EURUSD, H1

US initial jobless claims fell -26,000 to 900,000 in the week ended January 16. This follows the prior week’s sharply downwardly revised 142,000 surge to 926,000 (was 965,000) which was the highest level since late August. But the 4-week moving average rose to 848,000 versus the prior 824,500 (was 834,250). Initial jobless claims (NSA) tumbled -151,300 to 960,700 in the January 16 week after rising 192,300 (was 231,300). Continuing claims dropped -127,000 to 5.054 million in the January 9 week after bouncing 109,000 to 5.81 million (was 5.271 million). The initial claims number will get a little extra scrutiny as it coincides with the BLS employment survey week.

US housing starts climbed 5.8% to 1.669 mln in December, well above expectations, following the 3.1% jump to 1.578 mln (was 1.547 mln) in November. This is the fourth straight monthly increase and is the highest since late 2006. Building permits increased 4.5% to 1.709 mln last month after November’s 5.9% surge to 1.635 mln (was 1.639 mln). All of the strength in starts was in the single family arena, posting a 12.0% pop, while multifamily starts dropped -13.6% following respective increases of 1.4% (was 0.4%) and 9.1% (was 4.0%). And this is an 8th straight monthly gain (since May) for single family starts.

The Philly Fed manufacturing index rebounded 17.4 points to 26.5 in January, much stronger than expected, after dropping -11.6 points to 9.1 (was 11.1) in December. The index has been in expansion since June and was at 13.7 a year ago. Gains were broadbased. The employment index surged to 22.5 from 5.6 (was 8.5). The workweek edged up to 18.6 from 15.5 (was 18.0). New orders jumped to 30.0 from 1.9 (was 2.3). Prices paid nearly doubled to 45.4 versus 24.9 (was 27.1) and prices received increased to 36.6 from 16.1 (was 18.0). The 6-month activity index rose to 52.8 from 43.1 (was 39.2). But the future employment gauge dipped to 38.9 from 41.3 (was 41.0), and new orders were unchanged at 47.5 (December was revised from 41.5). Prices paid slid to 41.3 from 45.1 (was 46.6), with prices received at 33.9 from 34.3 (was 35.5).

The Dollar moved slightly higher after the mostly upbeat data, which saw initial jobless claims fall less than expected, but continuing claims down more than forecast. Housing starts beat expectations, while the Philly Fed index was stronger than consensus. USDJPY traded from near 103.45 to 103.55, while EURUSD initially dipped to near 1.2150 from 1.2165.

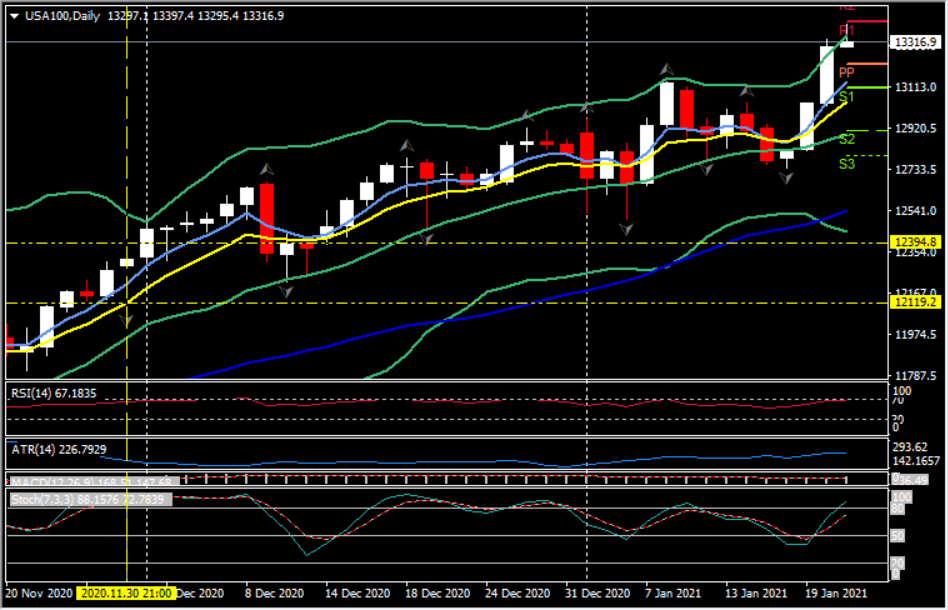

Equities have opened higher, all three of the major US indices at all-time highs, the USA100 leads the way to trade at 13,310.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.