FX News Today

USD reversed its 5 day run as Yields stalled too. House vote tonight to impeach President Trump, (YouTube have banned him for 7 days), Pence will not initiate the 25th Amendment to remove him. The symbolism is significant, no President has ever been impeached twice. Equities flat too (UBER +7.24%,TSLA +4.72%, FB -2.24%, GooGL & NFLX -1.00%) Asian markets also flat. GBP rallied after Bailey pushed back on Negative Interest Rates. Oil rallied over 1% after surprise inventory drawdowns peaked at $53.90, AUD pegged by possible RBA “push back” to strong AUD. Gold recovered $1850.

China reported its largest daily new COVID-19 cases in 5 months.

USDIndex – Back under 90.00 from rejection of 90.50 yesterday. Trades at 89.95 just over S3 – PP 90.40 – S3 89.90, S2 90.07

EUR – Recovered back over 1.2200 (R2) – Trades at 1.2215 now– PP – 1.2157. R3 1.2225 –

JPY – Reverses under 104.000 – after rejection 104.50 on Monday. – Trades at 103.68 (200hr MA). – PP 103.90, S1 103.55

GBP – Big rally – spurred by USD weakness and Governor Bailey pushing back on Negative Interest Rates. Breached 1.3600 after multiple attempts – rallied to 1.3690 – PP 1.3585, R1 1.3668, R2 1.3715

AUD – Over 0.7700 yesterday to test 0.7770 (R2) now. R1 0.7748 – NZD – Over 0.7200 yesterday to test 0.7240 (R3) now. r2 0.7215 CAD – back to test 1.2700 (S2) today as Oil rises – S1 1.2725, S3 1.2664 from Friday CHF – Trades back to 0.8850 (200hrMA) and under S3 (0.8865)- PP 0.8900

BTC – Back to around $34,600. – PP today 34,500, r1 36,600, s1 32,800

GOLD – Recovers over 1850 (PP) – Trades at 1860 (R1) – R2 1875, PP 1840 USOil – New 11-mth high $53.90 (R2) after surprise drawdown in private inventories (EIA data later). R3 $54.70, r1 53.55.

USA500 – Closed up 1.5 (+0.04%) 3800 – USA500 FUTS now at 3808. 48 days north of 20SMA (3740).

Today – EZ industrial production, US CPI, ECB’s Lagarde, Fed’s Bullard, Brainard, Harker, Clarida

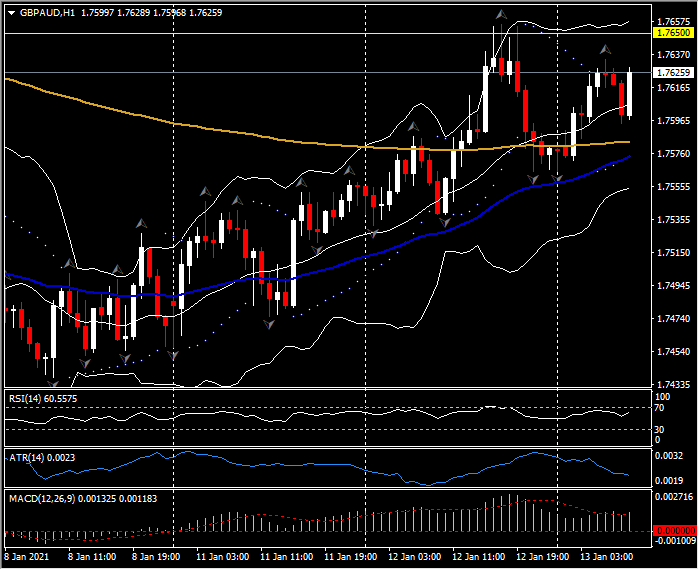

Biggest (FX) Mover @ (07:30 GMT) GBPAUD (+0.23%) 5th day higher – Bounced from 200MA on open, testing 1.7625 now, key resistance 1.7650. Fast MAs aligned and trending higher, RSI 59 and rising, MACD histogram & signal line aligned higher and north of 0 line from Monday open, Stochastics rising to OB. H1 ATR 0.023, Daily ATR 0.0125.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.