FED – no more additional Bond buying but will keep on buying (adding to the massive balance sheet) until ‘substantial progress’ is made, next few months “particularly challenging”

- FOMC didn’t make any big changes – tweaked its statement to an uber-accommodative posture, which was underscored several times by Chair Powell in his press conference.

- FED – no more additional Bond buying but will keep on buying (adding to the massive balance sheet) until ‘substantial progress’ is made, next few months “particularly challenging”.

- There were no indications that any shifts in guidance or asset purchases would be made near term as Powell indicated the economy is suffering from the pandemic, not a lack of accommodative conditions.

- Weaker than expected US retail sales report was a catalyst for profit taking, especially with the major indexes already at or near record highs on vaccine and stimulus hopes.

- Asian stock markets have moved broadly higher, after a mixed close on Wall Street overnight that left the USA30 slightly lower.

- Stimulus progress – noises all positive on the $908b ($600-700 paychecks likely) – McConnell continued urging his fellow Republicans to seal a deal.

- Australian strong employment data, while better than expected growth numbers out of New Zealand put pressure on local bonds overnight.

- GER30 and UK100 futures are up 0.3% and 0.4% respectively this morning, with hopes of a Brexit deal rising after signals that the UK that is now happy with the latest incarnation of the EU’s plan to manage level playing field provisions and a future divergence from EU rules and regulations. – A deal seems palpable now.

- Bitcoin rose above USD 22,000 for the first time ever and oil prices held onto gains after US crude inventories unexpectedly declined.

- US called Vietnam and Switzerland currency manipulators – the US’s official label as “currency manipulator”, makes any difference to the central bank’s focus on currency intervention as the main tool to manage inflation and money flows.

- Google and FaceBook are accused of “collusion”.

Currency Market

USD popped and then dropped post Fed!

EUR – spiked to 1.2231 – doors open to 1.24-1.2460

GBP – rallied to 1.3570 (February 2018 area)

JPY – 3rd day down – retesting the 6-week Support which coincides with 4-year Support

CAD – bottoming at 1.2700 for 3 consecutive days

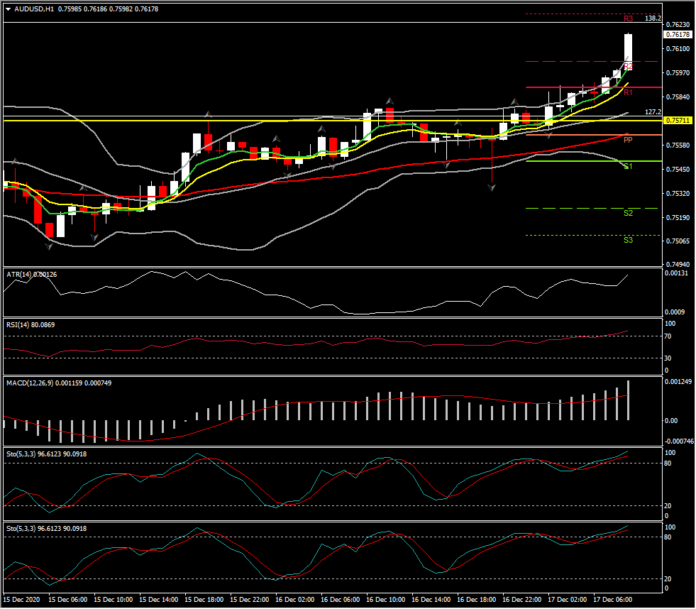

AUD – broke 0.7600 (above R2) – R3 at 0.7628

CHF – readying to form a Rounded Top??

GOLD – 3rd day of higher moves to 50-MA (R1) at 1873, R2 1875

USOil – Breached $48.00 (9 mth high) after inventories showed bigger draw than expected. Holds $48.50 and R3

USA500 – Closed up 6.55 (+0.18%) at 3701 – USA500 FUTS now at 3712. 31 days north of 20-DMA (3656)

Today’s Calendar

Today’s data calendar is thin on the ground, including the final reading for Eurozone November HICP. BUT two central banks report today(BoE and SNB already did) and we also have the COVID-19 vaccine announcement from the US.

Central Banks Review: BoE is likely to keep its options open for now, while keeping policy settings on hold. Markets will also wait for a comment on yesterday’s inflation numbers, which came in much lower than anticipated.

Biggest (FX) Mover – AUDUSD (0.50% as of 09:50) – It spiked above 0.7600 breaking the nearly 2-year resistance and R2 for the day. R3 sits at 0.7628. Technical indicators intraday extend further to the upside, with RSI at 79 pointing higher and MACD likewise. H1 ATR 0.00126, Daily ATR 0.00593.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.