Boris Johnson won decisive majority in the UK election. The Conservatives have already won an overall majority with the Conservatives currently at 641 seats – up 47 from the last election – while Labour is at just 203. With 648 of the 650 House of Commons seats declared, the Conservatives have 362 seats, a gain of 47 seats, versus Labour’s 203, a loss of 59 seats. This is the best Conservative Party victory since 1987. Johnson will now have a sufficiently strong majority to get the Withdrawal Agreement Bill through parliament and lead the UK out of the EU, likely by the end of January.

A transition period will then start during which nothing much will change and both sides will try to reach an agreement on the future trading relationship. Johnson has pledged that this period will end in December next year, which seems much too short a time to reach a meaningful deal, but many expect that he will go back on his word if needed.

So uncertainty on the trade front will not disappear completely, but at least the most toxic form of a no-deal Brexit seems off the table, which has seen the Sterling up by over 2% versus the Dollar, Euro and Yen (averaged) in light of the unexpectedly large win.

Other key takeaways include:

- The SNP have dominated in Scotland, winning 83% of the seats there, meaning that there will be a vigorous push for Scottish independence (justified by the fact that Scotland strongly voted for remaining in the EU in 2016);

- The Brexit Party, as expected, didn’t win a single seat, but syphoned votes away from Labour in many seats in the Midlands and the North of England;

- The size of the Conservative Party is such that, according to BBC analysis, the hardcore Brexit faction of the party will be rendered weaker, which should give PM Johnson leeway in his upcoming negotiations with the EU on a future trade deal (and will most likely extend the post-Brexit transition period beyond the end of 2020, despite his manifesto pledge not to).

Cable hit a 20-month peak of 1.3513, since settling in the lower 1.3400s, up on the mid 1.3100s pre-election levels. EURGBP hit lows last seen in July 2016. Elsewhere, the Euro, outside the case against the Pound, has rallied, being positively influenced by the UK election result, which heralds the end of Brexit uncertainty.

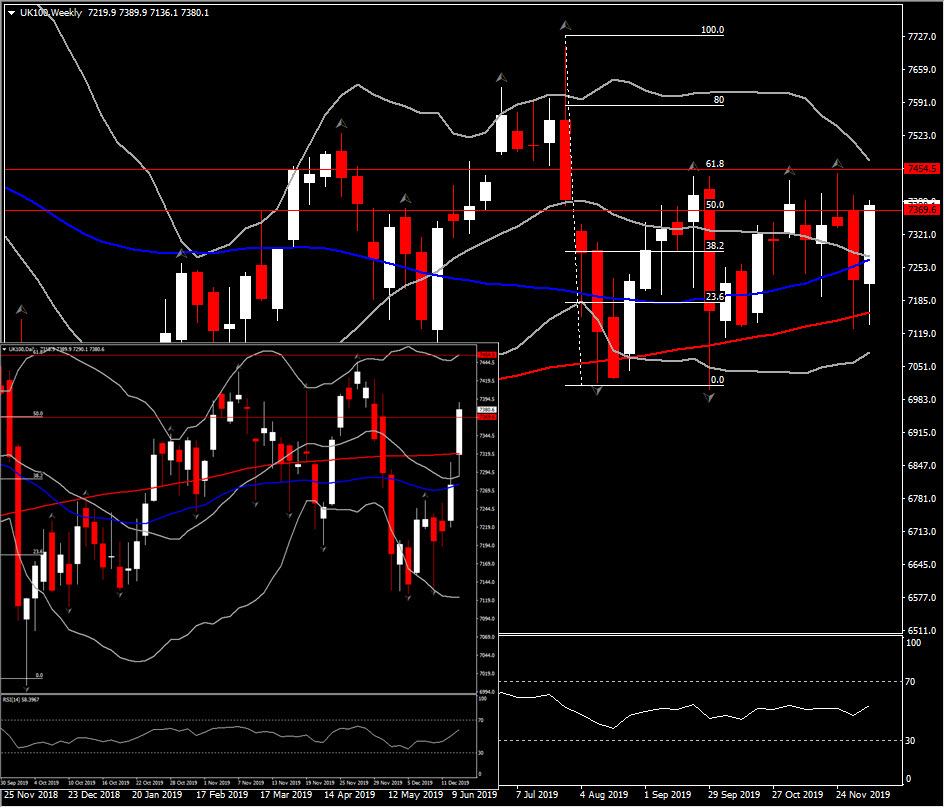

Additionally, the UK100 opened higher this morning, spiking to 7,372 from 7,290. In general the UK asset’s negative outlook has been reversed the past few days, however it will be interesting to see whether the UK100 and in general the UK’s stock market could sustain a rally far away from the 2016 levels. Despite the support from the elections last night, there is still a lot of work to be done in securing a new relationship with the EU.

As for the UK100, after the break of the midpoint from July’s drift, and the rejection of all 3 moving averages on a daily and weekly basis (20-,50-, 200- period) the next level to be watched is the 61.8% Fib. level, at 7,454.5, with some Analyst supporting that the Index could retest of the 8,000 level by the end of the year.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.