The fears of an immediate outright war in the Mideast continue to fade after US President Trump said the phase one trade deal with China will be signed on January 15 or shortly after.

Markets look quite calmer as the focus turns more on the economic side of the world, at least so far today. In the Asia session we have seen yields moving higher and stocks traded narrowly mixed on the anticipation of the Non-Farm Payrolls today. Meanwhile, in the currency market, Yen and Loonie remain on the back foot, with antipodean currencies outperforming after the better than expected retail sales for November, which rose 0.9% m/m.

The New Zealand Dollar was supported by the Australian Dollar’s strength against all majors other than the Aussie of course. The New Zealand Dollar has been one of the top gainers in the past 3 months, with the largest gains seen against the Euro.

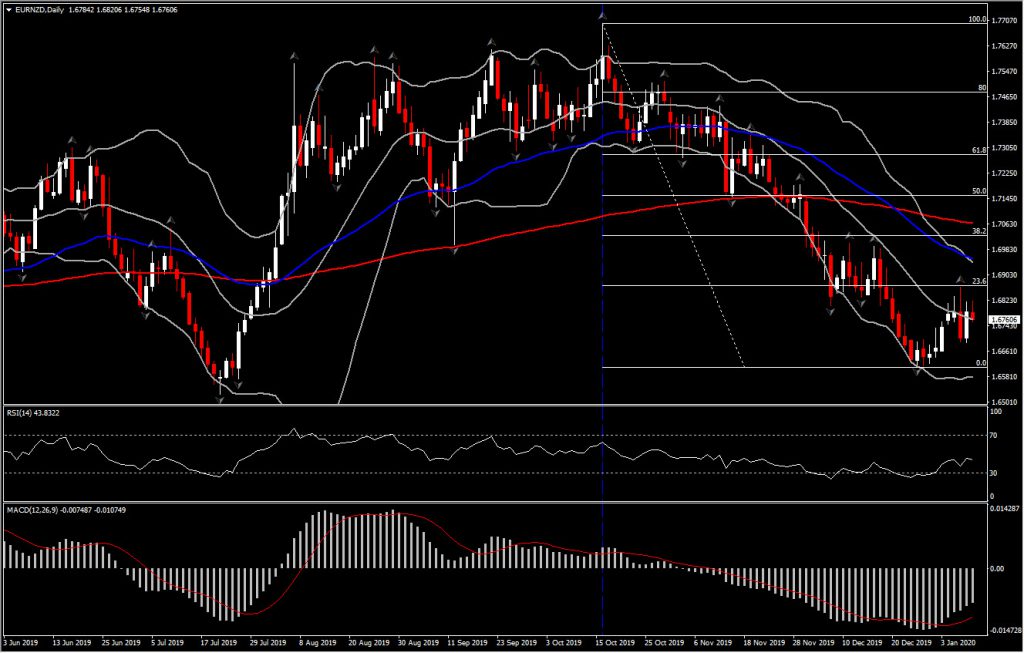

EURNZD advanced in the first 7 days of the year, however the boost did not last for long. After the 1.6900 (23.6% Fib. level from year’s peak) retest and the strong rebound yesterday above 20-day SMA, the asset pulled back again to 0.6770. This came on the back of the strong Australian retail sales but also on the confluence of December’s and the 3-month downtrend Resistance at 1.6800-1.6815 area.

According to momentum indicators however, the momentum suggests that recovery will continue for the asset despite the pressure seen so far today. The MACD lines posted a swing well above the signal line, but remain below neutral, something that presents positive bias in the medium term but keeps the long term outlook negative. The RSI holds below 50 but its return to November’s high spreads some optimism for the EURNZD future.

Hence the key levels to be watched in the medium term for EURNZD is the 1.6815 and 1.6870 to the upside, while a downside risk could be seen if the asset moves below the tweezer bottoms (Wednesday – Thursday) at 1.6889. A rally above the mentioned Resistance area could open the doors to 1.7000, while a decisive turn lower could retest December’s and July’s bottom.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.