The policy stalemate on another pandemic relief bill remained and will remain a major source of concern to investors and fostered a solid bid in Treasuries that knocked already historically low yields down further to test fresh nadirs, with the exception of the 30-year. The declines in rates comes despite the solid US factory orders report yesterday and even as Wall Street extends gains, with yes, another record on the NASDAQ in its seemingly inexorable rise toward the 11,000 level.

Treasuries retain a bid on momentum on uncertainty over the fiscal situation, and signs of an economic slowing from some high frequency data. There’s still a decent sized corporate calendar, but it’s not as heavy as yesterday’s that included the mammoth $10 bln deal from Alphabet, which saw strong sponsorship for the 6 tranches which all priced at record low yields.

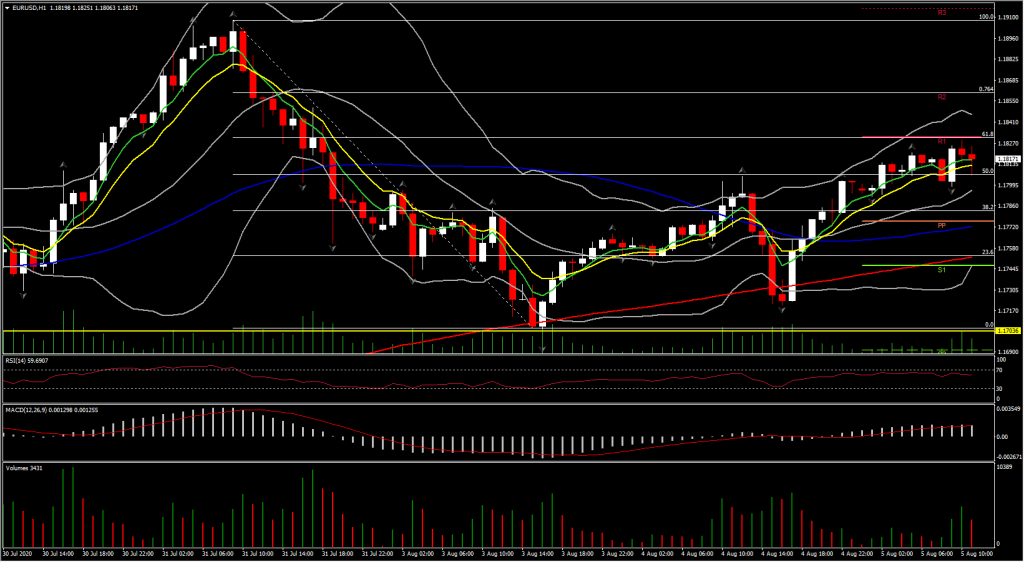

Global Equity markets yesterday and so far today, have been supported by some optimism on a fiscal package, along with more solid data in the way of US factory orders. Amid ongoing talks on a fiscal package, there have been some small positive comments from the negotiators suggesting some progress. However, not so fast. Senate Leader McConnell urged an agreement soon and said he was willing to back an imperfect bill. Republican Senator Perdue said talks could take two more weeks as the Democrats are not “negotiating in good faith.” Treasury Secretary Mnuchin will be making more offers. Senate Minority Leader Schumer said there are five or six issues that still need to be worked out. But he added he’s not going to strike a deal just for the sake of it. There still is a wide divide on the big issues including the total size of the package, the extra unemployment benefits, evictions, and funding the Postal Service.

Asian markets traded mixed, against the background of disappointing services PMIs, but news that the US and China will meet on August 15 to evaluate the success of the phase one trade deal so far, has helped to lift sentiment. The meeting will take place against the background of growing US-China tensions and while Chinese officials voiced optimism that the meeting will be positive, reports that a key Trump cabinet ally is heading to Taiwan is unlikely to be supportive.

Nikkei was down -0.41% and the ASX has lost -0.61%, despite positive housing finance data and the RBA’s AUD $500 million of 3-year government bonds buying today. S&P placed Australian state of Victoria on negative ratings watch, which highlights the link between virus restrictions, official debt and ultimately ratings.

