Market News Today

Equities heavy as Yields, Copper and VIX soar. USD recovers from lows; safe haven JPY & CHF suffer. US10yr yields touched 1.38% (now 1.345%), Equities closed down on Friday and for the week, FUTS now into 5th day lower. Reflation trade & progress in vaccination worldwide, especially in developed economies, helps commodity currencies & boosts sentiment for riskier assets. Commodities lifted (especially Copper) – except Gold ($1790) which appears to be losing its inflation hedge status to BTC, (new ATHs over $57K). VIX FUTS up 4.4% to 25.80.

This week – RBNZ rate decision, Progress on stimulus 1.9tn stimulus package, US GDP, Durable Goods, Consumer Confidence, PCE & Powell testimony. Earnings season continues (392 of S&P500 reported – 80% have beat estimates)

Today – German IFO, ECB’s Lagarde, Fed’s Bowman. UK PM Johnson to outline lockdown exit plans for England. Earnings from Marathon Oil & Occidental Petroleum.

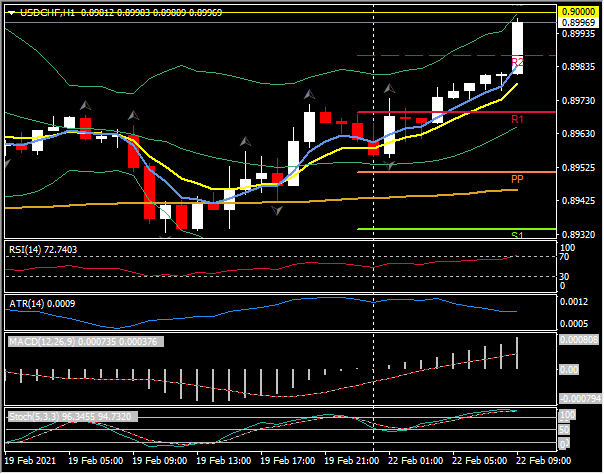

Biggest (FX) Mover @ (07:30 GMT) USDCHF (+0.34%) Rallied from 200MA on Friday (0.8940) Over 20 Ma Friday over R1 and R2 today – moving to test 0.9000 Faster MA’s aligned and trending higher, RSI 72 OB but still rising, MACD histogram & signal line aligned higher and broke over 0 line on open today. Stochs. very OB and touching 100. H1 ATR 0.0009 Daily ATR 0.0080.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.