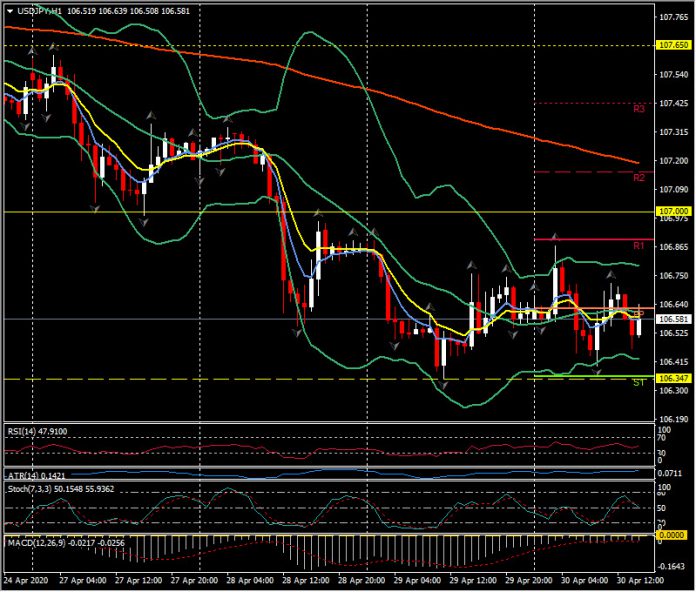

USDJPY, H1

US initial jobless claims fell -603k to 3,839k in the week ended April 25 following the -795k drop to 4,442k in the April 18 week (revised from 4,427k). The 4-week moving average declined to 5,033k versus 5,790k (revised from 5,786.5k). Continuing claims increased 2,174k to 17,992k in the April 18 week after the prior week’s 3,904k jump to 15,818k (15,976k). Despite the slippage in claims during the past two weeks, levels remain at lofty levels consistent with massive layoffs amid the near shutdown of the economy. The total new unemployment claims have now topped 30 million in the last six weeks – is this the nadir and is all the bad news now priced in? US equity futures continue to show gains today.

US spending tanked -7.5% in March with income falling -2.0%. It’s the steepest spending drop drop on record, and is the biggest income decline since January 2013. In February, spending edged up 0.2%, while income had jumped 0.6%. Compensation declined -2.8% from 0.5%. Wages and salaries dropped -3.1% after rising 0.5% previously. Disposable income was down -2.0% versus 0.5%. The savings rate surged 13.1% after the 8.0% (8.2%) rise. The headline chain price index fell -0.3%, the largest drop since January 2015, following February’s 0.1% gain, with the core rate sliding to -0.1%, the weakest since March 2017, from 0.2%. On a 12-month basis, the headline slowed to 1.3% y/y versus 1.8% y/y, and was 1.7% y/y for the core versus 1.8% y/y.

The Dollar was little changed following the data, which saw initial jobless claims rise more than expected, personal income fall more than consensus, ECI rise more than forecast, and consumption drop more than expected. EURUSD idles near 1.0865, as USDJPY sits near 106.60. The USDJPY has declined some 100+ pips so far this week as it test lows for the month under the key 107.00.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.