The increase in coronavirus cases around the world, the United States stimulus negotiations and the Brexit talks between the United Kingdom and the European Union, who are making the last efforts to reach a trade agreement- despite following divided into three issues: fishing, competition rules and governance of possible agreement- have led markets in Asia and the Pacific to operate in mixed form this week. Some investors are already looking for the best way for US legislators to reinvigorate efforts to approve some stimulus in the markets in the face of the pandemic.

Some sectors that noticed some setbacks last Monday, within the Japanese stock market, were those of paper and pulp, rail and bus and real estate. It was a negative day for the JP225, which ended with falls of 0.76% to the 26,547.44 points, with a minimum volume of 26,500.32 , a trading range for the JPY 225 between its highest and lowest points; during the beginning of the week it stood at 1.46% , after the last week will notice an increase of 0.43% , maintaining a rise of 14.86% in interannual terms. This year the index has been 0.98%, which still owes it below its maximum of this year which was 26,809.37 points but with 60.38% above its minimum valuation of this year which was 16,552. 83 points.

Companies that managed to position themselves with the best values during the session on the JP225 were: Toppan Printing Co. Ltd. with an increase of 6.84% and 1,608.8 points, Chiyoda Corp, which advanced 6.25% and 255.0 points, Denki Kagaku Kogyo KK which rose 5.48% and 3,660.0 points, Olympus Corp, which fell 5.32% and 2,242.0 points, ended the index, ANA Holdings Inc., which for its part fell 5.21% and 2,357 points and finally Kawasaki Kisen Kaisha Ltd. which yielded 5.06% and 1,913.0 points.

On the other hand, the Bank of Japan has become the largest owner of the nation’s shares, exceeding 400,000 million dollars in the total value of its shares. These massive purchases of tradable funds on the Stock Exchange by the Bank of Japan were intended to support the market during the pandemic; this combined with subsequent valuation gains have brought the value of the Japanese equity portfolio to 45.1 trillion yen ($ 433 billion) according to last month’s figures.

ETF purchases by the Bank of Japan began in 2010 and accelerated as part of a stimulus package implemented by the governor Haruhiko Kuroda aimed at revitalizing the economy, this program was intensified in support of the coronavirus outbreak that caused a fall in the stock markets; amid a new global upturn and to the possible development of a vaccine, the benchmark Topix (Tokyo stock price index) rose 11% last month, while the JP225 increased 15% in its best month since 1994 , managing to boost profits.

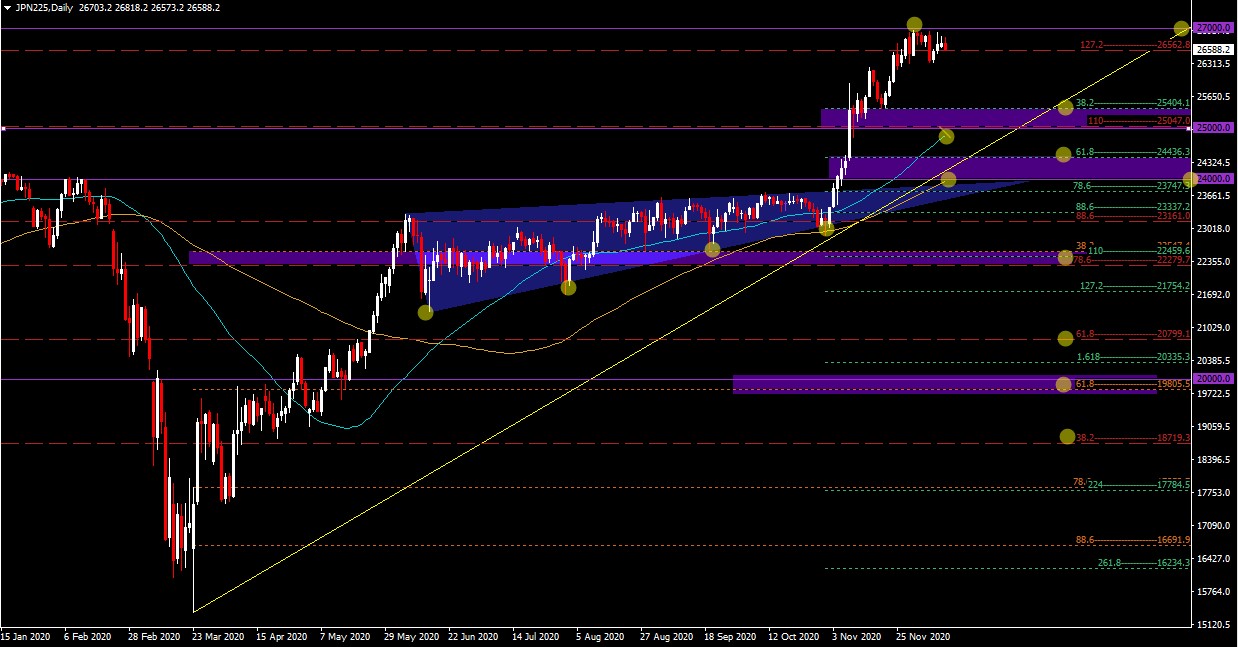

Currently, the price of JP225 is at 26635.7 leaving behind a new all-time high at 26970.7 very close to the psychological resistance of 27000, this after a bullish rally when exiting a triangle that broke higher from a bounce in the moving average of 100 daily periods in price 22869.7. As immediate supports we have the Fibo 38.2% at 25404.1, the moving average of 21 daily periods that is currently at 24876, the psychological level of 25000 and below the Fibo 38.2% at 24436.3, below is the bullish guideline that we currently carry very close to the psychological support of 24000 and finally close support the hypotenuse of the triangle and the moving average of 100 daily periods with its current price of 23952.

Click here to access the HotForex economic calendar.

Do you want to learn how to trade and analyze the markets? Join our webinars and get analysis and trading ideas combined with a better understanding of how markets operate. Click HERE

Aldo Weidner Z.

Market Analyst – HF Educational Office – Latam.

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.