Lagarde leads dovish ECB voices at central bank conference. The Bundesbank President warned that large scale asset purchases are likely to blur the line between monetary and fiscal policy and could undermine the central bank’s independence, confirming that Weidmann will continue to caution against turning PEPP into a permanent feature, although the majority of speakers so far this morning fell into the dovish camp, with Kazmir saying the risks of deflation are balanced, Rehn saying that he sees the risk that inflation continues to be too slow and Mueller suggesting that the ECB doesn’t expect the recovery to continue as fast as before.

Lagarde meanwhile focused on the idea of a symmetric inflation target and while she suggested that it is an ongoing discussion, her comments suggest that this is indeed the way the ECB’s strategy review is going, with the upper limit replaced by a symmetric target. In reality that should not change things too much as the ECB has always focused on a medium term inflation measure and allowed temporary overshoots over and above the target. Still, as Lagarde highlighted, a commitment to let inflation overshoot could help to bring up inflation expectations at a time when official rates are already touching the lower bound.

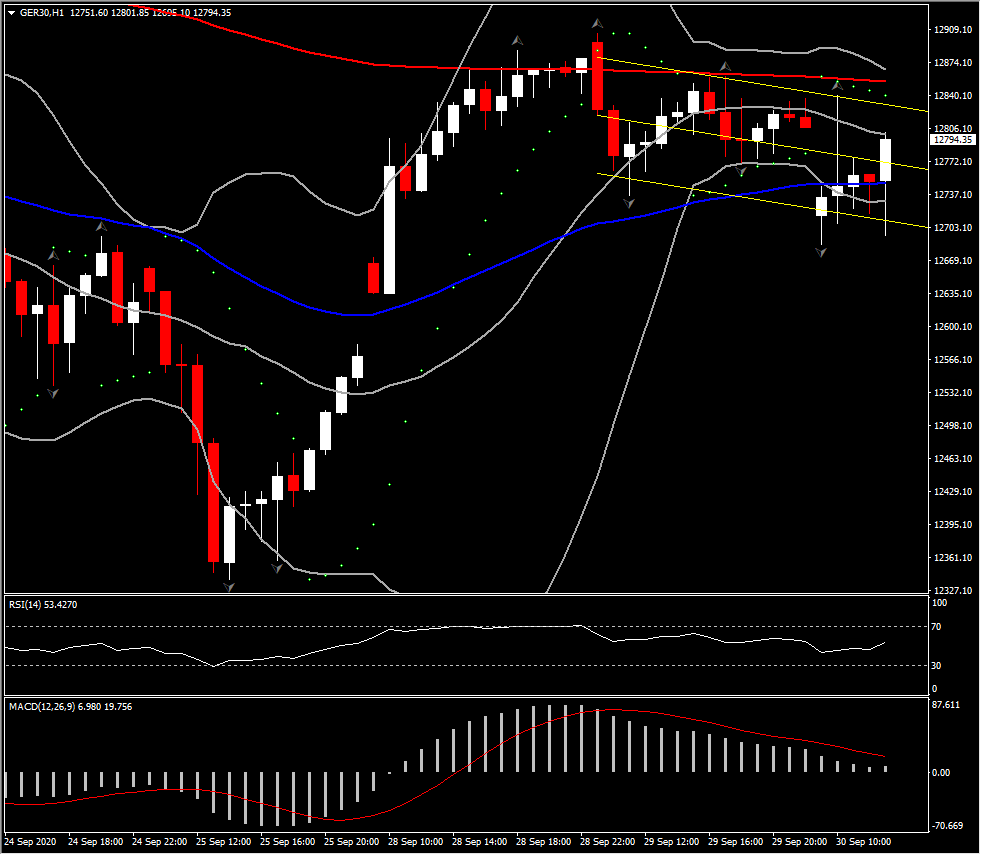

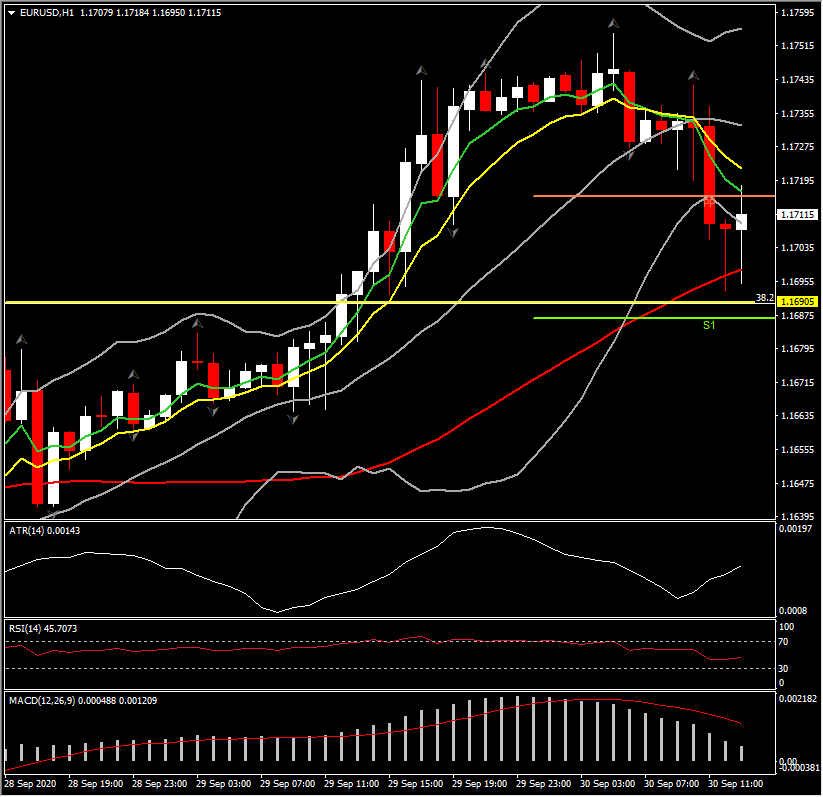

For now, the dovish comments have put pressure on the EUR and supported GER30. Dovish leaning comments helped Eurozone bonds to outperform despite stronger than expected German labour market data and a surprisingly strong rebound in German retail sales. Eurozone peripheral bond markets still struggled though, highlighting that investors are hoping for more than a change in the official inflation target, as credit risk rises amid fears that the resurgence of Covid-19 case numbers will interrupt the still fragile recovery.

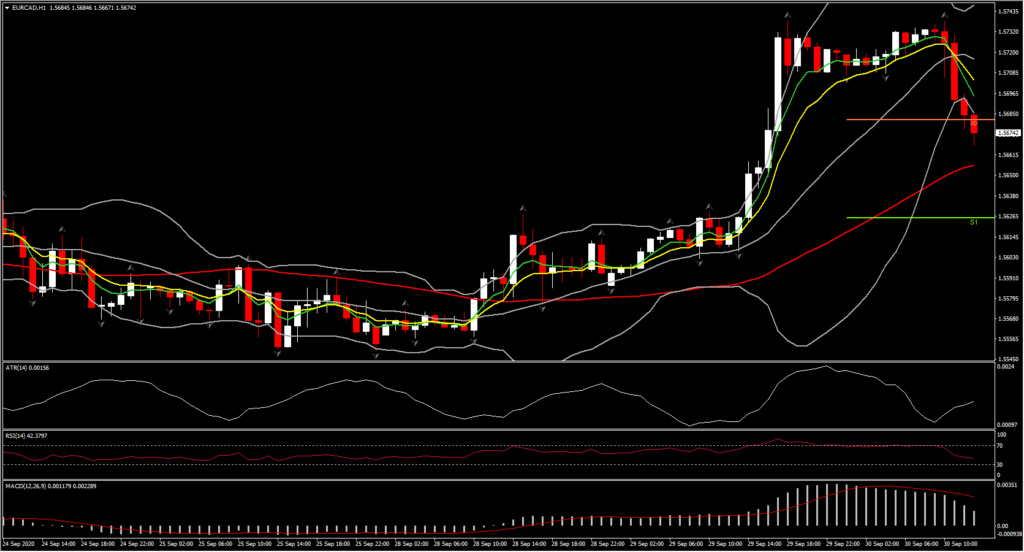

