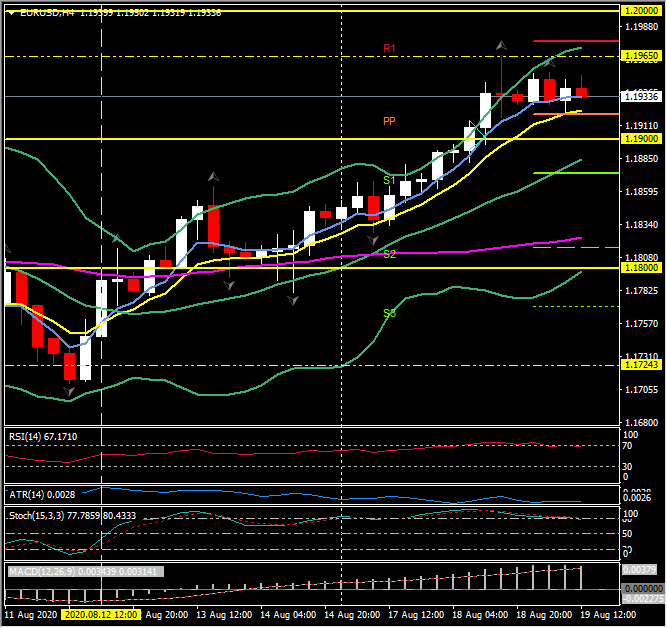

EURUSD, H4

Eurozone HICP inflation was confirmed at 0.4% y/y, in line with the preliminary release. The uptick in the headline rate came despite the dampening impact of Germany’s temporary cut to the VAT rate. Energy prices also remain much lower than a year ago and core inflation lifted to 1.2% y/y in June from 0.8% y/y in the previous month.

Mixed signals then for the ECB, and while there may be nothing in the data to suggest a serious risk of deflation, the low headline rate will add to the arguments of those at the council who are pushing for a more symmetric inflation target that would require the ECB to let inflation run above target for a while following a period of below-target headline rates. In the current situation that would push the first rate hike even further into the future. A similar debate seems to be happening at the FOMC, which is currently also conducting a framework review.

EURUSD has settled off yesterday’s 27-month peak at 1.1965, concurrently with the USDIndex (DXY) consolidating recent losses above Tuesday’s 17-month low at 92.15. The softer dollar hypothesis, which has been dominant in markets for several months, is currently being challenged. Most incoming US data are showing a strong rebound in economic activity, while the S&P 500 and Nasdaq equity indices have scaled to record highs. News that House Speaker Pelosi said that the Democrats are willing to trim their proposals has been taken as a positive, as it increases the odds that the Republicans and Democrats will break their stalemate and reach a deal on the next pandemic fiscal rescue package. July data showed an acceleration in homebuilding in the US to the most in almost four years. Coronavirus infections are now dropping sharply in the recently afflicted sun states, such as Arizona, Texas and Florida, indicating the downward phase of a classic Gompertz curve progression of respiratory illness as community immunity builds up.

In focus is today’s publication of the minutes from the recent FOMC meeting, which comes amid market speculation that the Fed may adopt an average inflation target, specifically with the aim of pushing inflation above the 2% target. This has been a dollar negative, as it has driven real Treasury yields deep into negative terrain. Any confirmation of this would bolster the softer dollar hypothesis, and likely push EURUSD above 1.2000, while any lack of reference to this issue would have an inverse effect. The advent of the 750 bln Euro recovery fund, which has reduced perceived EU break-up risks, and the fact that Europe has come through the pandemic ahead of the US (having been impacted earlier), have also been underpinning factors of EURUSD.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.