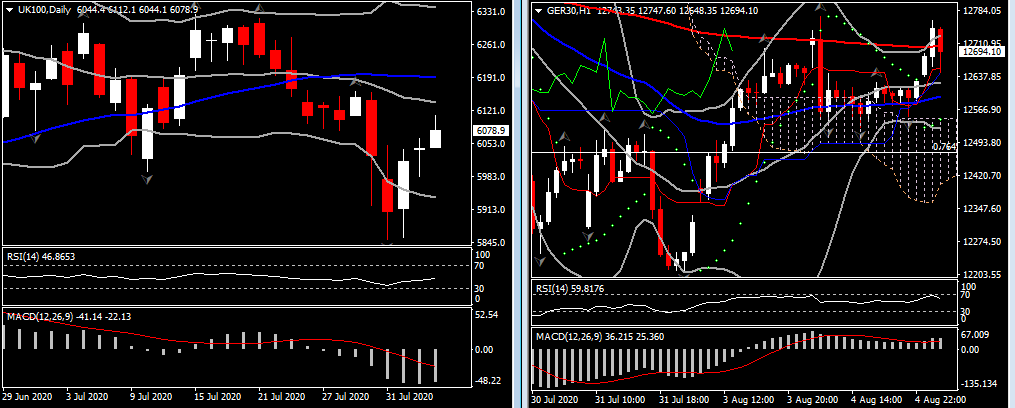

Other economic data releases in the Asia session that kept the session mixed were the positive labour market data out of New Zealand while services PMIs were mixed, China’s reading falling short of expectations and Japan’s services PMI which lifted to 45.5 from 45.0, while Australia’s reading fell back to 58.2 from 58.5.Against that background GER30 and UK100 futures are up 0.5% and 0.4% respectively ahead of today’s round of final Services PMIs for July.

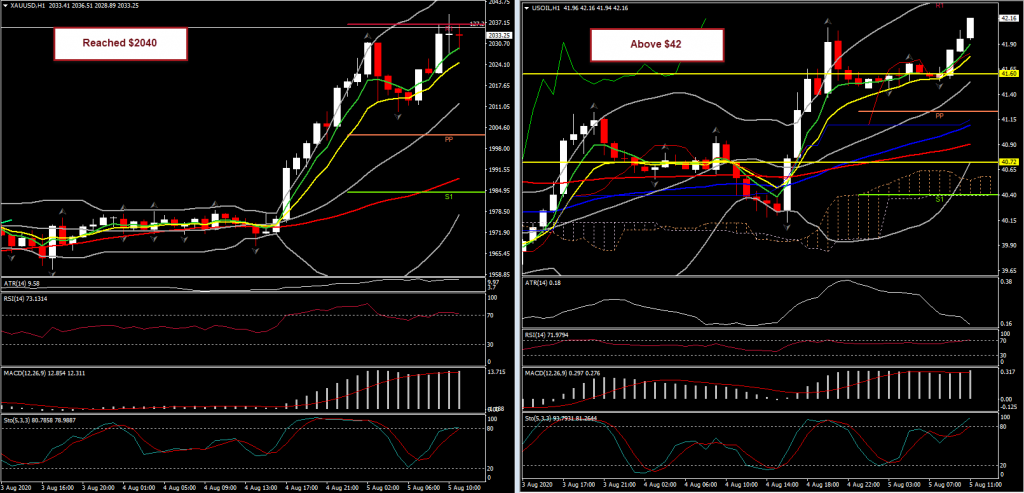

The Dollar has remained soft while Gold prices have spurted to a fresh nominal high at $2,040.55 (still a long way from a record peak in inflation-adjusted terms.The USOIL is currently trading above $42.00 per barrel, after climbing earlier following an explosion at Lebanon’s main port, which fuelled concern over instability in the region.Downside risks for the Canadian dollar include the OPEC+ group’s course to easing output quotas, which could weigh on oil prices, alongside the coronavirus pandemic and geopolitical tensions, should they derail the recovery in global asset markets.

Clearly virus developments and the risk of new travel and border disruptions will continue to cloud over the outlook for tour operators, airlines and the hospitality sector.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.