The Dollar traded steady against the Euro, Yen, and Canadian dollar, along with most other currencies, though gains versus the Pound while losing ground to the Australian and New Zealand dollars in what could be best described as being low-volume activity.

AUD, NZD: Feeling the risk-on vibe in global markets

AUD and NZD have edged higher in quiet, low volume trading. Both AUDUSD and NZDUSD printed a 10-day highs, at 0.6927 and 0.6628. Both pairings look set to enter 2020 near their recent 5- and 4-month highs. Anticipation of the US-China trade deal and recent data showing a steadying in global growth following a recent soft patch have been benefiting the antipodean commodity currencies. President Trump said over the weekend that the US and China would “very shortly” be signing off on the phase-1 trade deal, while Beijing stated earlier China that it will be lowering tariffs on a range of products, from pork and avocado, to some types of semiconductors.

|

Asset

|

Daily bias | Week’s Range |

|---|---|---|

|

AUDUSD – 0.6928

NZDUSD – 0.6627

|

Bullish |

0.6830-0.6950 0.6575-0.6660 |

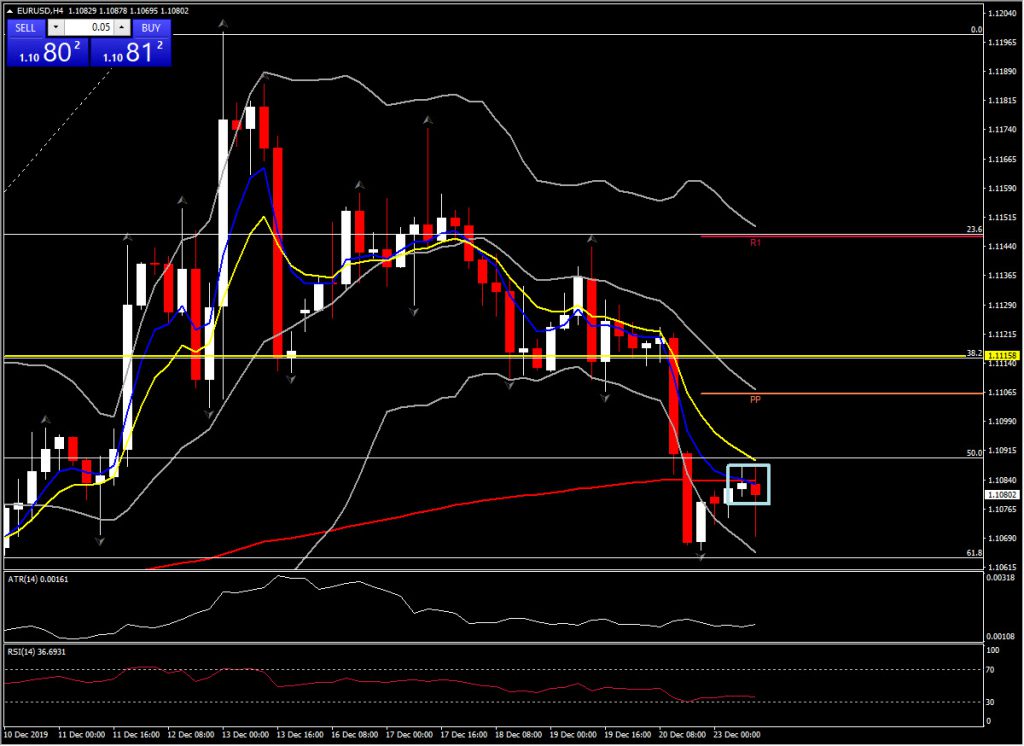

EUR: Continued to ply narrow ranges

|

Asset

|

Daily bias | Week’s Range |

|---|---|---|

|

EURUSD – 1.1074

|

Mildly Bearish | 1.1056-1.1145 |

Elsewhere, narrow ranges have prevailed. EURUSD has held in a tight rate below 1.1100, consolidating after dropping the upper 1.1100s over the last week in the immediate wake of the UK election. EURJPY and EURCHF have traded lower after seeing respective a six-month and six-week highs. EURUSD has been trending lower since early 2018, dropping from levels near 1.2500 and posting a 32-month low at 1.0879 in earlier October, the current nadir of the trend. The pair has since settled in a range marked by 1.0981 and 1.1179. The pricing out of further Fed tightening, after the central bank hiked rates three times, has taken the wind out of the sails of the dollar. The EURUSD will enter 2020 without strong directional impulse. The US economy has been holding up, while the Eurozone economy has stabilized following a soft patch.

