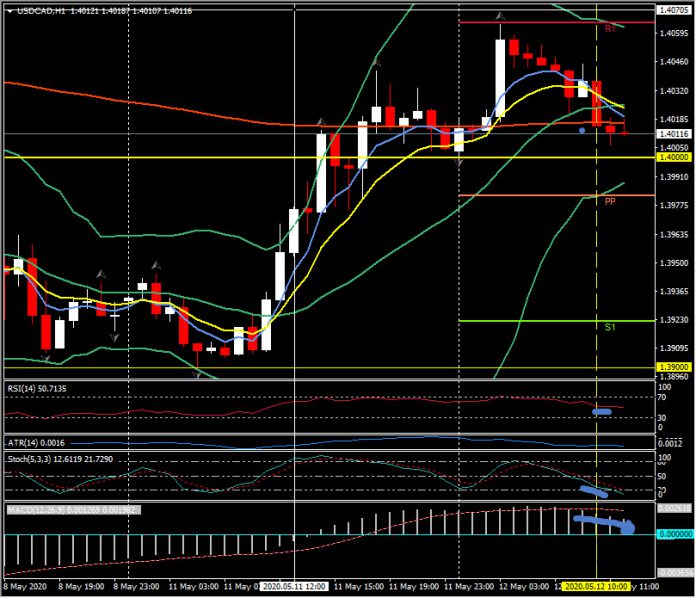

USDCAD, H1

USDCAD printed a five-day high at 1.4065 (R1), with the Canadian Dollar having weakened amid a backdrop of flagging global stock markets amid concerns about fraying relations between the US and China at a time when news of various upticks in the rates of coronavirus infections in various major economies is fanning fears of there being second waves in infection rates, with nations only just beginning to reopen from lockdowns.

USDCAD yesterday posted a 12-day low at 1.3900 before rebounding. Oil prices are moderately firmer today, continuing to consolidate off the one-month high seen last week at $26.08 (USOil). The high marked a 258% rebound from the April-28th low at $10.07. Prices still remain down by over 60% from the January high, and well off the average price that has been prevailing in recent years. The June WTI contract expires May 19th and the USOil June contract expires May 15th. The massive rotation lower in oil prices, caused by a supply/demand imbalance of historic proportions as a consequence of virus-containing lockdown measures in many global economies, marks a significant deterioration in Canada’s terms of trade, given the importance of oil exports to the nation. The 8% year-to-date weakening in the Loonie versus the US Dollar, along with the 4%-plus decline against the Euro and near 8% drop versus the Yen, reflects the pricing-in of this reality in currency markets.

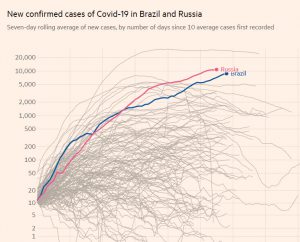

Going forward, focus is on economies that are reopening from virus-containing lockdowns, and how successful, extensive and durable this proves to be. All going well, this would rekindle demand for oil and other commodities, which should in turn put in an underpinning for Canada’s currency. Goldman Sachs is forecasting crude prices at $51 in 2021. There is a risk of setbacks, of course, in the event that re-openings cause a significant second wave of infections. As the chart below shows, however, new infections are still rising in some key countries, notably Brazil, Russia and India.

From the rally to 1.4065 earlier, USDCAD has rotated lower at a break of the 20 and 200-hour moving average at 1.4015. The H1 ATR is 0.0015 with the MACD histogram losing steam and the signal line moving lower, RSI is neutral (51) and the Stochastics have moved down into the overbought zone. The daily pivot point sits at 1.3980, below the psychological 1.4000 round number. S1 is at 1.3925 and R1 resides at today’s high at 1.4065.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.