Market News Today

USD down again, Equities finished flat but Asian markets & Futs. higher after good earnings reports from Twitter, Cisco, Lyft and Toyota. Oil holds at 13-month highs, Gold holds 1840, BTC peaked at 48k and 10-yr Yields closed at 1.16% again, with expectations of inflation raised. Overnight JPY PPI in line but CNY CPI surprisingly dipped too (-0.3%), German CPI in line with expectations at 0.8%.

Today – US CPI, Oil inventories, ECB’s Lagarde, Panetta, BoE’s Bailey, Fed’s Powell, new Bonds from the UK, Germany & the US – Earnings from Coke, General Motors, Under Armour, Uber & 152 more US companies.

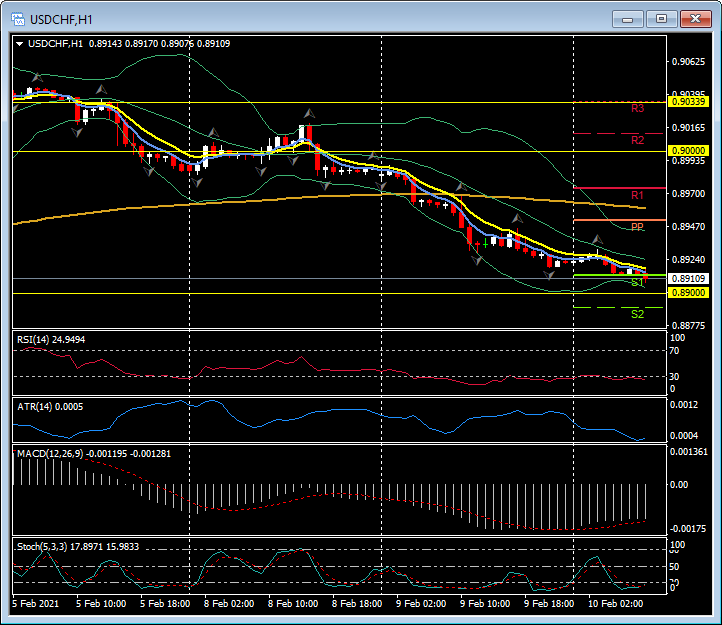

Biggest (FX) Mover @ (07:30 GMT) USDCHF (-0.14%) Continued Friday’s decline from 0.9050 highs and re-break of 20 MA on Monday below 0.9000 to test S1 today at 0.8910. Faster MAs aligned and trending lower, RSI 24 & and OS, MACD histogram & signal line aligned lower & significantly under 0 line, Stochs OS zone from earlier this morning. H1 ATR 0.0005, Daily ATR 0.0050.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.