CISCO, Daily

Cisco Systems Inc. (Cisco) has long been THE player in the USA for global network equipment hardware sales like routers, switches and gateways. In recent years it has also, like many hardware companies, moved into software applications and security.

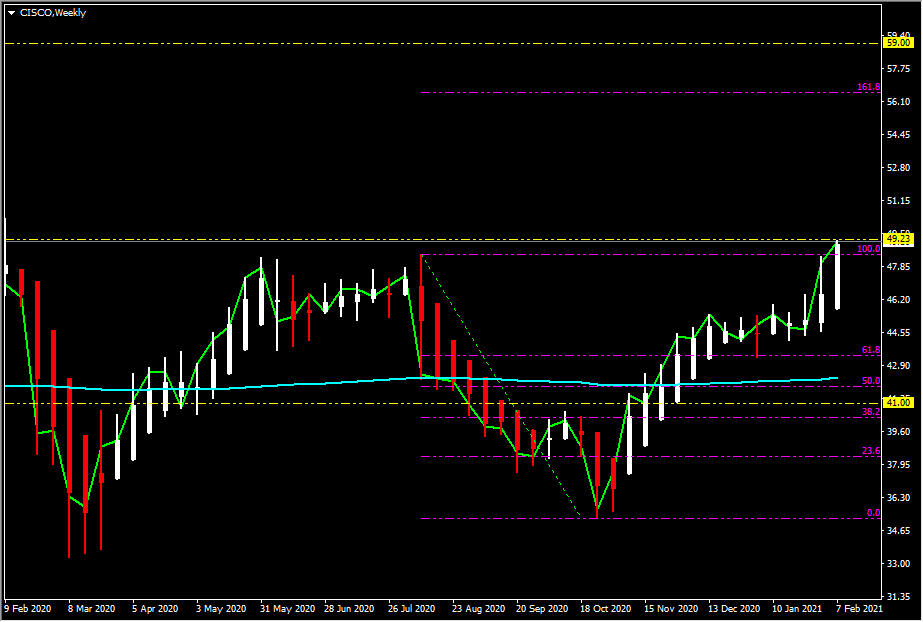

The technology giant, often referred to as the backbone of the internet, reports its quarterly earnings on February 9th after the close of the New York trading session. Its shares have been in high demand following the October low at $35.17, closing Friday at $48.08, up $0.83 (+1.76%) but still some 4.38% below the key 52-week high of $50.28. The rally from the October low represents a gain of some 36.70%, which even outperforms the USA100’s gain over the same period of 22.70%.

Last quarter Cisco revenues jumped 8% to reach $13.1 billion, ahead of all estimates. More specifically, the application business surged 18% and security climbed 11%. It also saw its adjusted earnings per share jump 23% to also beat estimates.

Cisco is calling for its quarterly 2020 revenues to actually contract some 0.72% and its earnings per share (EPS) to come in at $0.76, down some 1.3% on the same quarter last year. For the full-year numbers, expectations are for contraction of 0.93% for both EPS ($3.18) and revenues ($48.84 bn). Market expectations have also cooled recently, with a change in outlook from Morgan Stanley that changed their recommendation from “overweight” to “equal-weight” and lowered their price target to $49.00 from $51.00 a share.¹ Nomura also downgraded the company to a “Neutral” from a “Buy” in December. However, Piper Jaffray reiterated their “Overweight” rating in October with a price target in the $55.00-$59.00 range and remain the most bullish of all analysts covering Cisco².

Technically, the Fibonacci extension suggests the stock could rise to beyond the $56.00 level should the $50.00 level be breached and broken. Key support sits at S1 and the 61.8 Fibonacci level at $43.32 and the 200-week moving average and 50.0 Fibonacci level at $42.00.

¹https://www.marketwatch.com/story/cisco-stock-downgraded-at-morgan-stanley-2020-02-12?siteid=yhoof2&yptr=yahoo

²https://www.finviz.com/quote.ashx?t=CSCO

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.