Market News Today

Stocks and bonds remain mostly underwater. The disappointing jobless claims report and higher Treasury yields also pressured. Bloomberg highlighted that the gauge of global equities is heading for its first weekly fall since January. Reflation trades continue and Treasuries pared early losses during the course of the session, leaving the 10-year yield at 1.30%, up 0.7 bp on yesterday’s close. The JPN225 closed with a loss of -0.7%, the USA100 closed -0.7% lower, with the USA500 off -0.4%, and the USA30 down -0.38%. GER30 and UK100 futures are up 0.3% and 0.02% respectively at the moment.

Headlines:

- Rising concern that the sharp rise in yields could weigh on corporate profit.

- The officials are increasingly concerned that the sharp rise in yields and thus refinancing costs will lead to sharp corrections in risk assets and that the halt in equities for now will be welcome in some quarters.

- Could the Stocks pause turn into a free tumble? Stocks are a difficult balancing act also for central banks, which continue to try and dampen fears of a cliff edge scenario on stimulus, without fuelling too much of a rally that buys into a recovery which may take longer to materialise than many hope.

- German PPI inflation jumped to 1.4% y/y in January, from just 0.8% y/y in the previous month.

- Elon Musk says Bitcoin is “simply a less dumb form of liquidity than cash”.

Today – Data releases focus on preliminary February PMI readings for the Eurozone, Germany and the UK, along with UK and Canadian Retail Sales. The US February PMI readings are also due.

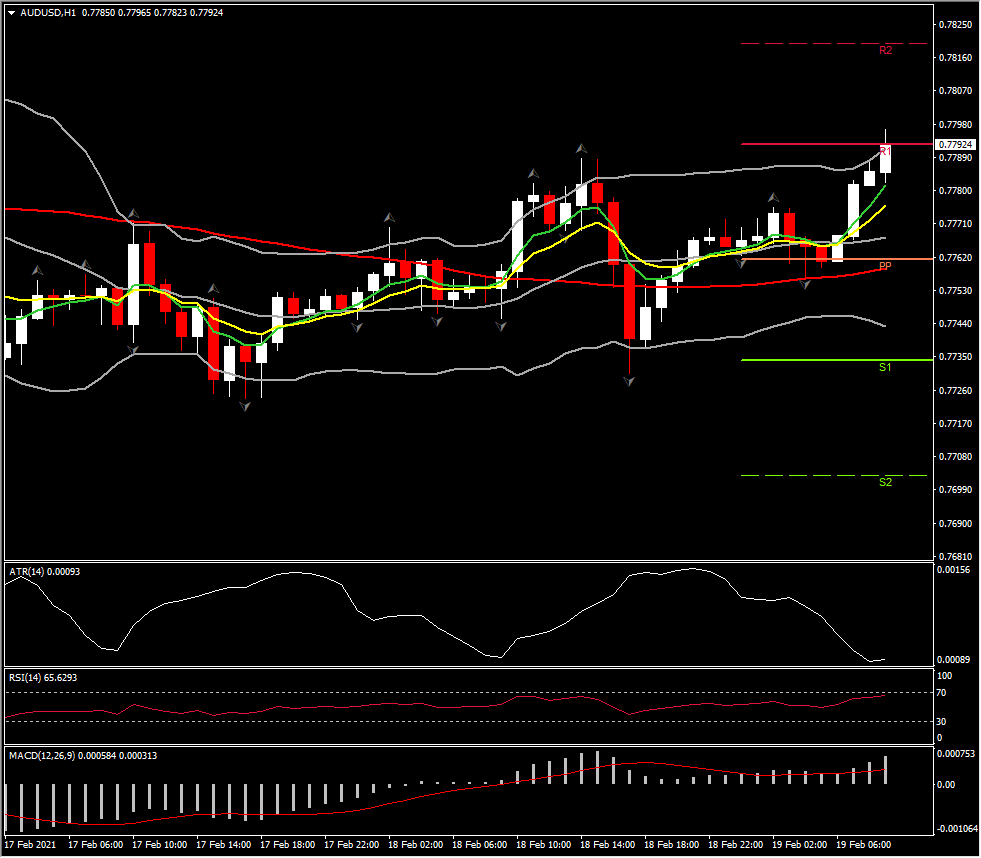

Biggest (FX) Mover @ (07:30 GMT) AUDUSD (+0.33%) Spike to 0.7797, ahead of the European open. Fast MAs aligned higher as the asset breaks the R1, with momentum indicators, MACD and RSI bullishly crossed. R2 at 0.7820 and PP: 0.7760 ATR 1H: 0.00095, ATR Daily 0.00549.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.