Kraft Heinz (NASDAQ: KHC) is set to release its Q4 and full 2020 fiscal year report this Thursday, 11th February 2021, before the US market opens. Being probably one of the biggest headaches of the greatest investor of all time – Warren Buffett and his company. The market participants are eyeing the results that shall be delivered by the North American consumer-packaged food and beverage company in order to further evaluate its performance.

Undoubtedly, the company has stumbled in the past few years due to various obstacles which have hindered its growth. Failure in company restructuring, an SEC investigation on accounting irregularities, a writedown worth over $15 billion, ineffective cost-cutting strategy, supply chain issues, reduced competitiveness to meet consumers’ preference and demand… these are among factors that served as a headwind to the company’s growth.

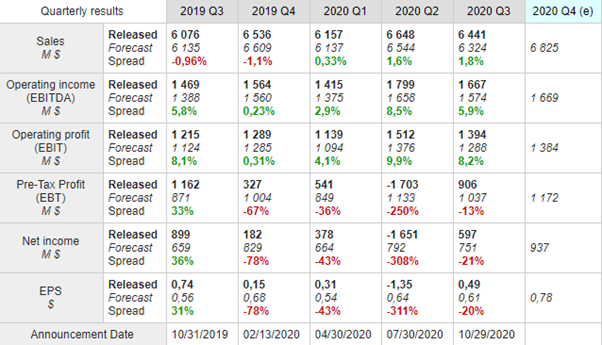

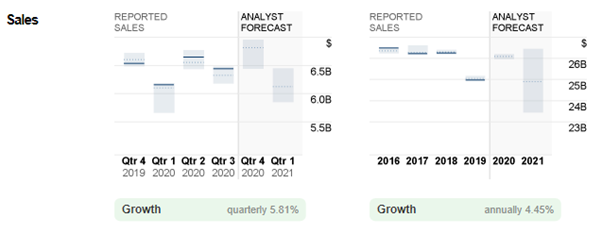

Surprisingly, Kraft Heinz has been performing well in sales generation for the past three quarters in 2020; according to CEO Miguel Patricio, the positive results were due to elevated at-home consumption and continuous effort made by the company in response to the Covid-19 pandemic.

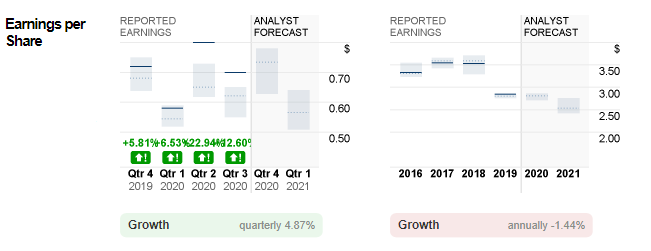

Nevertheless, the company posted net income of $597 million in Q3 2020, down 33.59% from the previous year , while EPS was also down 33.78% (y/y) to $0.49. The losses, according to the CEO, were attributed to pending cheese transactions and increasing sales of the natural cheese business.

For the upcoming announcement, consensus estimates for EPS stand at $0.73, revised slightly higher by $0.01/share from a year ago. Looking at past performance from 2016 to 2019, results on reported earnings were mixed. The company particularly underperformed in 2017 and 2018, with reported EPS at $3.55 and $3.53 respectively, missing estimates by 1.13% and 1.67%.

On the contrary, analysts’ forecast for Q4 2020 sales stand at 6.8B, up 4.62% from a year ago. In general, Kraft Heinz has managed to meet consensus expectations within the past few years, with the only exception in 2017 when sales generated fell short by 0.1B , at 26.2B.

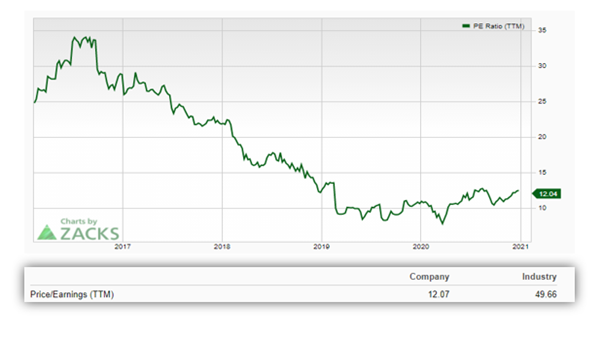

Figure 4 shows that the trailing 12-month PE ratio of Kraft Heinz was last recorded at 12.07. Compared to readings of other companies in the industry, it is fairly reasonable to say that Heinz is still possibly undervalued, which may also be one of the reasons for analysts and researchers to suggest a Hold on this stock.

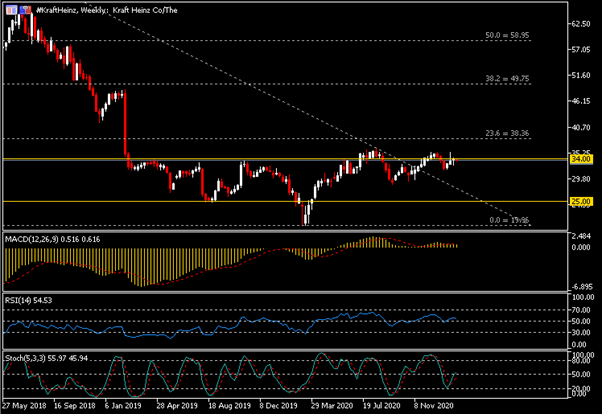

Technical Overview:

Following an enormous decline since the beginning of 2017, #KraftHeinz found its ground at $19.96 before extending higher to the current key level 34.00. Current price action suggests market indecisiveness. Looking at the indicators, MACD lines remain hovered above the neutral line, while RSI and Stochastics are seen traded above 50.00.

From the Daily Chart, 34.00 and 36.00 are the key resistance in near-term. A successful breakout above these levels may suggest the share price will extend its momentum and test the 38.30 – 38.70 zone . On the downside, key support lies at 31.50, 28.50 and 25.00.

Click here to access the HotForex Economic Calendar

Larince Zhang

Market Analyst – HF Educational Office

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.