GBPUSD, H1

The Dollar has recovered most of yesterday’s losses. The narrow trade-weighted USDIndex lifted to a peak of 96.17, up from Wednesday’s five-week low at 95.78. The rotation higher in the US currency was driven by a bout of risk aversion in global stock markets, which raised safe-haven demand for dollars. News that the Trump administration is considering a ban on members of the Chinese Communist Party and their families from entering the US, which would mark a significant further deterioration in US-Sino relations, sparked risk-off positioning in global markets. An earlier report that human trials in Oxford University’s candidate vaccine have been positive had little impact, with a leak of this yesterday having already familiarized markets. In the mix have been nagging concerns about a second wave of coronavirus infections, with Tokyo, for instance, reporting another daily record in new cases.

Data so far today has included Chinese June production, which met expectations with growth of 4.8% y/y, and a 1.8% y/y contraction in Chinese June retail sales, which thwarted expectations for 0.5% growth. Australian June employment rose 210.8k, more than double the consensus forecast, though the jobless rate edged up to 7.4% from 7.3%. UK June labour data showed a partial rebound following the significant lockdown contraction, however, as Andrew Sentance, a former member of the MPC tweeted earlier, the “Headline unemployment rate of 3.9 pc gives a false picture of UK labour market. Payrolls are down by 650,000 over the past 3 months & hours worked have dropped by nearly 17pc. Benefit claimant numbers has more than doubled to 2.6 million and job vacancies have more than halved.”

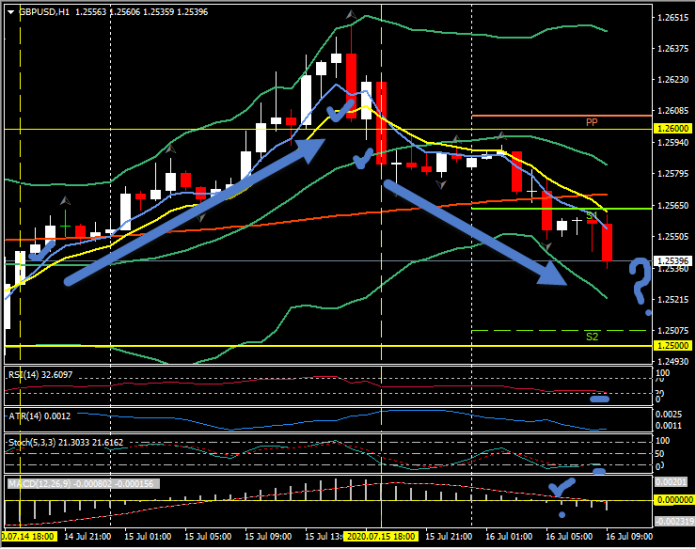

In currencies, dollar firmness weighed on EURUSD, which tipped under 1.1400 after yesterday posting a three-and-a-half-month high at 1.1452. Cable printed a two-day low at 1.2536. USDJPY saw little direction, holding in a narrow range near 107.00, above the six-day low seen yesterday at 106.66. AUDUSD ebbed back under 0.7000, leaving yesterday’s five-week high at 0.7039. The risk-sensitive AUDJPY cross edged out a two-day low. USDCAD lifted out of a one-week low at 1.3500. However, the biggest mover of the main pairs is Cable, down from 1.2640 yesterday, lower from 15:00 (GMT), breaching the 20 MA & under 1.2600 and now under the 200MA. Faster MAs aligned lower; RSI (34) moving lower. MACD Histogram and Signal line both moving lower & under 0 from earlier too. Stochs into the OS zone – H1 ATR 0.0012, Daily ATR 0.0098. Support at S2 (1.2540) currently.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.