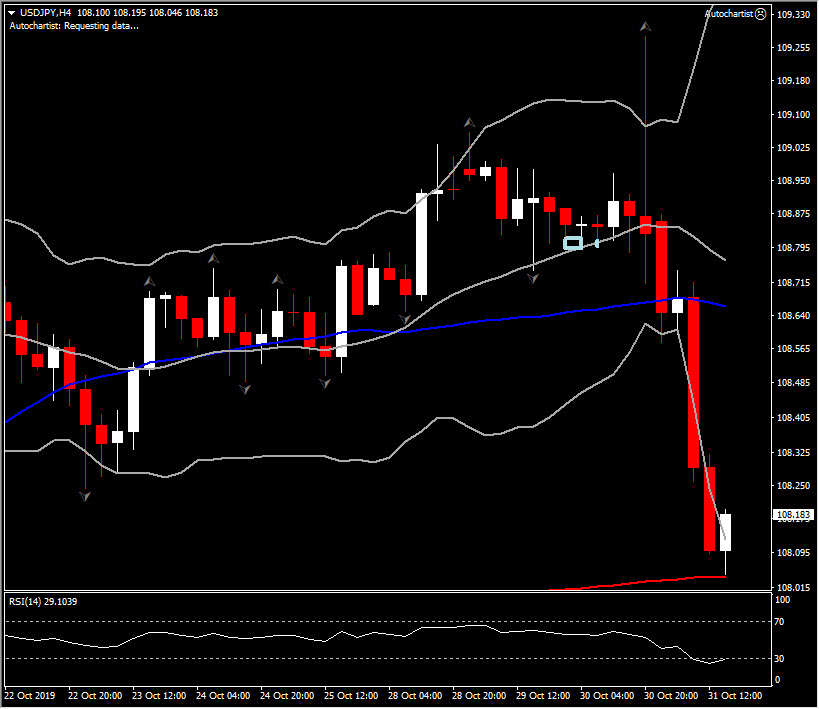

Yen safe haven buying kicked in on a Bloomberg report citing ‘in the know’ sources saying that China is pessimistic that a comprehensive and long-term trade can be made with the “impulsive” Trump, and fear that he might pull out of the pending partial agreement (which appears to have hit a snag, with Beijing objecting to the quantities of US agricultural produce that the White House is demanding China buys).

The Yen concomitantly rose, pressing USDJPY to intraday losses of nearly 0.5%, with the pair hitting a 16-day low at 108.04. The biggest movement out of the main Dollar pairings and associated cross rates have been AUDJPY and CADJPY, which are showing declines of over 0.5% at prevailing levels. The Yen has been little affected by a dovish shift in the BoJ’s policy guidance today.

Click here to access the HotForex Economic calendar.

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.