Investor confidence is shaking, resulting in quick risk-off trade. Yields are lower as equities dive, with European stock markets being sold off. GER30 and UK100 are down -1.1% and -1.6% respectively. Other than virus concerns, the news regarding the surprise resignation of British finance minister Sajid Javid today weighed further on European stock markets and EUR. This move underlined Prime Minister Boris Johnson’s desire to tighten his grip on government in a long-planned reshuffle by jettisoning a minister who refused to toe the line. The chancellor was replaced by Rishi Sunak who it is perceived would be more open to growth initiatives.

On the news Pound appreciated strongly against the US Dollar and Euro, instead of depreciating, due to the hopes of a more expansive UK budget. That said, it seems that market participants have taken this resignation as a sign of no change in the BoE monetary policy. However, this assumption could never fundamentally support the Pound as Brexit trade uncertainty remains in the spotlight, while it remains doubtful whether the March budget it could save the UK economy.

Available January data out of the UK have shown a rebound in economic activity as the fog of political uncertainty cleared following the December general election, while Prime Minister Johnson yesterday announced big plans for infrastructure projects (increasing expectations for the government’s 2020-21 budget, to be detailed in March, to show a significant expansion in fiscal boost). These have helped quell concerns about Brexit and divergence from the EU for now.

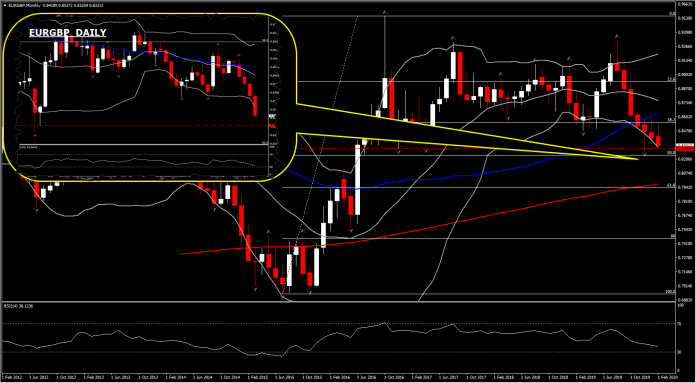

So far today, Cable topped at 1.3044 while EURGBP declined to 0.8325. The overall driver for EUR meanwhile remains the COVID-19 outbreak, with the European Commission admitting that the virus outbreak means the balance of risks is tilted to the downside. Warnings that the impact on ports, production and demand will dent growth not just in China are piling up, especially after the sharp increase in coronavirus cases due to the inaccurate counting methodology of the infected. Moody’s warned that the impact could be felt over the next three quarters.

Against that background there was nothing in last week’s Eurozone data releases that would really change the outlook, with most indicators backward looking and focusing on Q4 2019. Final services and composite PMI readings for the Eurozone and the UK meanwhile do suggest an improvement in sentiment at the start of the year, but virus risks and the fact that the transition period could end without a follow up deal between the UK and the EU in place raises the question of whether this post UK election bounce can be sustained.

EURGBP fell into major-trend low territory, a breath above the lowest level seen since July 2016. The 43-month low terrain between the 0.8240-0.8300 area remains a significant solid Support for the asset, since it coincides with the midpoint of the strong rally seen in 2015-2016. A move below it could clear the 2-month sideways outlook for EURGBP.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.