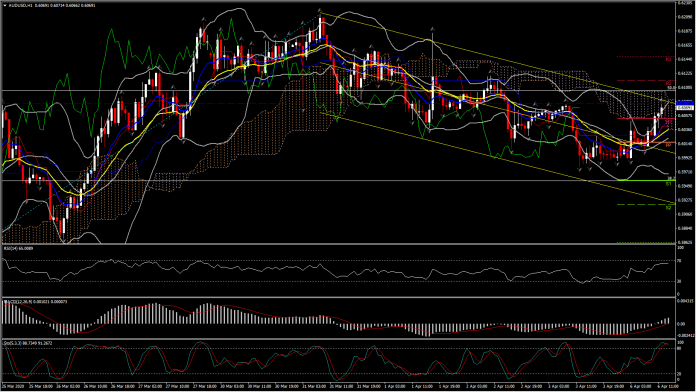

According to the momentum indicators, in the near term the asset’s bullish momentum looks to running out of steam. The RSI is turning lower from 65 peak, Stochastic confirmed a bearish cross in the overbought area while the MACD is heading northwards however its signal line holds below zero. In contrast, the intraday 10- and 20-hours EMA are moving aligned higher suggesting further intraday gains.

In case of a bounce off the upper channel line (0.6075), the price could challenge the 50% Fibonacci retracement level (0.6092) of the drift from 0.6685, and the R2 at 0.6111. A strong close above the latter tonight could turn the focus to March 31 peak (0.6214) and to 61.8% Fib. level (0.6230).

In summary, daily picture remains bearish with lower highs being developed and momentum indicators negatively configured. Near term picture had turned positive in the Asia session, suggesting further gains intraday however these gains looks to be temporary and limited as the intraday bullish momentum has started falling.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.