FAANGs earnings reports are on the way all on the same day, on the top of soaring positive Covid tests in Europe and parts of North America, the risk of next week’s US election results being contested and the delay in US stimulus relief, which are keeping markets on edge. Hence along with Facebook, Apple and Alphabet (Google), Amazon – the world’s second largest company by market capitalization – is due to release its earnings report on October 29 after market close.

Additionally on tap on the 29th will be: Apple, Alphabet, Facebook, Comcast, Shopify, Anheuser-Busch, American Tower, Starbucks, Shell, Fidelity National Information, Stryker, Activision Blizzard, Southern Company, March & McLennan, ICE, Vertex Pharma, Moody’s, Global Payments, Takeda Pharma, Newmont, Spotify, Illumina, DuPont, Keurig Dr Pepper, Baxter, TC Energy, Kraft Heinz, Xcel Energy, Twitter, ConocoPhillips, IDEXX Labs, Seagen, T. Rowe Price, Yum! Brands, Motorola, ING, Parker-Hannifin, Carrier, Moderna, Alexion Pharma, ResMed, AMTEK, Church & Dwight, Kellogg, PG&E, Fortinet, CMS Energy, International Paper, Altice, Xylem, CBRE, Martin Marietta, Exact Sciences, Monolithic, Bio-Rad, Alnylam Pharma, Hartford, Zendesk, Arch Capital, NovoCure, Live Nation, Eastman Chemical, Molson Coors, DaVita, and MGM Resorts.

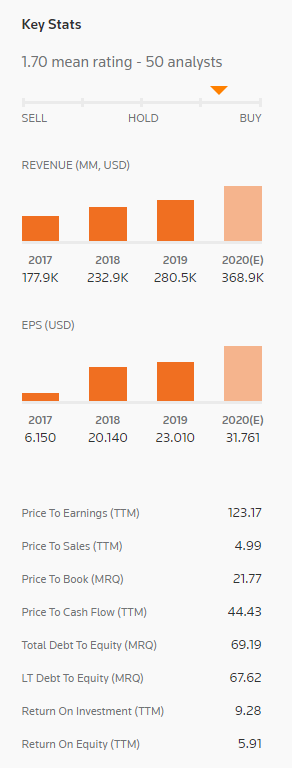

Amazon has a market capitalization of $1,606,373,146,343 — more than approximately 99.98% of US stocks hence its earnings report is expected to add heightened volatility for tech stocks and the USA100 as its component. The report will be for the fiscal Quarter ending Sep 2020, which according to Zacks Investment Research, is expected to experience a near quarter rally of its Earnings Per Share (EPS),compared to last year, at $7.27 from $4.23, which reflects a rise of 71.9%. In Q3, the company’s sales are seen between $87 billion and $93 billion, with the yearly change seen at approximately 24-33% by the end of 2020. In the second quarter, Amazon’s sales were up a stellar 40% at $88.9 billion while its earnings of $10.3 surpassed Wall Street estimates of $1.46 by 600%.

If the pandemic remains strongly in place, Amazon could experience another stellar report based mainly on its consumer online shopping, which was already proven by Prime day’s success with the company stating that small- and medium-sized independent sellers made more than $3.5 billion in Prime Day sales, a 60% increase from last year.

Amazon’s revenue stream is also impressive, including from the Amazon Web Service, as the biggest part of Amazon’s income is derived from its cloud segment. Amazon Web Services (AWS) has posted a significant increase in both sales and operating income year after year, but has skyrocketed this year more precisely due to the pandemic-induced growth of the work-from-home economy. In Q3, was also AWS made generally available for the io2 for Amazon Elastic Block Store and the Amazon Braket.

Additionally, AWS made Contact Lens for Amazon Connect, Amazon Timestream, Amazon Fraud Detector, AWS IoT SiteWise and Amazon Interactive Video Service generally available. Hence all the above have attracted business to Amazon and this reflects AWS as a key metric for investors on tomorrow’s report.

Amazon meanwhile, introduced Luxury Stores in its e-business while it extended its grocery retail with Prime-enabled fast delivery services, such as Prime Free One Day service, Amazon Fresh, a robust 2-hour delivery service of natural and organic product, while it also opened its first Amazon Fresh grocery store, and enabled online shopping at the Amazon Fresh supermarket.

Once again Amazon appears to have a large potential for growth in the coming years despite the global economic slowdown with the US in recession and the risk of double recession in Europe.

Amazon share price appears to have stalled around the $3,250 area this week, ahead of the Q3 earnings report. It is currently traded only 9% below all record highs and has been strongly sustaining the $3,000 floor the past 4 months.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.