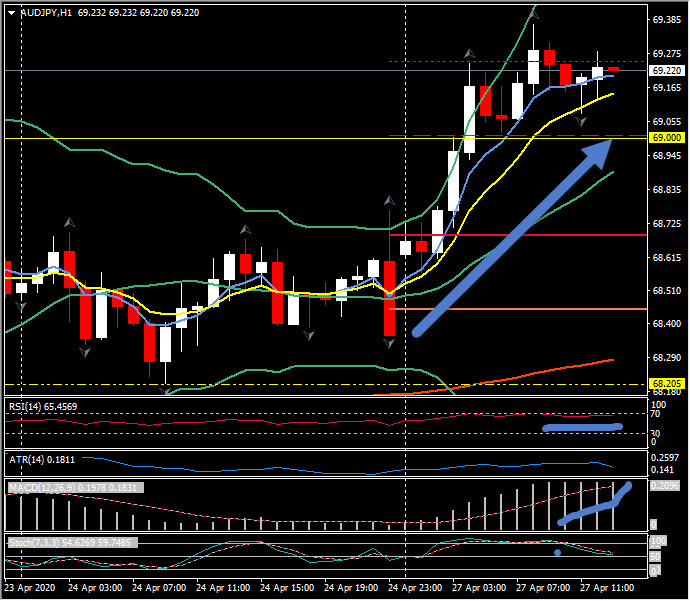

AUDJPY, H1

The Australian Dollar has outperformed while the US Dollar has underperformed amid a backdrop of rising stock markets in Asia. The narrow trade-weighted USD index dropped 0.5% in making a one-week low at 99.86, while EURUSD concomitantly posted a five-day high at 1.0860, putting in some more distance from the one-month low that was seen last week at 1.0726. Both AUDUSD and NZDUSD rallied as markets cheered moves in both Australia and New Zealand to reopen their economies from coronavirus lockdowns. Both countries stand out as being among the most successful in flattening their infection-rates curves. The Aussie Dollar rallied by over 1.2% in making a seven-week high at 0.6470. USDJPY, meanwhile, ebbed below last week’s lows in posting a 12-day low at 107.14, largely reflecting the softer tone in the Dollar today. The BoJ, as expected, announced that JGB purchases can now be unlimited (formerly capped at Y80 tln per year) while announcing an increase in corporate bond and commercial paper. The Yen wasn’t impacted. The move, aside from being anticipated, is largely symbolic, as the central bank’s 0% target on the 10-year JGB was being met without the need for unlimited purchases.

Elsewhere, the Pound was buoyed by news that Prime Minister Johnson will today be returning to work after recovering from his brush with Covid-19. Cable posted a one-week high at 1.2455, while EURGBP ebbed to within a couple of pips of last Thursday’s low at 0.8708.

Ahead this week, the Fed and ECB meet on policy. The former is expected to be a non-event for markets, with no change widely anticipated (having already done so much to respond to the pandemic), while the ECB is likely to extend its debt purchases to include junk bonds and take purchases into the 1.00-1.25 trillion euro level. On the corporate side, it is a massive week for Earnings with tech giants and industrial bellweathers all on the conference calls. Highlights include Amazon, Apple, Facebook, Microsoft, Caterpillar, Ford, GE & Chevron, as 173 of the S&P500 confirm results and highlight the outlook.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.