The SNB will meet to set monetary policy on Thursday. No changes are expected in their two core policies:

- The interest rate policy, set at -0.75%, or;

- Continued FX intervention, due to the exorbitant swiss franc value.

If there is a change, it will likely be related to the so-called threshold factor, which is basically a multiple of the minimum reserve requirement held by the bank, which is exempt from negative interest rates. This factor was last changed to 30 from 25 in April and other changes could occur, as franc deposits continue to build up and have climbed again to CHF 130bn since the pandemic.

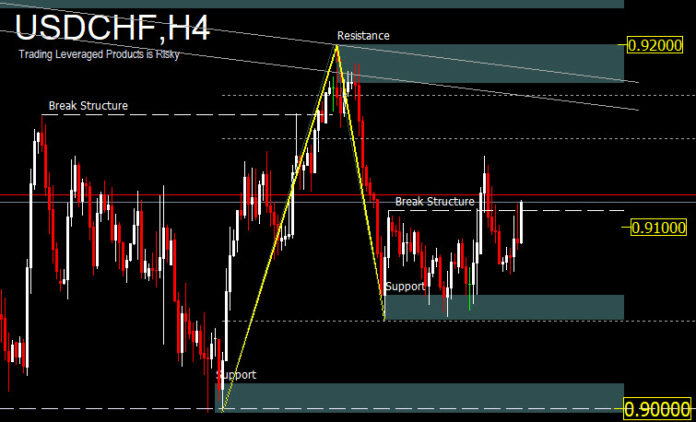

USDCHF was still in the consolidation zone in the 0.9000-0.9200 range last week and the outlook has not changed. The bias early this week looks neutral. On the downside a break of the 0.8998 low would continue the deeper downtrend, however the psychological level 0.9000 is still a significant support level.

On the upside, the break of 0.9200 should continue the rebound from 0.8998 short term base, towards the projected target of 100 Fibo. Expansion around 0.9250 with continued resistance level 0.9325. Divergence bias is seen on H4, however, it has not been validated, before being able breach 0.9200. However, it looks like the catalyst of this week’s SNB meeting, will make technically meaningful changes to the pair.

On the upside, the break of 0.9200 should continue the rebound from 0.8998 short term base, towards the projected target of 100 Fibo. Expansion around 0.9250 with continued resistance level 0.9325. Divergence bias is seen on H4, however, it has not been validated, before being able breach 0.9200. However, it looks like the catalyst of this week’s SNB meeting, will make technically meaningful changes to the pair.

Regardless of the SNB meeting, expect EURCHF to take cues from USDCHF. EURCHF weakened slightly last week, but recovered ahead of support at 1.0720 and closed higher at 1.0789. Initial bias will remain neutral at first. Further upside is still possible, given the price is above the slope of the 26- week EMA which is equivalent to the 1/2 year moving average and the previous break of the descending trendline. On the upside, a break of 1.0876 would continue the rebound from 1.0503 and target a high of 1.0915.

Regardless of the SNB meeting, expect EURCHF to take cues from USDCHF. EURCHF weakened slightly last week, but recovered ahead of support at 1.0720 and closed higher at 1.0789. Initial bias will remain neutral at first. Further upside is still possible, given the price is above the slope of the 26- week EMA which is equivalent to the 1/2 year moving average and the previous break of the descending trendline. On the upside, a break of 1.0876 would continue the rebound from 1.0503 and target a high of 1.0915.

On the downside, a break of 1.0720 would turn bias back to the downside to retest support at 1.0600 or 1.0500. But for as long as hidden divergence is functional and the 200 EMA, which is the dynamic support, holds, and possible SNB intervention is likely, the pair could continue the rally.

Click here to access the Economic Calendar

Adi Phangestu

Market Analyst – HFIndonesia

Disclaimer: This material is provided as general marketing communications for informational purposes only and is not provided for independent investment research. This communication does not contain investment advice or recommendations or solicitations for the purchase or sale of any financial instrument. All information presented comes from a trusted, reputable source. Any information that contains an indication of past performance is not a guarantee or reliable indicator of future performance. Users should be aware, that any investment in Leveraged Products is subject to a certain degree of uncertainty and that any investment of this type involves a high level of risk for which the sole responsibility and responsibility is borne by the user. We are not responsible for any losses arising from any investment made based on the information provided in this communication. Reproduction or further distribution of this communication is prohibited without our prior written permission.

Risk Warning : Trading Leveraged Products such as Forex and Derivatives may not be suitable for all investors as they carry a high level of risk to your capital. Before trading, please ensure that you fully understand the risk involved, taking into account your investment objectives and level of experience and seek independent advice and input if necessary.