Virus developments remain in focus as China tentatively returns to work. Many factories remain closed as the virus continues to spread and supply chain disruptions are also being felt outside of China. The official death toll now exceeds that of the SARS outbreak and there are plenty of reports suggesting that the real number of victims is much higher than official data suggests.

So far the sense seems to be that the virus will dent, but not derail, global recovery as the number of new cases may be starting to decelerate. Clearly that will depend on how quickly the virus can be brought under control.

Hence, as China has returned to work after a protracted Lunar New Year period, but quarantine measures and travel restrictions continue to impact, stock markets continued to struggled lower overnight as focus remains on virus development.

Narrow ranges have been prevailing for the most part in early week trading among the main currencies, though the Australian Dollar managed a near 0.5% gain, rebounding after hitting an 11-year low against the US Dollar on Friday. AUDUSD posted a high at 0.6707, which retraced just over half of the decline seen on Friday. Thus it seems that the 11-year bottom holds strongly.

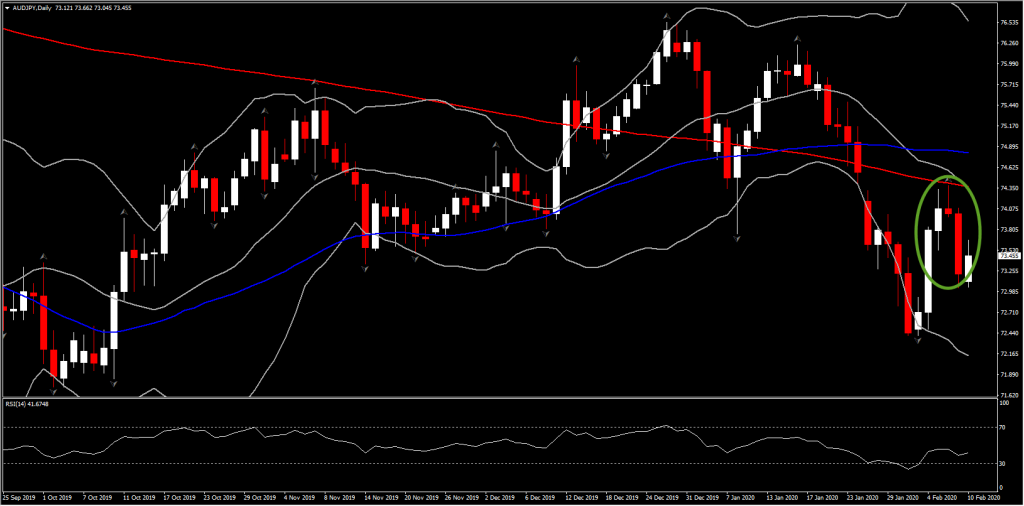

Aussie strengthened after China CPI data. On the Aussie rally and amid a largely weaker Yen, AUDJPY spiked to 73.66 overnight and it has been consolidating around it since then. However, as AUDJPY tends to be a strong indicator and predictor of future risk-on activity in global markets, it will remain in the spotlight, as any spike in concerns over the fallout from the virus epidemic will weigh on the Australian Dollar.

From the technical perspective, today’s optimisms looks temporary as AUDJPY formed an evening star on risk aversion seen on Friday. This puts the assets in a negative outlook in the medium term, with the 1-week performance being a correction in the more than a month decline.

The RSI is now around 41 and the MACD lines have flattened in the negative area, preparing for a fresh bear cross whilst Stochastic has already formed one. These all look to be lead indicators for a potential pullback of AUDJPY, if we see the asset turning below its 73.00 low again. This could open the doors towards 71.00 area.

Support holds at 73.00, while Resistance levels are at 74.00 and 74.38 (Friday’s peak). For a shift in the outlook there would need to be a move above the latter.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.