Through its various subsidiaries, Chevron Corporation conducts business throughout the world, consolidating itself as one of the world’s leading energy companies, participating in practically all areas of the energy industry. The company, headquartered in San Ramon, California, is involved in searching, producing and transporting crude oil and natural gas; refining, marketing and distributing fuel and lubricants for transportation; manufacturing and selling petrochemicals and additives, generating energy, and developing and implementing technologies that enhance business value in all aspects of the company’s operations.

Seeing itself in a scenario where it faces long-term headwinds due to the energy transition to cleaner fuel sources, Chevron has presented the proposal to acquire all the units that are listed on the stock exchange under the company name Noble Midstream Partners, for which the oil company has offered to exchange shares for all remaining publicly traded units of its affiliate at a value of $12.47 per unit. This agreement values the Midstream company at $1.13 billion.

Last year, Chevron reached an agreement to acquire a 62% stake in Noble Midstream in order to own its former MLP parent, Noble Energy, at a cost of $13 billion, becoming Noble’s largest customer. Midstream, a pipeline company, provides midstream services related to water, natural gas, and crude oil under an agreement with producers such as DJ Basin of Colorado and Delaware Basin of Texas. If Chevron manages to buy full control of the entity, eventually it will be able to further integrate its operations within the business while reducing its costs, as well as obtaining complete control over the infrastructure in order to improve the flexibility of developing the assets that generate the operations from Noble Energy.

Chevron is already the majority owner of another pipeline company. Offering to buy the shares of another pipeline operator like Noble Midstream Partners for around $422 million would help streamline what is already a very well-integrated relationship. On Friday, February 5, units rose 2.4% to $12.77, while the market concentrated on the precedent of other limited pipeline companies that have obtained premium offers, such as TC Energy Corp of Canada, which agreed last December to acquire the shares it does not yet own in its US unit for $1.68 billion.

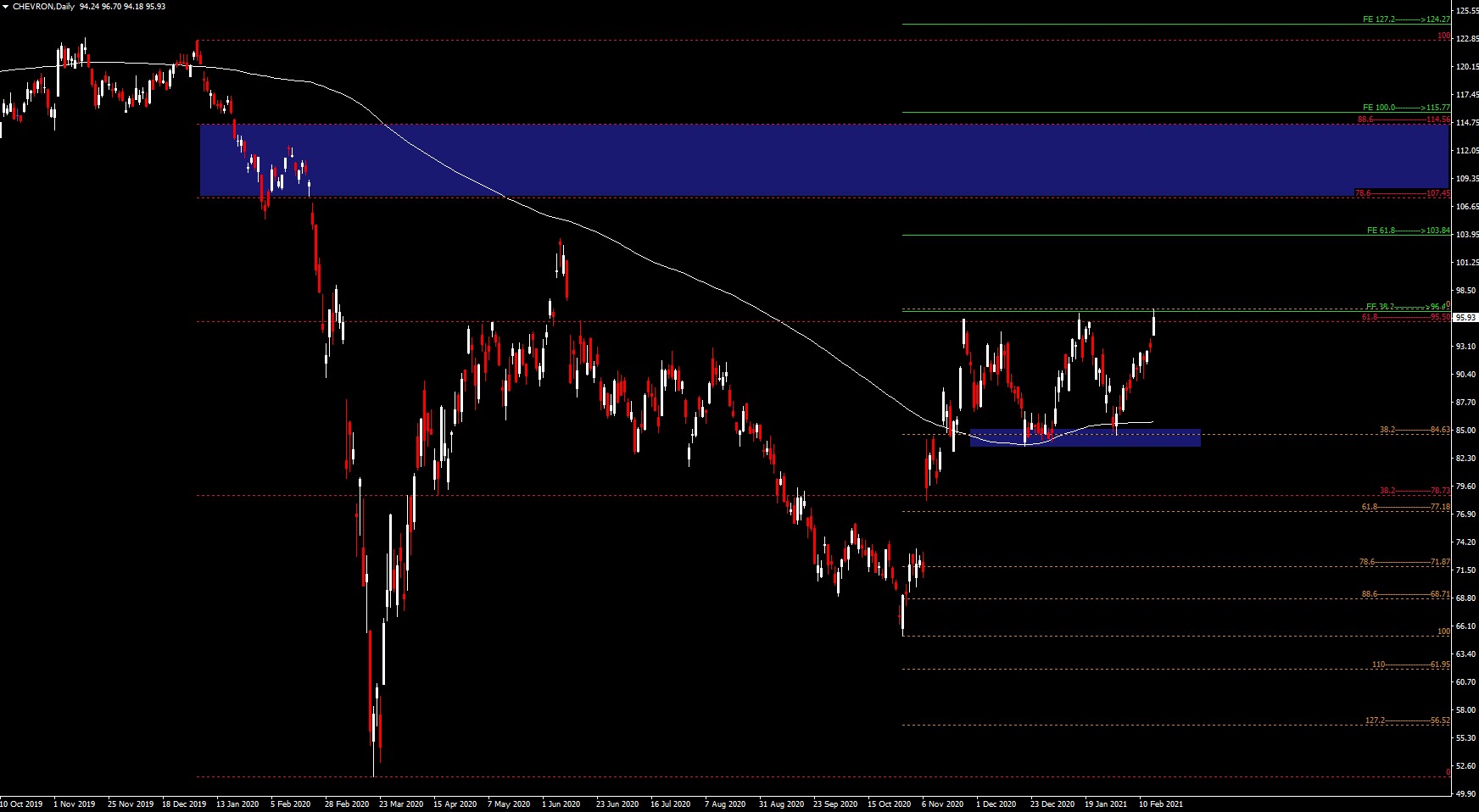

The price of Chevron had remained in a range from November to today that went from the 200-day SMA with the 38.2% Fib. level Support at $84.63 and the 61.8% Fib. level at $ 95.50. Currently the price is at $95.93 giving indications of having made a double bottom to break the range to the upside, but let’s not forget that we have the very important psychological level at $100 that could be the target currently sought. If this level is broken we could see the price rise to FE 61.8 at $103.84, 78.6% Fib. level at $107.45, the FE 100 at $115.77 and finally up to 2019 prices at the FE 127.2 at $124.27.

Click here to access the HotForex Economic Calendar

Aldo Weidner Z.

Market Analyst – HF Educational Office – LATAM

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.