Market News Today

USD recovered after better than expected PMI’s. – Earlier AstraZeneca vaccine hopes lifted stocks, EZ PMIs worse than expected, UK’s better than expected but both poor. Trump acknowledged that Biden transition should start – Equities rallied further (Nikkei back and up 2.5%) & riskier currencies gained a bid. Biden to name Yellen as Treasury Secretary & Kerry as Climate Tsar. In total a triple whammy for sentiment and risk appetite. USOil followed stocks higher and Gold trades $50 lower than Friday’s close. German GDP revised higher to 8.5% in final reading, from 8.2%.

Shortened Thanksgiving Week Ahead – Highlights – FOMC mins – more significance, after Mnuchin removed emergency funding – possibility of action at their Dec. meeting. Plus – Consumer Confidence, Durable Goods & GDP

USDIndex – Sank to support at 92.00 yesterday – rallied to 92.70, post PMI’s. back under PP now at 92.35. S1 92.10, R1 92.90.

EUR – Rejected 1.1900 & tested down to 1.1800, again yesterday. Now 1.1855 (PP) JPY – down to 103.67 lows yesterday. Rallied to 104.60, now back to 104.40. PP 104.25.

GBP – rallied to a smidge shy of 1.3400, & down to 1.3262. Back to 1.3340 (PP)now all in anticipation of EU-UK Trade announcement this week?

AUD – 0.7340 – 0.7270 range yesterday. Trades at 0.7320 now (R1), PP 0.7295 NZD – down to test 0.6900 yesterday, another good Asian session for king Kiwi, back to test R2 0.6990 earlier, now at 0.6975.

CAD – Back to 1.3040 (S1) ; R1 & 200Ma cap at 1.3090, S2 1.3015 CHF – 0.9075 lows to 0.9150 yesterday. Back to PP and 200Ma now 0.9115, s1 0.9093

BTC – Holds bid at $18,400 (PP). Tested to 18k low yesterday.

GOLD – Collapsed 3% from 1876 to test S1 at 1820 earlier – now 1830 – PP 1850 USOil – Rallied over R1 to $43.70. Vaccine hopes & OPEC+ production cut noises continue to support prices. R2 today 43.90. Private inventories later, official EIA data tomorrow.

USA500 – Closed +20 (+0.56%) 3577 – USA500 FUTS now at 3605.

Today – German IFO, US Consumer Confidence, BoE’s Haskel, Fed’s Bullard, Williams, ECB’s Schnabel, Lagarde, Lane,

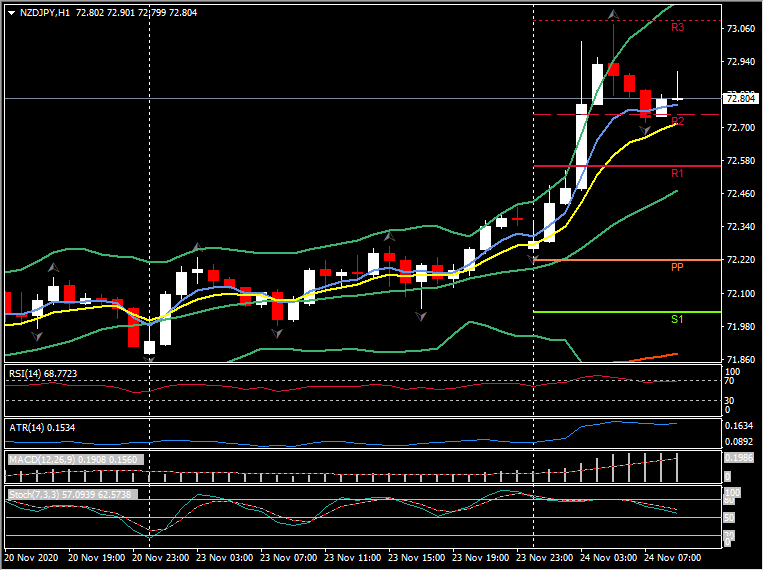

Biggest (FX) Mover @ (07:30 GMT) NZDJPY (+0.79%) –. Holds rally from yesterdays sub 72.00 open, ran to test R3 at 73.05 earlier. Fast MA’s aligned higher but cooling at R2, RSI 68 moving below OB zone, MACD histogram & signal line aligned higher, breached 0-line last week. Stochs. lowering from OB H1 ATR 0.2565 Daily ATR 0.7411.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.