Cisco, Q4 earning report.

Cisco (CSCO), another tech giant, will report its gains and losses this afternoon after the close of the US market. The report will be for the fiscal Quarter ending Jan 2020.

The year 2019 was an amazing year for tech companies, as many believe that the main US indexes such as NASDAQ, Dow Jones and S&P 500, breaching their all-time highs with new records was because of tech companies. So far, Twitter had an expected growth, Amazon had positive reports, Apple grew more than Microsoft, and if we count Tesla (because it looks to be a mostly tech company, even if is best known for producing a car!), tech companies were just amazing.

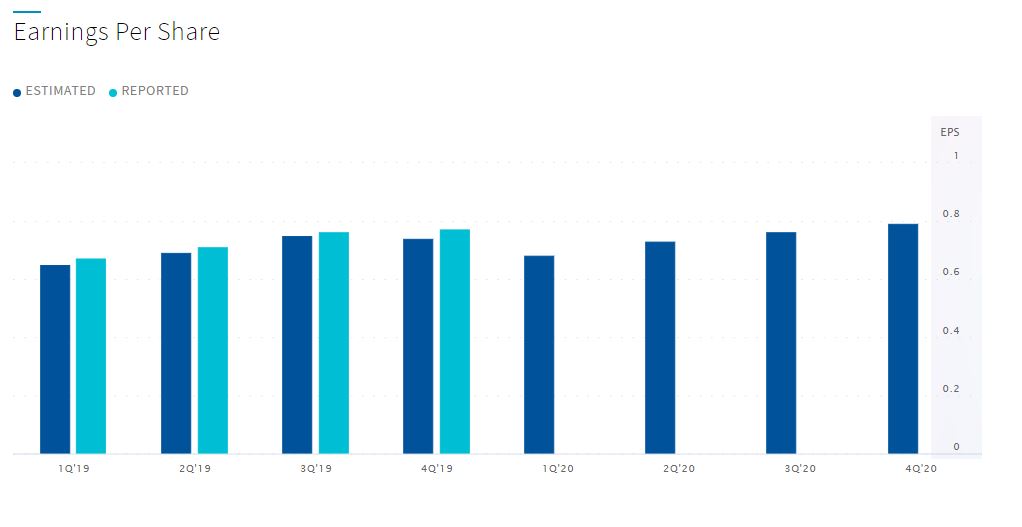

In regards to Cisco, according to Zacks Investment Research, based on 9 analysts’ forecasts, the consensus EPS forecast for the quarter is $0.68. The reported EPS for the same quarter last year was $0.67.

I just have to mention here that despite falling from over $58 to $43 in share price, in the second part of 2019, the company had positive reports in all past 4 single quarters.

Check the figure below from NASDAQ.

So far in 2020, the company’s shares have raised by 3%, however, Cisco’s withdrawal from the Mobile World Congress in Barcelona later this month and concerns about COVID-19, which may not affect this report, will probably affect later quarters, if the Chinese programs for keeping the virus from spreading, take longer than expected. As of the latest update, the Chinese officials have claimed that it will be over by April.

The best rated and selling products of Cisco in 2019 were still the Cisco ISR 4000 routers series, Catalyst 2960X switches series, IP Phone 7800 series and ASA5500 series. Although there are many new products, such as ISR900, ISR1100, Catalyst 9300 and the Firepower 2100 Series Appliances… those old men still have strong power! (medium.com) The company’s main income comes from “infrastructure platforms” and “Applications and Security” products (Cisco investor report).

Chuck Robbins and company management are trying to transform the Cisco model from a data networking and communications model to a Security, Applications and Subscription model that moves away from Routing and Switching. These changes in the management and business model got more attention especially after the US-China trade war affected their business, as it affected China’s Huawei as well. Although it is still too early to see its effect, its stock should reflect those changes.

What could make investors worry, with all the new company plans and products, is its cash balance. “Before the share repurchase “bulge” in fiscal ’19, Cisco was generating about $2.5 bl in free cash flow per quarter. Since tax reform was passed in December ’17, Cisco’s cash balance has fallen from $74 billion in January ’18 to $23 billion as of November ’19.” (Seekingalpha.com). It sounds like they are spending lots of cash to keep investors happy and interested.

Technical overview:

The all-time high Cisco stock closing price was $80.06 on March 27, 2000 and after that, was $58 in July 2019. After last July’s free fall to $43.40, in December it recovered almost 40% and crossed the 38.2% Fibo level three times, but never had a full weekly candle above.

Now, $47 is the first Support that sits at its 23.6% of Fibonacci level and 20 Weekly MA, and could easily be reached with a negative report, while with a positive report, $51 (50% of Fibo and 50 weekly MA) is key Resistance, and closing the weekly candle above this level could help the market bulls.

Click here to access the HotForex Economic Calendar

Ahura Chalki

Regional Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.