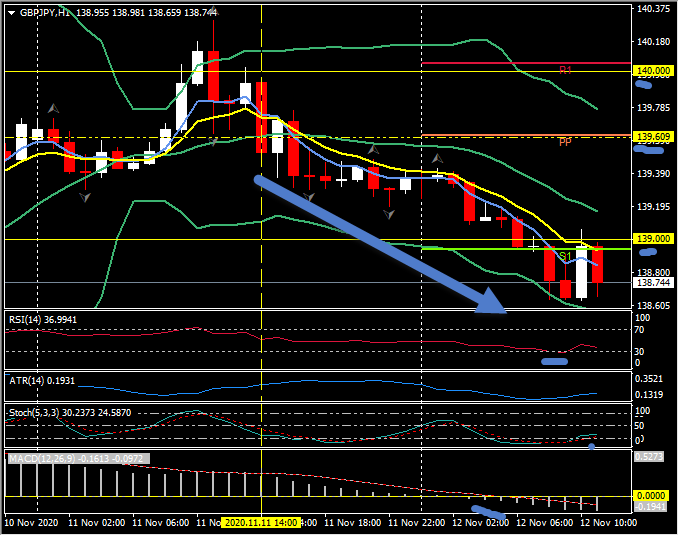

GBPJPY, H1

Some reversal in recent positioning themes has been seen, with the dollar bloc and Pound softening against the Dollar, and the Yen outperforming moderately. This dynamic has been concomitant with global stock markets, outside the case of Japan, flagging. A fall in Chinese tech stocks, sparked by Beijing regulators launching an antitrust investigation, led a broader paring of recent gains in equity markets, which surged over the last week. Some caution had already been creeping back into markets, at least enough to deter investors from entering new positions at the recently heightened levels. The raised level of optimism for a Covid-19 vaccine assisted return to normality remains intact, though there is some way to go and there are known unknowns, including long-term vaccine efficacy and population-wide safety issues. There also appears to be some disquiet about Trump’s refusal to accept the election results, especially with his move to fire his defence secretary, which some fear means that he will try to stay in office. Unnamed Trump aides cited by the Washington Post, however, say that he has no real plan to overturn the results. Japan’s Nikkei 225 gets a special mention for bucking the trend in rallying to a fresh 29-year high.

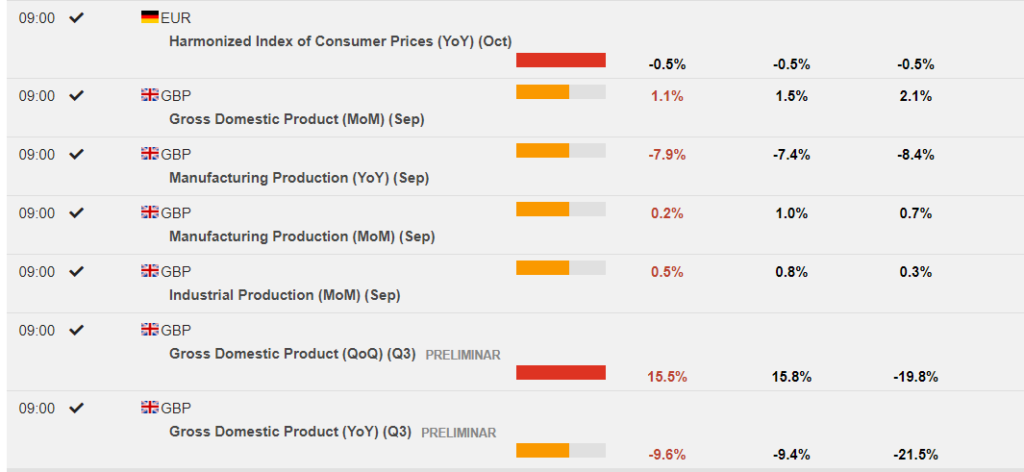

In currencies, EURUSD has been trading neutrally in the mid-to-upper 1.1700s. The pair completed a more-than 50% retrace of the outsized gain the pair saw last week and through to Monday, which left a two-month peak at 1.1920. USDJPY has ebbed moderately, to the lower 105.00s. The Pound has come under some moderate pressure, correcting recent gains. There is still no breakthrough in EU-UK trade talks. Sources cited by Reuters yesterday reported that the ‘final-final’ deadline is the end of next week, (November 20) so the clock is ticking. The general expectation remains that there will be a last minute climbdown and the two sides will strike a deal. Media networks, meanwhile, are increasingly highlighting the likely disruptive impacts of the UK leaving the single market and customs union, which will happen in just seven weeks’ time. Today’s UK GDP data, although a Q3 record at 15.5%, showed further weakness during September and was 3 ticks below expectations of 15.8%. The current data shows the UK economy is -9.7% smaller than it was at the end of Q4 2019.

Technically, GBPJPY rejected 140.00 yesterday, moving under the 20-Hour moving average into the close. Today the pair have moved under 139.00 and tested S2 at 138.70, and R3 is at 138.05. The fast MAs are aligned and trending lower, RSI is 36 and falling, the MACD histogram & signal line are also aligned lower and breached 0 line this morning. Stochastics have moved into the oversold zone but remain weak. The H1 ATR is 0.1630, and the Daily ATR is 1.3000.

Elsewhere, the Kiwi Dollar dropped back after a short-lived rally following remarks by RBNZ’s Hawkesby, who said that while negative interest rates remain an option, less monetary stimulus now appears necessary than previously thought, which essentially repeated the signalling from the central bank yesterday in the wake of its policy review. NZDUSD printed a 20-month high at 0.6914 before retreating to the mid 0.6800s.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.