Intel Corporation is one of the largest chip manufacturers in the world; it designs and manufactures microprocessors for the data center and personal computer markets around the world. It is considered to have been a pioneer in x86 architecture for microprocessors, also for being the leading proponent of Moore’s Law that attempts to regulate advances in semiconductor manufacturing. With the current transition to “cloud” storage, Intel has also sought new forms of expansion in the face of low sales in personal computers, as well as the new vision of large rival technology companies that are choosing to develop their own chips, causing a 6.3% drop in Intel shares.

Another factor that has affected Intel’s statistics is the battle it has had for several years with Advanced Micro Devices, a company that after some time being beaten in the PC market by Intel has managed to take the technical lead by becoming the chipmaker for Microsoft’s new Xbox and Sony’s PlayStation 5; While Intel has been seen to rely on the Taiwan Semiconductor factory to meet production targets that has failed to deliver optimal results, leading the company to add data centers and autonomous cars among its lines of business.

One of the options that Intel could aspire to if it decided to risk a new technology that Apple devices have incorporated, the ARM architecture, which uses RISC, with single-cycle instructions that are only useful to perform specific tasks, which makes it necessary to incorporate many different cores to do the same, which differentiates it from the x86 architecture in which Intel has specialized and which is based on CISC, with very broad sets of instructions that serve to solve very complex problems, giving it great versatility to carry out any operation with the same core.

Although this new technology would not enter Intel’s plans in the short or medium term until the company manages to find a point of stability and understand if consumers of the premium efficiency of hard performance give up for a lower consumption, even if the ARM processors are less efficient than x86, so despite being a potential transition it is not on the company’s radar for now.

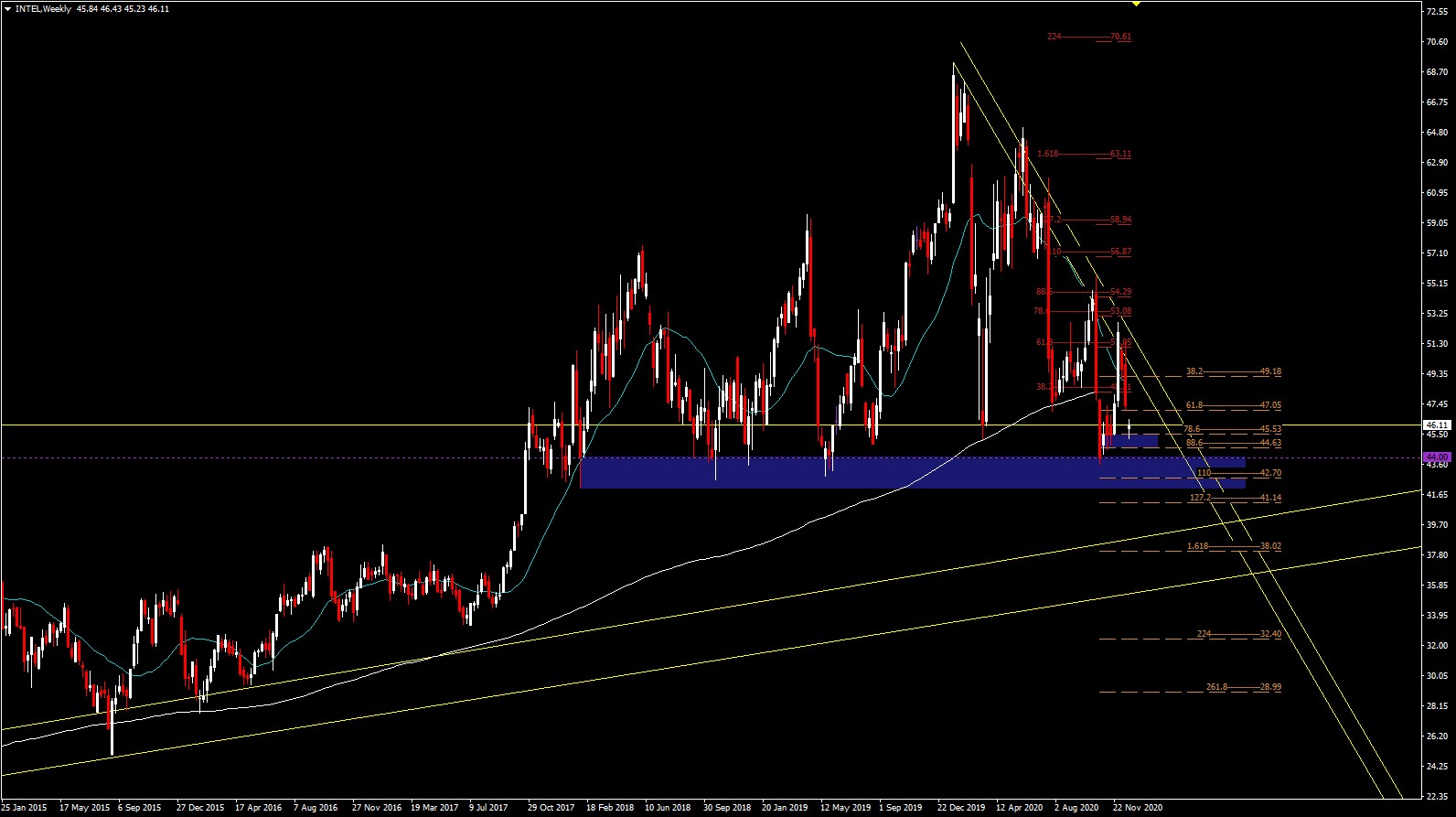

For the session on Friday, December 18, Intel shares fell 2.3% to a value of $ 49.49 to close at $ 50.65, 40.01% below its 52-week high of $ 69.29, where the growth in the company’s sales reached -13.7% for the current quarter and a decrease of 17.6% for the next, leaving the growth estimates for the current quarter of –27.6% and –32.2% for the next quarter. On the other hand, the interannual growth of Intel’s quarterly revenues decreased 4.5%, positioning its value at $ 78.1 billion dollars during the last twelve months; in turn, the company’s value is currently above its 50-day moving average at $ 47.49 and below its 200-day moving average of $ 52.20.

The price holds above $ 44.00 Support level that has been maintained since 2018. The price continues its downward trend that started this year from its annual maximum at $69.27 with quite sharp falls.

Resistances are seen on Fib. 61.8% at $47, Fib. 38.2% at $48.21, 21-Day SMA, Fib. 38.2% at $49.18, psychological level of $50 and above the previous highs at $51.05.

Click here to access the HotForex Economic Calendar

Aldo Weidner Zapien, Market Analyst – HF Office of Education – Mexico

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.