FX News Today

USD continues to bounce, JPY, AUD & NZD weaken, Yields up as virus worries escalate and China pushes back on US sanctions and reacts to US normalizing relations with Taiwan. Plus, Speaker Pelosi’s plans to impeach President Trump if the cabinet doesn’t act to remove him. Equities closed at new ATHs on Friday, despite big miss for NFP. Asian markets mixed (Japan closed today) Gold, Bitcoin and Oil all down sharply. Overnight – Chinese inflation better than expected and Aussie Retail Sales in line at a perky 7%.

This week – US Retail Sales and Inflation (CPI & PPI), UK GDP, lots of Central bankers speaking topped by Powell on Thursday.

USDIndex – 4th day higher from 33-mth low (89.15) and back over 90.00 – trades at 90.31 – PP 89.90 – Touching a 19-day high earlier.

EUR – 3rd day lower trades under 1.2200 – 1.2165 earlier, for a 17-day low, back to 1.2185 now– PP – 1.2235

JPY – 4th day higher – breached n holds 104.00 – Trades at 104.12 (R1) , close to one-month highs – PP 103.87

GBP – down under 1.3500 this morning – testing S2 at 1.3480 PP 1.3580

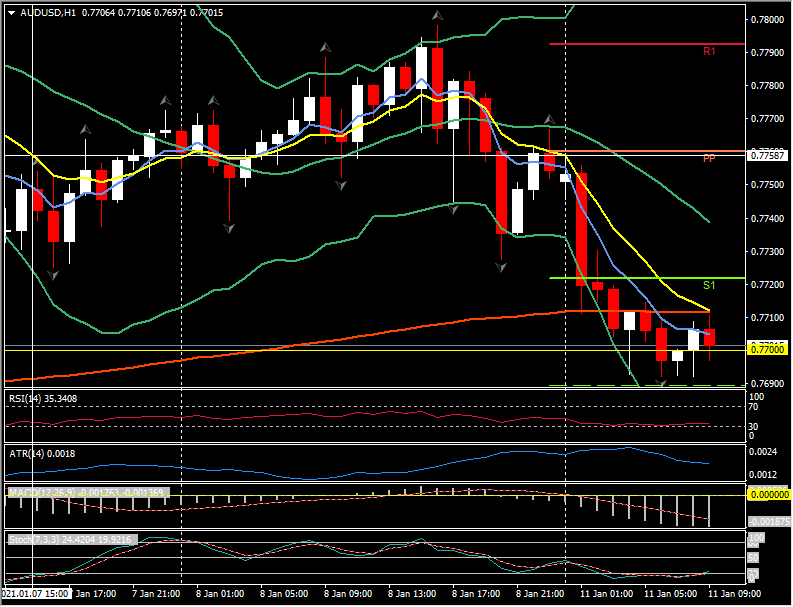

AUD – Back down to trade at 0.7700 (s2) – PP 0.7760 NZD – slips under 0.7200 this morning – PP 0.7240, trades at 0.7185 CAD – breaches and holds over 1.2700 (PP) – moving higher on weaker Oil prices – trades at 1.2765 (R2) CHF – Trades at R1 around 0.8885 – up from 3 yr lows on Wednesday at 0.8757. PP 0.8850

BTC – Parabolic bazooka boom continued Friday to new ATHs over $41,800 – rapidly retraced to day – “Back” under $35,000.

GOLD – Big faller (1920-1830) on Friday, Trades at 1850 now, PP 1875 USOil – $52.70 high Friday – trades at $51.50 (PP) now – still elevated

USA500 – Closed up 20 (+0.55%) 3824 – USA500 FUTS now at 3803. 46 days north of 20SMA (3722).

Today – EZ Sentix Index, BoE’s Tenreyro, ECB’s Lagarde, Fed’s Bostic, Kaplan.

Biggest (FX) Mover @ (07:30 GMT) AUDUSD (-0.65%) Continued Friday’s decline on open, moved down from PP, now under 200Hr MA to pivot at 0.7700. S2 0.7690. Slow & Fast MAs aligned and trending lower, RSI 35 and falling, MACD histogram & signal line aligned lower, significant break of 0 line this morning, Stochastics rising from OS zone. H1 ATR 0.0018, Daily ATR 0.0082.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.