USA500,H1

A widening US trade gap, a persistently high (although falling) claims and a big beat for ISM Services

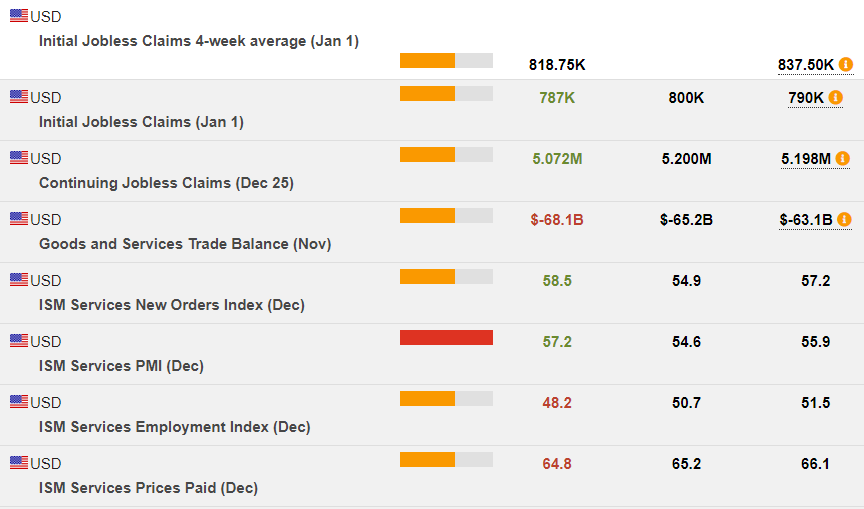

The -3,000 initial claims drop to 787,000 in the New Year’s week extended declines of -16,000 to 790,000 (was 787,000) in the Christmas week and -86,000 to 806,000 in the week before that, while claims on a non-seasonally adjusted (NSA) basis surged 77,000 to 922,000, after falling -27,000 to 845,000 (was 841,000) last week and -69,000 to 873,000 in the week before that. The modest seasonally-adjusted (SA) claims drop was in line with many assumptions despite the big NSA swings that were apparently well-anticipated by the seasonal factors this week despite this year’s unusual holiday experience, and considerable volatility since the Veteran’s Day holiday.

Continuing claims fell -126,000 to 5.072 million after a -124,000 drop to 5.198 million (was 5.219 million), leaving a continued steady decline. Initial claims averaged 828,000 in December, versus lower prior averages of 749,000 in November and 786,000 in October, but a higher 855,000 in September. The 892,000 December BLS survey week reading exceeded recent survey week readings of 748,000 in November, 797,000 in October, and 866,000 in September. Continuing claims fell -767,000 between the November and December BLS survey weeks. Expectations are still for a December payroll rise around 100,000 though risk is for a weaker print, and potentially a decline, (Barclays have a -50,000 figure) especially given the -123,000 decline in the ADP report yesterday.

The US trade deficit rose 8.0% to -$68.1 bln in November, bigger than expected and the second largest on record, bested only by the -$68.3 bln from August 2006. The deficit had widened 1.7% to -$63.1 bln in October. Both exports and imports continue to improve, posting 6 straight monthly gains. November exports increased 1.2% to $184.2 bln after the prior 2.2% climb to $182.0 bln. Imports jumped 2.9% to $252.3 versus the 2.1% pop to $245.1 bln. The “real” goods trade balance surged to -$96.5 bln, an all-time low, versus -$89.9 bln previously.

Stocks have opened positively. The USA500 has broken yesterday’s high of 3783 and is trading up over 3800, while the USA100 has opened up 1.5% at 12,800, with the USA30 higher by 120 points at 30,950. Biden’s formal recognition by Congress as president along with the Democratic capture of the two Georgia senate seats (and thus Senate control) has cheered the market, which is looking forward to a sizable increase in federal stimulus. President Trump promised an “orderly transition” on January 20, following the tragic scenes in the Capitol building yesterday.

The ISM December Services Index posted a much better than expected 57.2 reading versus 54.5 and up from 55.9 last month. Interestingly, unlike yesterday’s manufacturing data, the prices paid missed expectations at 64.8 versus 65.2 and fell from 66.1 in November.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.