Vipshop Holdings Limited (NYSE: VIPS) is scheduled to release its financial results for Q3 2020 on Friday, 13th November before the US market opens. Since its establishment in August 2008, the China-based company has developed into one of the leading online discount retailers for brands in the country, offering high quality, branded products at significant discounted prices to local consumers.

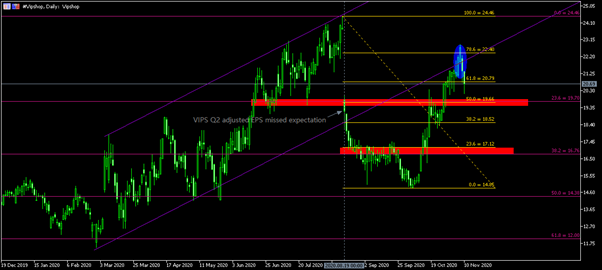

During the second quarter of the year, the company reported its unaudited financial results ended June 30, 2020 which showed a healthy growth in the percentage of total active customers by 5.7 million (or gains of 17% Y-o-Y) to 38.8 million following robust recovery in demand for apparel and a successful promotional campaign. Total net revenue was up 6.0% (Y-o-Y) to RMB 24.1 billion (or US $3.4 billion at a rate of RMB 7.0651 to US $1.00 as set forth in the H.10 statistical release of the Federal Reserve Board). Non-GAAP net income and Net income for Q2 2020 increased by 24.3% (Y-o-Y) and 88.9% (Y-o-Y) to RMB 1.3 billion (US $186.9 million) and RMB 1.5 billion (US $217.5 million) respectively. Nevertheless, it is worth noting that the company’s share price took a beating on the day of the last earnings release despite an overall boost in revenue and income following its adjusted EPS missing Wall Street’s estimate by $0.01, at $0.27.

For the upcoming fiscal results in Q3 2020, Zacks Consensus Estimate has projected growth in sales revenue at an average of $3.19 billion, up 16.13% (Y-o-Y) from Q3 2019. Earnings per share (EPS) is expected to achieve an increase of 8% (Y-o-Y) to $0.27/share. The positive EPS figure combines with Zacks’ ranking on the company at #2 (Buy), indicating an optimistic view of the investment research firm that Vipshop Holdings Ltd is likely to produce a positive surprise at its earnings announcement at the end of the week. On the flip side, 8 out of 11 Wall Street analysts have given a Buy rating on the company’s stock, with consensus price target at $19.90, up 6.42% and 21.94% from 3 months and 6 months ago, respectively. According to these analysts, ceiling price is set at $30.00 while floor price is set at $13.00.

As seen from the Weekly chart above, #Vipshop share price has gapped down and failed to extend its prior gains since the market opened this week. As of writing, the company’s share price stands at $20.89, down 6.56% from its intra-week high.

Looking at the Daily Chart, #Vipshop share price is currently testing D1 61.8 Fibonacci support zone ($20.50 – $20.80), following its retrace from the highlighted confluence zone (blue) that is formed by D1 78.6 Fibonacci level ($22.40) and the extended lower trend line of an ascending channel. A successful bearish breakout may indicate the share price could undergo extended pressure into testing the next crucial support zone near $19.50-$19.70, where W1 23.6 Fibonacci level and D1 50.0 Fibonacci level intersect each other. On the contrary, resistance levels to watch are $22.40 (D1 78.6 Fibonacci level), $23.00 and $24.46. A successful breakout above the all-time high ($24.46) may indicate the share price could turn bullish in the mid term, with FE 61.8 ($27.40) as a resistance level.

Click here to view the economic calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.