Vipshop Holdings Limited (NYSE: VIPS), a leading China-based online discount retailer for branded products in the country, is expected to report its earnings for the fiscal quarter ending December 2020 this Thursday 25th February before market open.

Driven by a surge in the number of active customers by 36% (y/y), or 11.4 million to a total of 43.4 million, and the company’s success in customer retention with the implementation of effective merchandising and branding strategies as well as a solid supply chain network, VIPS reported satisfying financial results during the third quarter of 2020. For instance, total net revenue has recorded gains of 18.2% (y/y) to $3.4B, mostly attributed to the 172.8 million total orders that were placed by customers, up 35% from a year ago.

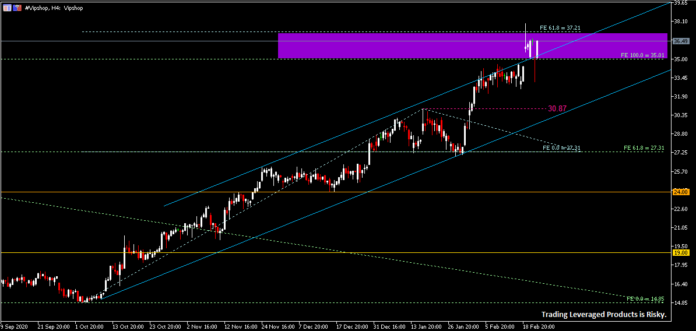

Figure 1: Reported EPS versus Analyst Forecast, by quarterly and annually. Source: https://money.cnn.com/quote/forecast/forecast.html?symb=VIPS.

For the upcoming announcement, earnings per share (EPS) is expected to hit $3.13, up 55.74% from the previous quarter. The target for yearly EPS growth is set to record an over 15% increase from the previous year to $8.54.

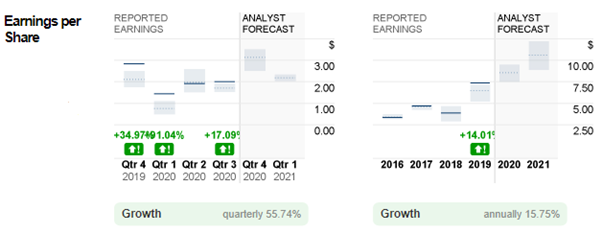

Figure 2: Reported Sales versus Analyst Forecast, by quarterly and annually. Source: https://money.cnn.com/quote/forecast/forecast.html?symb=VIPS.

On the other hand, consensus forecast for reported sales in Q4 2020 is $35.0B, up by over 50% from the previous quarter. It is also expected that annual reported sales will hit $100.7B, up 8.27% from a year ago.

Consensus median price estimates given by 23 analysts stand at $28.65, down 21.49% from the latest close price at $36.49. From the statistics given, forward P/E of VIPS stands at 21.48. This reading is much lower in comparison to its sector (consumer cyclical) and industry (internet retail), which stand at 28.01 and 39.85 respectively, indicating pessimistic market sentiment for the company’s growth within the period, thus explaining the downward revision of its share price. Even so, the company is still being rated “Buy” among polled investment analysts, considering the company’s robust fundamentals which have evidently supported the growth of its revenue and earnings by over 200% in the past 5 years.

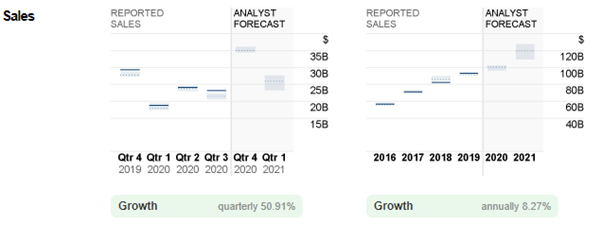

The Weekly chart shows that the #Vipshop share price has initiated a second round of bullish thrust following its rebound from a session low at $14.85 in early October last year. To date, gains from the second wave have exceeded 140%, with the share price well supported above $35.00. Indicators are bullishly aligned, with MACD lines extending towards north, while RSI and Stochastics are seen hovering around the overbought zone.

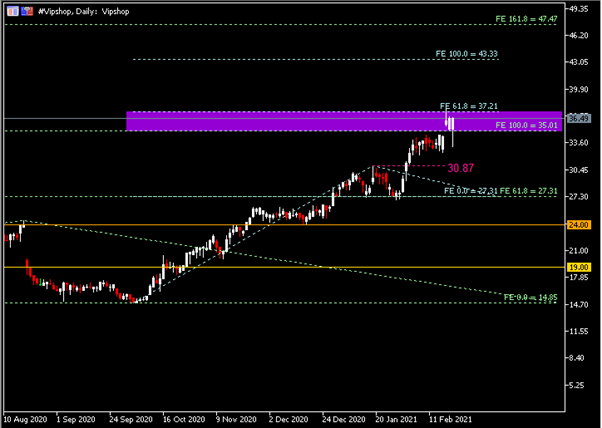

On the other hand, the Daily chart shows the #Vipshop share price testing the important resistance zone $35.00 – $37.20. If the breakout attempt is successful, the next resistance levels to watch are $43.35 (D1 FE 100.0) and $47.45 (W1 FE 161.8). Otherwise, if price retraces below the zone, support levels to focus on are $30.87 (Jan 2021 High), $27.30 (W1 FE 61.8) and $24.00.

Click here to access the HotForex Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.