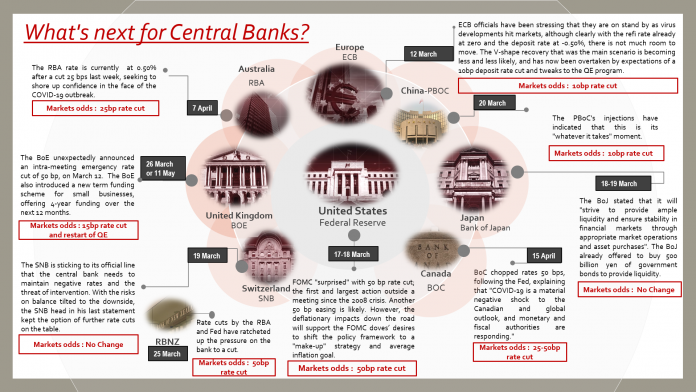

The FOMC’s first unscheduled rate cut since the financial crisis highlighted that the virus outbreak is shaping up to be a significant shock to the world economy. After FED, RBA, BoE and BoC followed, ECB is expected to join in adding stimulus. But what else should we expect from global central banks?

ECB Preview

Recession risks are rising as the virus continues to spread and increasingly disrupts not just supply chains, but also public life across Europe.

Hence after the BoE’s emergency cut, the pressure on the ECB to deliver a stimulus package tomorrow has increased and judging by leaked comments from ECB’s Lagarde it seems as though the central bank head was ready to act even before the BoE’s announcement. However, there isn’t much room for rate cuts for ECB although a 10 bp cut in the deposit rate is a possibility, even if this will have a largely signalling effect and the ECB is likely to tweak exemptions to limit the costs for banks. More targeted loan programs to secure funding for companies hit by virus disruptions – especially small and medium sized enterprises – will have more of an impact and is very widely anticipated now.

What would really help Eurozone spreads, which have widened again as risk aversion moves higher would be action on QE. Given that Italy is the most hit country in the Eurozone and set to breach deficit and debt targets as fiscal stimulus measures are being prepared, the pledge to buy additional Italian assets clearly would offer support. Topping up corporate bond purchases meanwhile would help to secure funding, especially in industries most hit by the fallout from the virus.

It may be too early now, but ultimately and if things get worse the ECB may also discuss widening the QE program to include stocks. A failure to deliver tomorrow would hit peripheral bond markets again, especially with the whole of Italy now under lockdown and the risk of recession pretty high.

FED Preview:

Markets are fully discounting a 25 bp rate cut from the Fed at the March 18th FOMC meeting, with a chance of there being a 50 bp move.

Fed funds futures are on the rise as additional Fed rate cuts are priced in, and amid ongoing safe haven flows. Supporting the rally in the futures are the continued weakness in equities amid growing fears over a recession resulting from COVID-19, the damping effect on inflation, and the widening response from global central banks. The implied March contract has fallen to 0.76%, suggesting another 50 bp rate cut is anticipated next week. June is priced at a remarkable 0.15% as the market flirts with the potential of negative rates. However, many Fedwatchers continue to believe aggressive rate cuts are a wrong-headed response to the COVID-19 crisis, if for no other reason than that the 0% or negative rate experiments in Europe and Asia have not been successful. The cascading effects of G7 easings could make life very difficult for emerging markets, with global knock-on effects.

BOJ Preview:

The BoJ has less room for monetary policy manoeuvre, while the Yen is widely seen as a natural safe haven currency, with Japan not depending on foreign investment inflows to sustain financing and with Japanese investors apt during times of risk aversion in global markets to repatriate capital from the sale of foreign assets, and/or put on currency hedges on foreign assets.

BOE Preview:

The UK government budget followed the BoE’s unexpected announcement in which they set a repo rate at 0.25%. The UK government has presented its 2020/1 budget, which put the coronavirus outbreak front and centre. There will be a fiscal stimulus of GBP 30 bln, which will target welfare, business support and sick pay changes.

The Chancellor of the Exchequer, Rishi Sunak, claimed the fiscal package is bigger than any other country’s response to the coronavirus situation, so far. He said that the action was commensurate with the Treasury preparing for the possibility of a recession.

From now onwards, as there is less room for monetary policy, BoE is expected to announce new quantitative easing measures in its next meeting.

SNB Preview:

SNB’s Jordan noted in January the downside risks and said the CHF remains highly valued, while sticking to the official line that the central bank needs to maintain negative rates and the threat of intervention. With the risks on balance tilted to the downside Jordan also kept the option of further rate cuts on the table. Meanwhile Jordan played down the importance of a US watchlist on “currency manipulators”, saying that central bank’s policy won’t change because of Switzerland’s recent inclusion and that there is a good dialogue with the US about FX.

RBNZ Preview:

The RBNZ next meets on March 25. The RBNZ held rates steady in February and signaled that in the central scenario there won’t be any additional easing this year, despite the virus outbreak. However, rate cuts by the RBA, Fed and BoE have ratcheted up the pressure on the bank to cut. Now markets expectations are set at a 25 bp cut to 0.75% later this month.

RBA Preview:

RBA cut interest rates by 25 bp to a new record low of 0.5% in March. The bank signalled that it is ready to do more in a coordinated fiscal-monetary policy reaction to the virus. RBA Governor Lowe said the virus outbreak is having a “significant effect” on the economy and “the uncertainty that it is creating is also likely to affect domestic spending”. – A follow-up 25 bp cut is possible in April.

BOC Preview:

Bank of Canada chopped rates 50 bps to 1.25% from 1.75%, matching the FOMC’s aggressive move in March. The move was not a surprise, although there was some uncertainty regarding a 25 bps or 50 bps cut. The BoC said “COVID-19 is a material negative shock to the Canadian and global outlook, and monetary and fiscal authorities are responding.” While the virus outbreak clearly drove the decision, it was also noted that “It is becoming clear that the first quarter of 2020 will be weaker than the Bank expected.”

The door is wide open to further easing if needed — “Governing Council stands ready to adjust monetary policy further if required to support economic growth and keep inflation on target.” A follow-up 25 or 50 bp cut is possible in April if the outlook continues to erode.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.