The Brexit saga will continue this week. On Friday, the EU and UK trade representatives were planning to be continue their face-to-face (or facemask-to-facemask) meetings in London through to Sunday evening. Despite the recent stand-off between the UK and some EU leaders (France, for instance, threatening to veto an agreement if it doesn’t get want it wants) it has been increasingly evident that both sides are set on reaching an accord. There is a sense that the backdrop of surging new Covid cases has helped realpolitik break out on both sides of the channel.

On Friday a Reuters article, citing French fishing industry sources, said that Macron’s government have warned them to expect a smaller catch. France has been the most vocal of the so-called coastal 8 EU nations that have been demanding unchanged access to UK waters for fishing, which has been the principal sticking point in trade talks, so the Reuters report is significant, revealing that a compromise appears to be in the works. The UK, meanwhile, signed its first post-Brexit trade deal on Friday, with Japan, a deal which was agreed in principle a month ago.

While France has threatened to veto an agreement if it doesn’t get want it wants, EU trade envoy Barnier and his team have extended their time in London through to this Wednesday as intensive talks on the future relationship continue. Brandon Lewis, a senior member of Boris Johnson’s cabinet, said yesterday that “there is a good chance we can get a deal,” and it is understood that Germany’s Merkel and other EU heads of state are putting pressure on France to compromise on its demand for unchanged access to UK waters for fishing. The UK wants a Norway-like agreement on fishing, where quotas are agreed annually, which most EU states see as reasonable.

With a no deal scenario now looking much less of a risk, the question now is more focused on how limited or how broad a deal might be between the EU and UK.

The consensus is for a narrower rather a broader deal, and we concur with this. But, it should also be considered that the EU and UK might conceivably surprise everyone with a much more comprehensive deal than is being expected. The Covid situation may be a motivation for this, and it should be remembered that the two sides are starting from perfect equivalence, so a broad agreement is entirely feasible. Even some Brexit ideologues in the UK have suggested that maintaining close alignment with EU rules — for now — may be the more pragmatic way forward given the Covid stresses, before diverging from EU rules in an evolving process over time.

As for the markets, European stock markets are currently in a sell-off, with the GER30 down -2.2%, the MIB down -1.2 bp and the Euro Stoxx 50 -1.50% as earnings reports add pressure to Equity markets and virus developments raise fears of a double dip recession. The UK100 is outperforming slightly, but still down -0.3%. The UK100 closed on Friday with a 2nd consecutive bearish candle with long lower tails indicating the rising bearish appetite. More technical analysis on FTSE could be seen on last week’s post.

