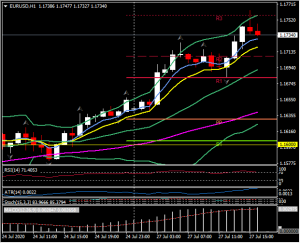

EURUSD, H1

US Durable Goods Orders rose 7.3% in June after a 15.1% (was 15.7%) bounce in May (second highest on record) following the -18.3% April plunge. Transportation orders remained supportive, climbing 20.0% after the 78.9% (was 82.0%) surge in May, correcting from the -48.9% April drop. Excluding transportation, orders were up 3.3% from 3.6% (was 3.7%), but missed expectations at 3.5%. Nondefense capital goods orders excluding aircraft increased 3.3% from the 1.6% May gain. Shipments jumped 14.9% from the prior 4.2% (was 4.4%) rise. Nondefense capital goods shipments excluding aircraft climbed 3.4% from 1.6% (was 1.5%) previously. Inventories edged up 0.1% from unchanged (was 0.1%). The inventory-shipment ratio dropped to 1.87 from 2.15. Overall a pretty solid report.

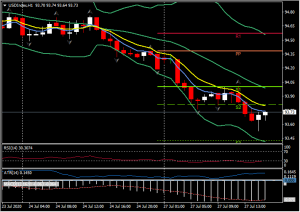

The Dollar ignored the bit better than consensus durable goods orders. EURUSD sits near 1.1750, just under trend highs (January 2018) of 1.1764 seen earlier, while USDJPY idles near 105.40. News that President Trump’s National Security Advisor Robert O’Brien has tested positive for the coronavirus also adds pressure to the USD today.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.