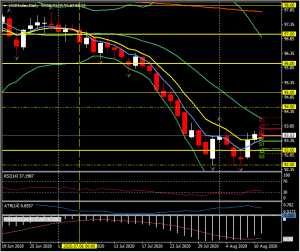

USDIndex, Daily

The narrow trade-weighted USDIndex edged out a one-week high at 93.71, making this the third consecutive trading day a higher high has been seen. A softer tone in the Euro has in part given buoyancy to the index while pushing EURUSD to a one-week low, at 1.1723. EURJPY concurrently rose about 40 pips to a peak at 124.75. USDJPY remained firm, but remained just shy of the one-week high seen yesterday at 106.21. AUDUSD ebbed back under 0.7150, leaving highs at 0.7185/86, though still remained net higher on the day, while AUDJPY pegged a four-day high. USDCAD ebbed to a four-day low at 1.3320, reflecting a modest degree of outperformance in the Canadian Dollar, which has been concomitant with oil prices edging out new highs. Front-month USOil futures printed a one-week high at $42.40.

Is the the Dollar etching out a recovery phase after recent out-performance and seven consecutive weeks of lows the wake of the July US jobs report, hopes of a new stimulus package and with new coronavirus cases now dropping sharply across the sun states?

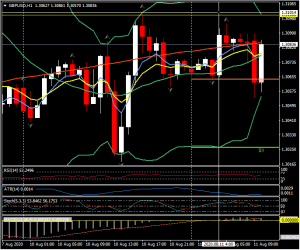

UK jobs data provided very mixed and confusing reading. The claimant count jumped 94,400 in July, bringing the claimant count rate to a whopping 7.5%, from 7.2% in the previous month. The less timely ILO unemployment rate unexpectedly held steady at 3.9% in the three months to June, but at the same time employment dropped -220K during that period. This was the biggest rise in over a decade highlighting the impact of lockdown measures. Still, it is less than Bloomberg consensus expectations predicted and ties in with the general theme of “not as bad as feared” – with regard to the initial impact of virus measures. The question of course is what will happen when governments have scrapped support measures and the furlough scheme runs its course. Cable was capped at 1.3100 yesterday, before slipping to 1.3055 following the claimant data, and has since recovered over today’s pivot point (1.3060) to trade at 1.3075.

Next up today is the German and Eurozone ZEW Economic Sentiment index at 09:00 GMT.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.