JPY: Fed keeps USDJPY buoyant

JPY: Fed keeps USDJPY buoyant

|

Asset

|

Daily bias | Week’s Range |

|---|---|---|

|

USDJPY 109.40

|

Mildly bullish to Neutral | 109.12-109.60 |

USDJPYremained in a directionally constrained stasis in the mid 109.0s. The pair is consolidating below the 7-month high at 109.72, seen in early December, which is the culmination of a rally from the late-August low at 104.45, a three-year low. Rallying global equity markets and a pricing out of Fed easing expectations have been keeping USDJPY buoyant.

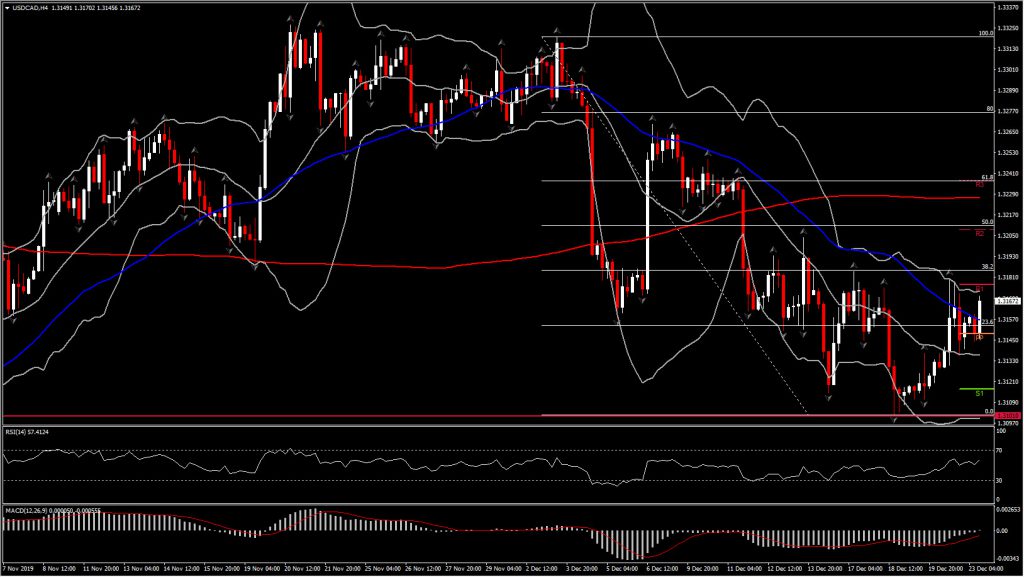

CAD: Holds above December floor

|

Asset

|

Daily bias | Week’s Range |

|---|---|---|

|

USDCAD – 1.3165

|

Bullish but Bearish in a weekly basis | 1.3100 – 1.3210 |

USDCAD has found a footing after a near 3-week phase of decline from levels above 1.3300. The pair on Friday printed a rebound-high at 1.3181, though this wasn’t enough to prevent a fourth consecutive down week being logged. The Canadian Dollar has over the last month been benefiting from positive developments on both the USMCA and US-China trade fronts. The Fed’s removing a forecast for a 25 bps hike in 2020 at its FOMC policy meeting this month also weighed on USDCAD. Another supportive factor for the Canadian currency is higher Oil prices, which up be over 10% from the lows seen in late November. USDCAD looks likely to continue to trade with a downside bias .

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.