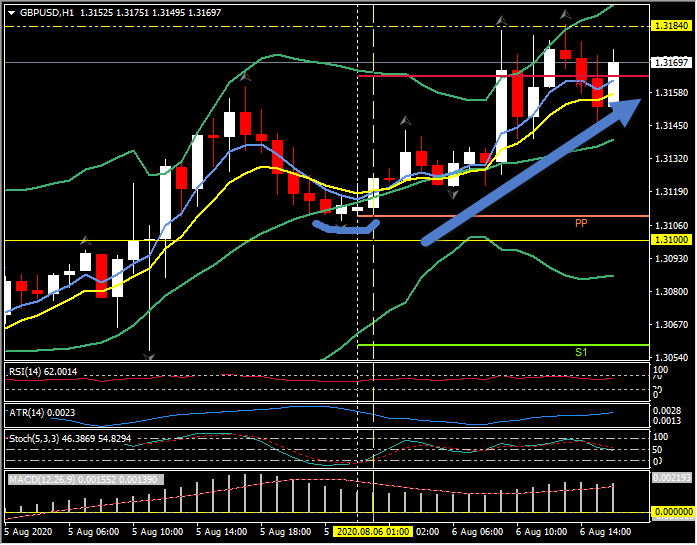

GBPUSD, H1

The Pound has outperformed on the BoE’s guidance, which gave a cautiously optimistic take on the outlook, stating that the lockdown-induced downturn is less severe than initially foreseen. Cable posted a new five-month peak at 1.3184, while EURGBP fell nearly 0.5% to a two-day low at 0.9000. The Pound has also gained about 0.5% versus the Australian Dollar, and is up on the Yen and other currencies, too.

The BoE left the repo rate at 0.10% and asset purchases totals unchanged, as had been widely anticipated. While the statement highlighted the likely sharp decline in Q2 activity levels, with GDP seen down around -20% y/y, it also noted the rebound in more timely higher-frequency indicators and a pick-up in housing market activity, and said that it expects a rebound, albeit gradual, in business investment. The BoE still cautioned that the unemployment rate is projected “to rise materially, to around 7.5% by the end of the year,” and stated it remains committed not to tighten policy “until there is clear evidence that significant progress is being made in eliminating spare capacity and achieving the 2% inflation target sustainably”. The warily more upbeat BoE comes with forex markets factoring in better odds for an EU-UK trade deal, with a number of recent sourced UK press reports suggesting that discussions are going better than the official line suggests. A new lockdown in the economically-important Manchester area, and Aberdeen in Scotland, along with the continued media-driven “feardemic,” is to an extent clouding the horizon at a time when government pandemic business support measures have started to unwind (compensation for furloughed workers was reduced this week).

Earlier, BOE Governor Bailey talked of negative interest rates being available and, in the toolbox, but “please don’t think we are about to use them…. that is not the current plan”.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.