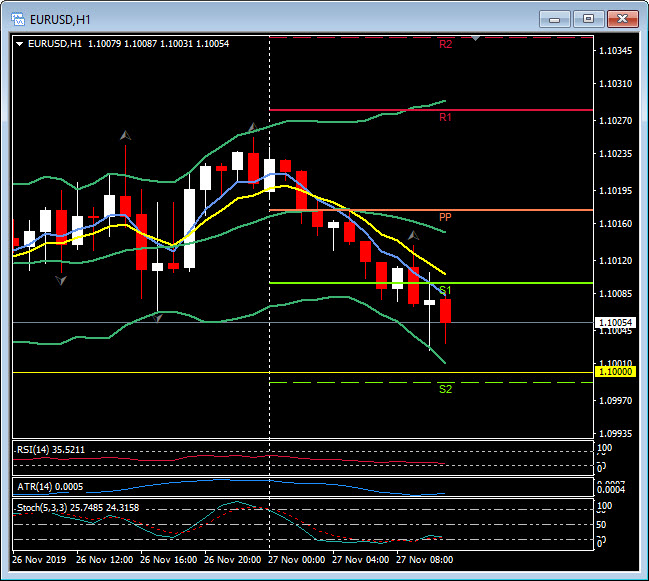

EURUSD, H1

EURUSD has printed a 13-day low of 1.1002, which sets up the pairing for a second consecutive week of decline. A broader bid in the Dollar has been in play, which picked up a measure of safe-haven demand following data showing a 9.9% y/y drop in Chinese industrial profits. The Chinese data dampened the risk-on sentiment in markets. October US data yesterday showed a fourth consecutive monthly contraction in consumer confidence and an unexpected ebb in new home sales, though confidence still remained at levels consistent with steady consumer spending, while prior-month housing data was revised up. Overall, the US economy still looks to be in a relatively good place, fitting of Fed Chair Powell’s “glass half full” characterisation earlier in the week.

In the Eurozone, confidence data over the past week showed some signs of stabilisation in the manufacturing sector, but the preliminary November PMI surveys also showed the spectre that weakness is spreading to the dominant services sector. EURUSD has been chopping around 1.1050 since early August, ranging from 1.0879 to 1.1179 over this period. The low marked a two-and-a-half year trough, the culmination of a bear trend that’s been unfolding since early 2018, from levels around 1.2500. Momentum of this trend has been waning with the Fed having cut interest rates three times since late July, though markets have now priced out further Fed easing. The Fed’s measure of the Dollar’s broad trade-weighted index is at near three-year highs. A continuation of Dollar firmness would likely keep EURUSD bias to the downside.

Conversely to the bid elsewhere for the Greenback, USDCAD edged out a five-day low at 1.3268 earlier, with the Canadian Dollar finding some support from buoyant oil prices. Front-month WTI crude prices rose over 2% from yesterday from the prior day’s lows, drawing back in on the two-month high seen last week. The rise in oil prices has been concomitant with a risk-on sentiment in global markets after President Trump said that the US and China were in the “final throes” of hammering out a “phase 1” trade deal. USDCAD remains above the eight-day low seen last Friday at 1.3254. The low was seen after BoC Governor Poloz stated that interest rates are “about right,” which was taken as a partial walk-back of recent dovish signalling from the central bank. At prevailing levels USDCAD is trading near to the midway point of a broadly sideways range that’s been seen since July 2018. More of the same looks likely, with a pivot around 1.3200, support at 1.3075 and resistance around 1.3350.

Note that US markets will be winding down into tomorrow’s Thanksgiving holiday, which will be the start of a long “bridge” weekend for many market participants in the US. Today is the last day of full trading for the month, with key US data including Durable Goods, the Second reading of GDP, PCE (the FED’s preferred measure of inflation), Spending & Income data as well as Pending Homes Sales and the weekly Crude Oil Inventories.

Join me live later on our Facebook page from 13:15 GMT as we analysis this key set of data.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.