EURUSD has dipped below 1.1700, extending the pullback from the 8-day high that was seen ahead of the London interbank open at 1.1755. EURJPY is also down but EURCAD is the one that underperformed the most from the Euro crosses, posting a drift of 0.32% so far, now at 1.5667 after earlier seeing a 30-day peak at 1.5738. The Euro is also lower against other currencies, albeit more moderately so. However EUR is likely to remain on an inclined path against CAD given the uncertainties about the new Covid restrictions cases, with the province of Quebec announcing a 28-day partial lockdown in Montreal and Quebec City as cases there spike. Aside from safe haven demand, the common currency has been affected by German Chancellor Merkel warning that a delay in the EU recovery fund looks “increasingly likely,” which is bad timing with nearly all European countries ratcheting up Covid restrictions.

In general though, all this comes amid the ECB policymaker campaign of verbal intervention to keep a lid on the Euro. Similar messaging from other central banks, including the BoE and RBA, has also contributed to an overall weakening in the strongly bearish dollar bias that forex market participants had until recently. The rhetorical interjections countervail the impact of the Fed’s regime shift to a lower-for-longer stance on interest rates.

In the US, focus remains on Congress and its continued attempts to reach a resolution on another pandemic-era fiscal support package. The approaching election is also firmly on the radar, too, as the net outcome (House, Senate and Presidency) will have major implications for fiscal policy. The integrity of the election is also at issue, with the risk of a contested election seemingly rising following the first presidential debate yesterday. In Europe, positive Covid test results have continued to soar in most countries (no lockdown, no facemask Sweden being the remarkable exception). Covid hospitalisations and mortality, while bumping higher over the last week in many countries (fitting the seasonal pattern for respiratory sickness in this part of the world), still remain at basement levels relative to the March/April peak. The ratio between Covid-caused death and flu- and pneumonia-caused death also remains low, again contrasting markedly to the March/April situation.

Nonetheless, the trend in most countries in Europe is for tighter restrictions and more localized lockdowns, which should limit the upside scope of the Euro.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.