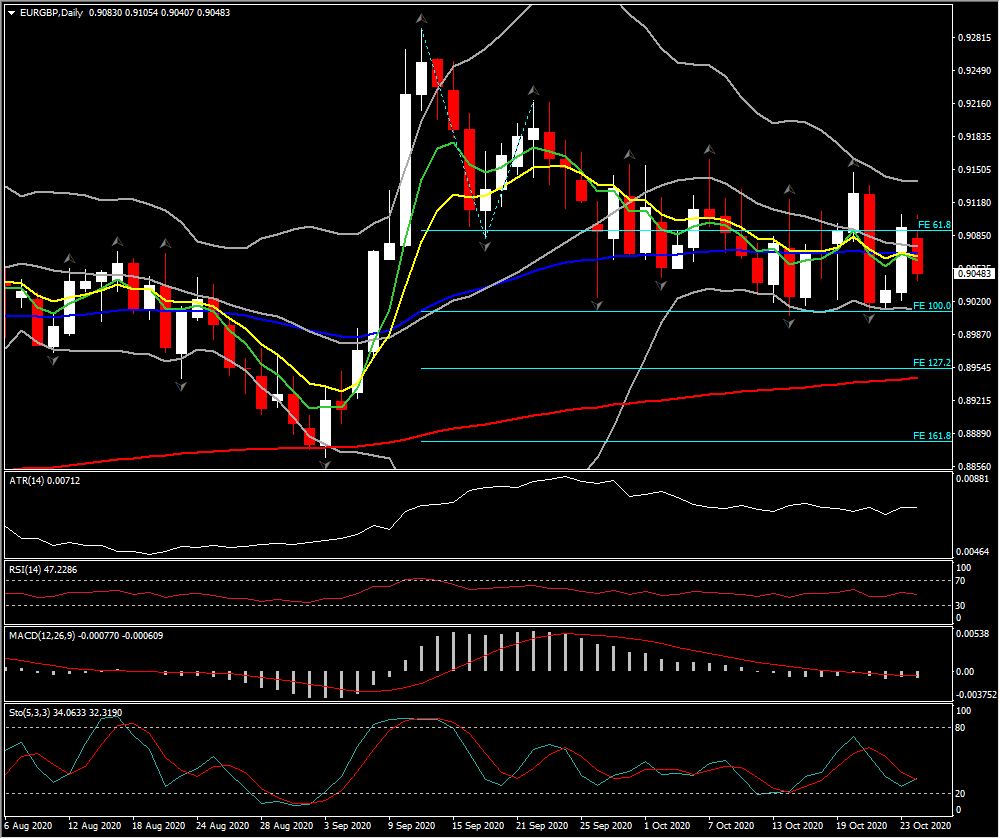

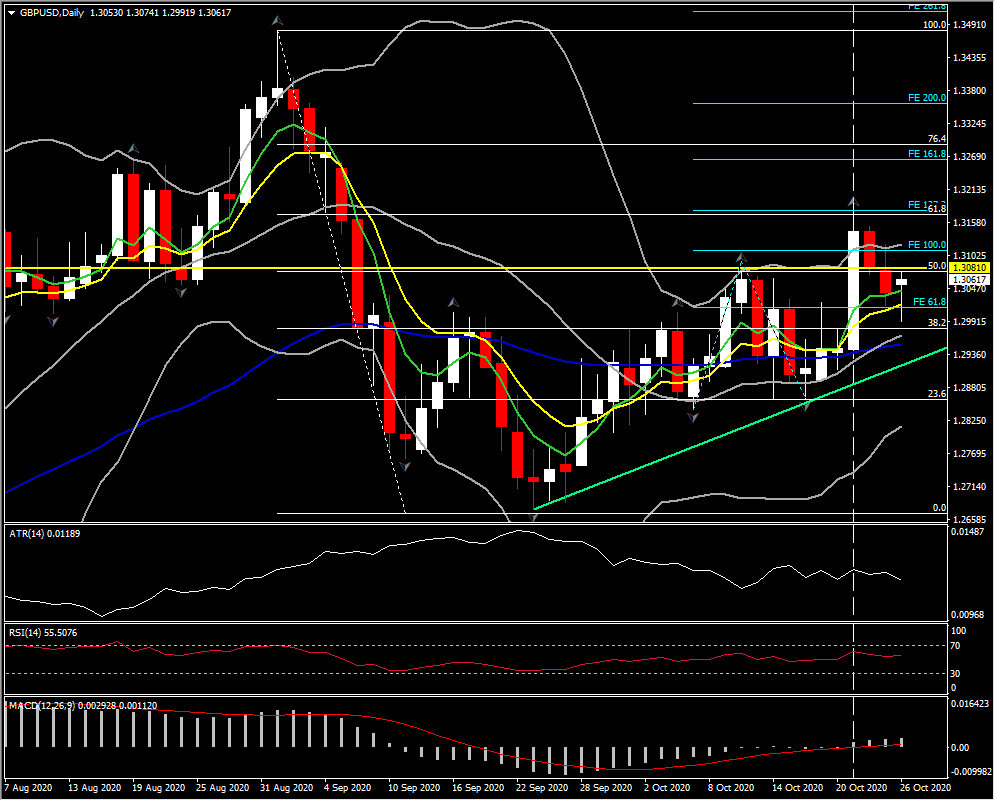

The Sterling meanwhile has rallied in London trading following a strong week, driving Cable to a 1.3074 high, up over 60 pips from the earlier lower, and EURGBP to a 0.9041 low. This is an expression of the currency market’s view that the EU and UK are heading to a trade deal. Considering that the currency might be at risk of sell-on-the fact reaction on news of any concrete breakthroughs in talks, GBP might seen ending the week bullishishly.

For technical perspective, there is a more cautious trading of pound in the medium term with momentum indicators extending into the positive area but quite close to neutral zone as well. In cable for example, the RSI at 55 in the daily chart as whilst MACD lines and Parabolic SAR are threatening higher. Bulls are boosting the Cable to the upswing since mid September breaking last week the 1.3080, representing the reversal of 50% of 3-month losses. Currently the price is slightly lower however it is well support by 2-month trendline and the 20-DMA. Hence a potential pullback before the next swing higher could find support at 1.2950-1.2970 (38% FE, 20-DMA and trendline). Break however of this area could completely change the overall positive outlook for pound.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.