The confirmation hearing of ex-Fed Chair Yellen as Treasury Secretary, and data on international capital flows yesterday led Wall Street higher as the market eyes a hefty expansion in stimulus under the Biden administration and the Democratic-led Congress.

Asian markets were also supported on the whole, although there were pockets of weakness, most notably in Japan with the Nikkei actually lower as the 2-day BoJ meeting kicks off. Stimulus hopes continue to underpin sentiment with earnings reports also adding support, although virus developments also remain in focus and Germany’s extension of the current lockdown measures and still high death count highlight that despite the rollout of vaccinations, the chances are still that both the Eurozone and the UK will see a technical recession over Q4/Q1 with the services sector in particular impacted by virus restrictions.

Netflix Inc surged in after-hours trade, after reporting a stronger rise in customers than expected. JPMorgan reported a $4.51 bln Q4 profit, exceeding expectations and more than doubling the profit seen in Q4 of 2019. BofA revealed a 22% drop in Q4 profits, but earnings per share came in better than expected. Earnings were generally supportive.

Bloomberg confirmed that the ECB is actively targeting spreads and thus borrowing costs for governments across the Eurozone, which at this stage is hardly a surprise and will become even more important once activity bounces back and the focus turns once again to the debt mountain accumulated during the pandemic.

- EUR – up at 1.2153, remains below 38.2% fib from the 1.2380-1.2050 down leg

- GBP – rebound continues with Cable moving above R1 at 1.3660

- JPY – down to 103.70 – S1 at 103.66

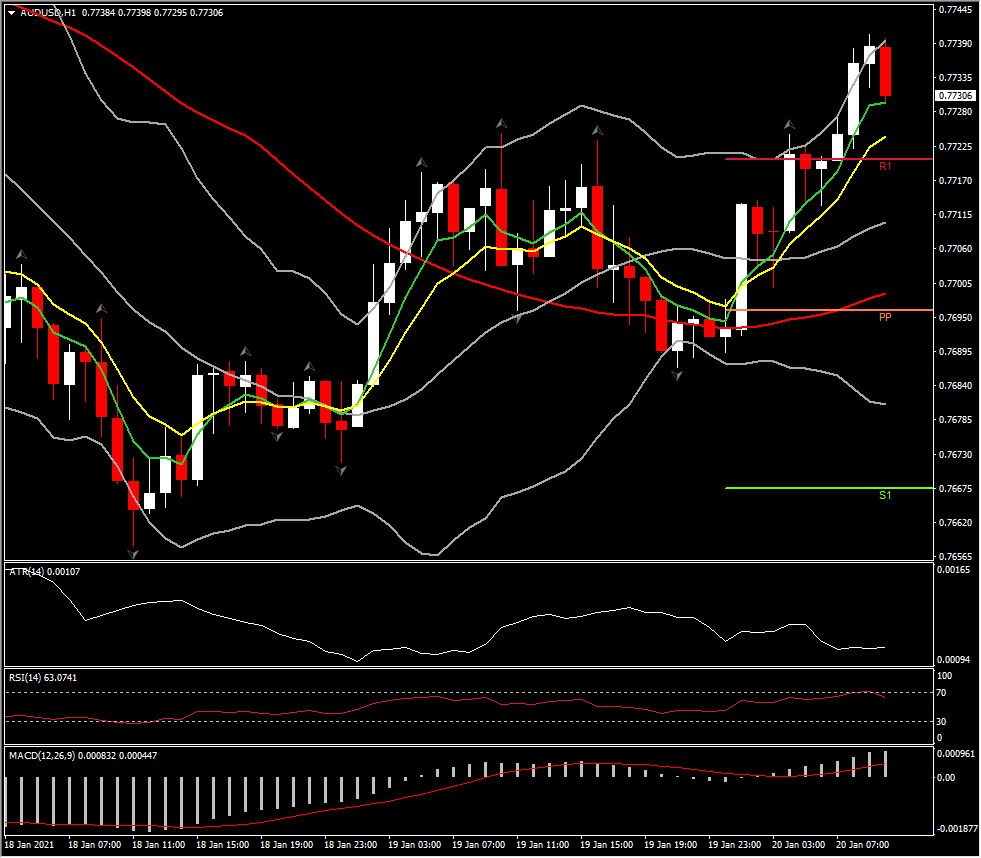

- AUD – outperformed to 0.7730 – R2 at 0.7750

- CAD – gains, retreating to its place below 1.2700

- GOLD – at 1854 – next Resistance at 1858 (R3 and 50DMA)

- USOil – lifted to 53.40, however renewed lockdowns have added pressure on the 1st half of 2021. February contract expires today so traded volume is now in the March contract. The IEA earlier cut Q1 oil demand by 600k bpd, and 300k bpd for all of 2021, which was likely behind the modest dip in prices. Hopes for a quicker vaccine rollout, along with new massive fiscal stimulus and strong China growth, may limit downside going forward, though oil bulls will need some proof of improvement in fairly short order if further significant oil price gains are to be seen. For now, the $52-$54 trading band seen over the past weeks looks set to hold for now.

- Bitcoin – turned lower to 35.7K

Today: All eyes will be on Washington today – Inauguration 16:15 GMT. The local data calendar meanwhile focuses on December inflation data for the UK and the Eurozone.

Biggest (FX) Mover – AUDUSD (+0.51% as of 07:35 GMT) – The asset reversed its 2-day losses, as it was supported quite well by the 20DMA. Intraday momentum indicators and fast MAs suggest an increasing positive bias, however in the daily timeframe positive bias remains under pressure. ATR H1 – 0.00107 & ATR Daily – 0.00794.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.