The Canadian Dollar has rallied, like other commodity currencies, amid rising global stock markets.

Front-month WTI crude prices also hit a new high at $35.77, the best level since early March, which has been a particular boon to the oil-correlating commodity currency sub group. USDCAD posted a fresh low at 1.3673, which is the lowest level seen since March 11th. Like other commodity currencies and risk assets, the Canadian currency is back to levels prevailing before the global market panic of mid March. This should give market participants pause for thought, as reopening economies are doing so only partially, and there is a risk for a second wave of coronavirus infections as social and economic re-liberalization unfolds (witness the spike in cases in South Korea, which has led to a re-introduction of lockdown measures). Nonetheless Oil will be key driver of CAD despite the general USD weakness, which saw the USDIndex falling to better than 2-month lows of 97.95.

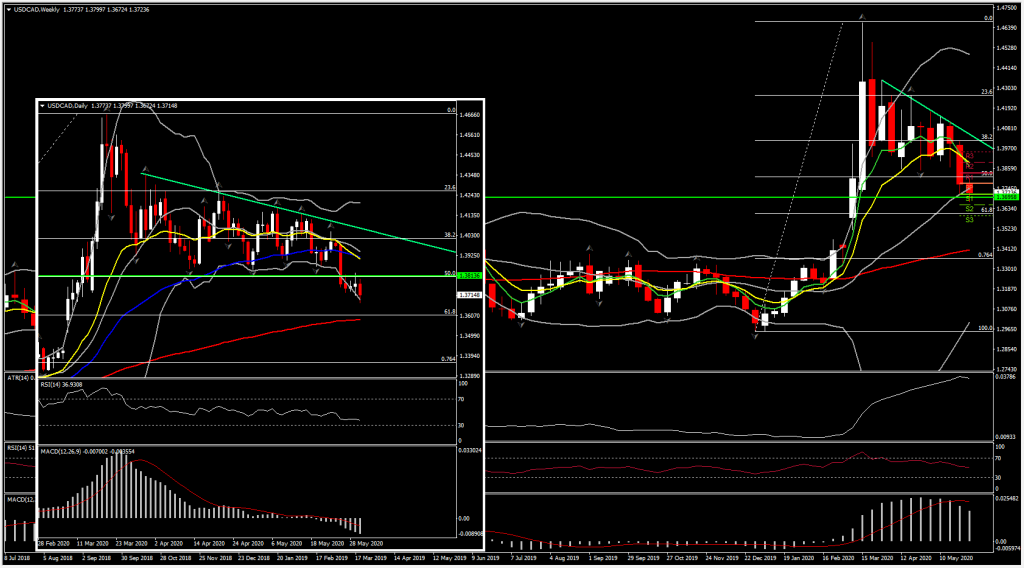

USDCAD extended for a 5th consecutive day below 50% Fib. retracement level and the 1.3800 Support level which has held since mid March. Daily momentum indicators are negatively configured, with MACD lines accelerating lower and RSI moving 30s. The break of 1.38 brings 1.36 back in play for completing the downside move from the 2-month descending triangle.

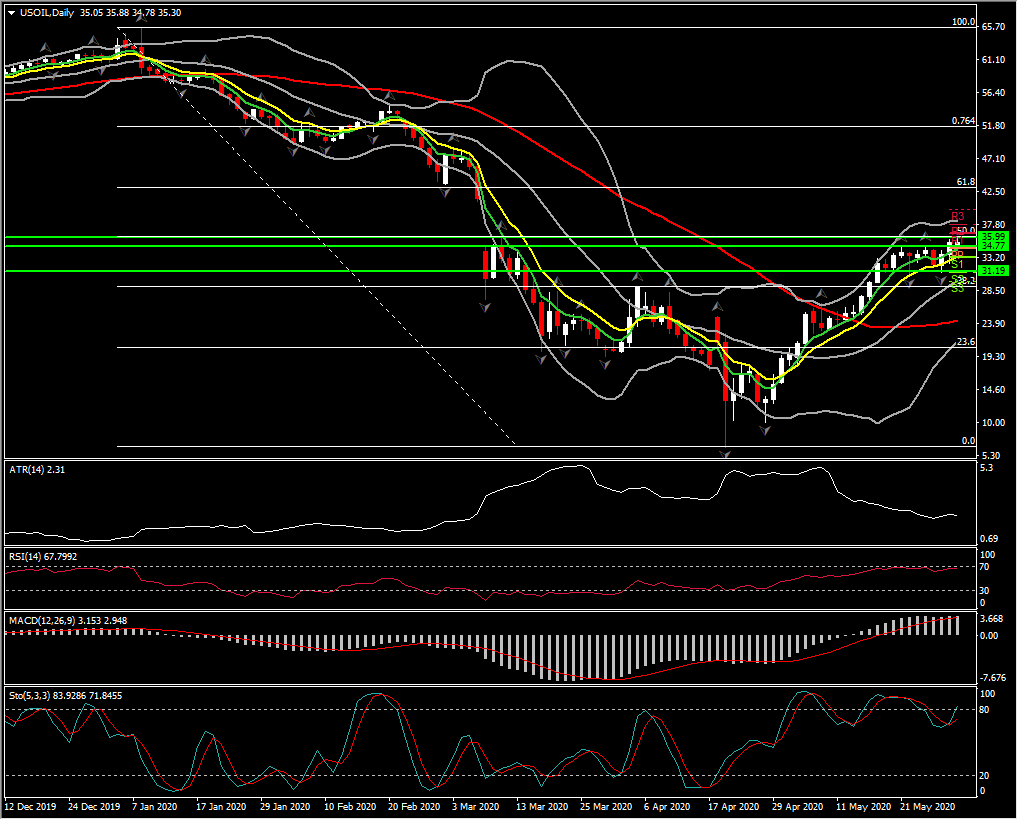

Oil outlook

The outlook for oil is still bullish as the energy market has largely ignored the US-China tensions as we head towards the OPEC+ meeting.

Oil holds steady above $35 so far, despite the announcement that China has halted the imports of some US farm goods, which has switched markets from a risk-on to a risk-off mode. A Bloomberg report, that Beijing has told major state-run agricultural entities to halt purchases of some US produce, including soya beans, has rattled the markets in general, but not USOIL. The move threatens the US-China trade deal, just after markets were relieved that President Trump refrained from touching trade in his list of measures to be taken against China in light of its Hong Kong security bill.

Meanwhile the speculations for Oil remain increasingly positive, as OPEC+ adherence to planned production cuts is reportedly high, and Russia is reportedly not objecting to the next meeting of the group being brought forward to June 4th (which is a good sign of its compliancy). There are media reports that the alliance are looking at extending current cuts of 9.7MMbbls/d for anywhere between 1-2 months.

Additionally, US output continues to fall amid the forced closure of hundreds of shale wells, with current pricing making such operations unviable. On the demand side, China and India are said to be increasing imports, while fuel use in general has been on the rise as economies emerge from lockdown. Apart from US-China tensions downside risk, in the bigger picture, as long as the nascent recovery isn’t scuttled by a second wave of COVID-19 infections, oil price risk going forward would appear to be to the upside.

Last but not least, for the Canadian Dollar and Oil , other than OPEC and trade tension, the BoC announcement highlights this week outlook. No change to the current 0.25% rate setting is expected from BoC, along with a reiteration of their all-in commitment to supporting the economy and financial markets. The Bank will also announce the change of its Governor as Tiff Macklem becomes the Bank of Canada’s 10th governor, taking over from current Gov. Stephen Poloz for a seven-year term.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.