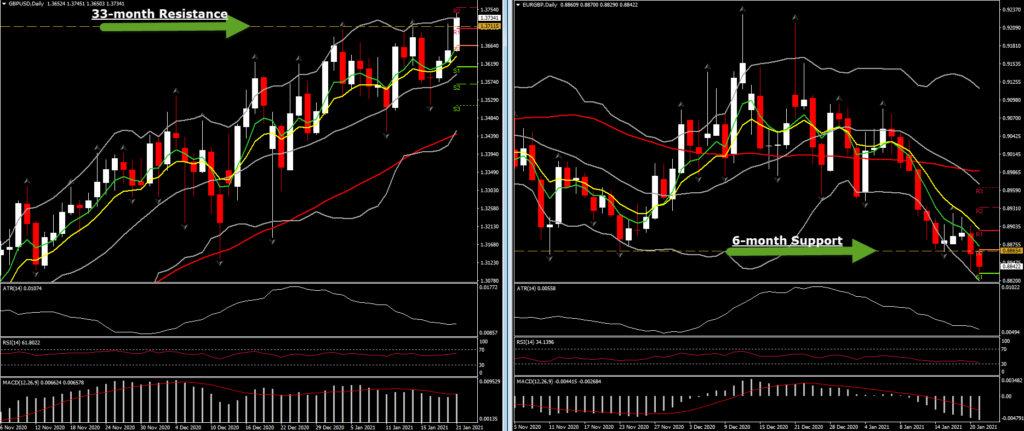

The Pound came into the spotlight today as it spiked higher since yesterday, with EURGBP breaking through 6-month lows at 0.8860, while earlier it extended declines, posting a fresh 8-month low at 0.8831. Cable concurrently punched above last week’s trend highs to a fresh 33-month peak at 1.3745, as the USDIndex edged out a 6-day low.

On the US Dollar side, market sentiment seems to remain bearish on the Greenback in the context of the reflation trade (which is hinged on a vaccine-assisted return to societal normalcy, alongside massive global stimulus and an expected spending spree of built-up consumer savings), on the view that US assets and by association the Greenback are overvalued against peers and emerging markets. Despite the anticipation of new US President Biden’s massive $1.9 tln stimulus package, and the associated asset price surge, US Treasury yields were subdued, with the long-term bonds coming off one-year highs and the 10-year note yield dropping below 1.08% for the first time since early January. This also aided US Dollar softness.

But the market at the same time seems less bearish on the Greenback since the Georgia runoff elections, where the Democrats won control of the Senate, given the implications for growth and Fed policy. Republicans have been voicing their opposition to the magnitude of Biden’s spending plans, though the Democrats’ desires should still find passage. There are some concerns about the regulatory and tax implications that the Biden administration will bring.

In Europe meanwhile, market narratives are talking about the breach of key downside technical levels in EURGBP, along with perkier than anticipated December inflation data out of the UK, which has come hot on the heels of BoE Governor Bailey and Deputy Governor Broadbent downplaying the negative interest rate option. UK December inflation figures saw headline CPI come in slightly warmer than expected, at a 0.6% y/y rate, up from 0.3% in the month prior. The median forecast had been for a rise to 0.5% y/y.

Other Pound positives, which we have been noting, include reports of long-term investor interest in UK assets over the last year, which have been left undervalued by the impact of both the long Brexit process and Covid lockdowns (the UK economy having underperformed G20 peers during lockdowns last year). An illustration of this is provided by the January update of Economist magazine’s Big Mac index, a measure of 56 currency valuations according to the theory of purchasing power parity, which showed the Pound to be 22% undervalued against the Dollar. Associated with this view is the fact that the UK is among the leaders of the pack in the rollout out of Covid vaccinations, and is on track to have nearly 25% of the population vaccinated including nearly all of the at-risk groups as soon as mid February. At this point, the UK government will start reversing out of restrictions, although most likely this will be in a cautious stage-by-stage process over several months.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.