Applied Materials Inc (AMAT) is a manufacturer of semiconductor, LCD and solar panel equipment. The company, valued at $104.82 billion, is expected to report first-quarter results of 2021 after the US market closes on Thursday, Feb 18. Zacks’ estimate for this quarter is for earnings to be $1.27/share. Interestingly, in the past four quarters there were three quarters that reported higher-than-expected numbers.

For this quarter, just like any other company in the semiconductor industry, Applied Materials has benefited from the growth of technology; in particular the advent of 5G technology, as well as the enormous growth of NAND flash memory and the new SSDs now used in many large enterprise computing devices, including notebooks, desktops, workstations and servers using DRAM memory.

In addition, the development of AI like machine learning is growing in tandem with the demand for computing technology in order to support the processing of large amounts of data available in various industries and allow businesses to efficiently respond to the needs of consumers that meet the target group.

Applied Materials’ investment in research and product development and addition of new product designs could also help expand its memory market share.

The uncertainty caused by the Covid 19 outbreak could affect the upcoming quarter’s earnings report, however, the previous two quarters have proven to be very strong. The company’s revenues have steadily grown to $4.39 billion in Q3 and $4.69 billion in Q4, while revenue for Q1 2021 is expected to be $4.95 billion.

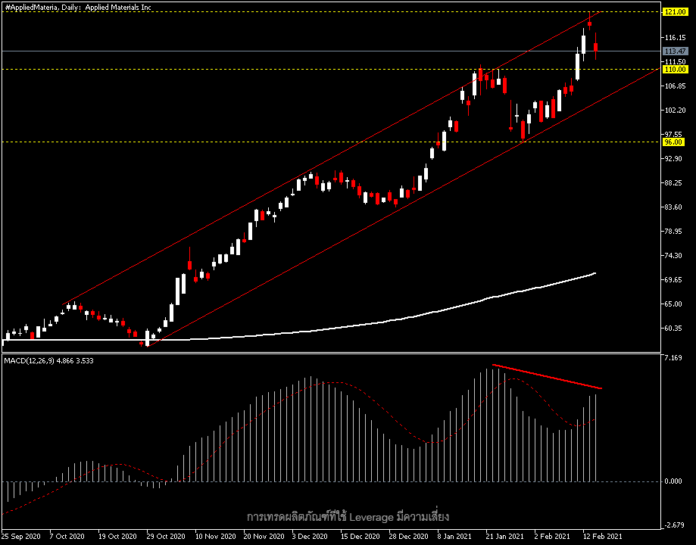

From the technical perspective there is a significant price movement. That is, the price could break the original high of $70 per share seen after the fourth quarter earnings report on Nov 12. Since seeing a new all-time high this week at the $121 zone, the stock is now stuck between the January high and the February high. The shortening of prices yesterday and today has led to a bearish divergence where the MACD started to move lower. If the report results are lower than investors expect we may see a severe drop in prices. The first support is at $110 and below that is $96. On the contrary, if the performance is good we could see the price go up to test $121 again and possibly go as far as the Fibonacci 261.8 level at $135.

Click here to access the HotForex Economic Calendar

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.