This week, Fed chair Powell testimony successfully convinced markets that the punch bowl of monetary stimulus isn’t going to be taken away anytime soon, even in the face of rising inflation. While admitting that USDIndex prices are “somewhat elevated” and that there would be a brief surge in price pressures as the economy opens up from Covid restrictions, he argued that the Fed should be able to anchor expectations to prevent a higher inflationary process from taking root.

Overall, Powell’s House testimony, while largely a repeat of the Senate testimony the day before, seemed to have a greater impact on damping down yields, taking away a bit from the reflation trade story that we have seen recently. However, inflation being allowed to run higher (more than in former cycles under the prevailing policy rubric), without accompanying monetary tightening, is bearish for the USD, as it implies loosening in the real interest rates and in real Treasury yields, at least in so far as it contrasts the circumstance in other economies, as appears to be the case. Hence the story continues, with USD under pressure, while once again commodities and commodity related currencies remain the gainers of the week and the month, despite today’s firmness!

USOil prices hit new 13-month highs, showing a near 31% gain on the year so far, which marks a substantial improvement in the terms of trade of the Canadian economy. USDCAD posted a 3-year low, CADJPY traded above the 85.00 level for the first time since March 2019, aided lower by a narrowing in the US yield advantage over the Canadian yields over the last day against the 10-year and other maturities, alongside another rise in oil prices to new 13-month highs.

The supply-gap oil supercycle thesis remains strong in market narratives, with many predicting prices at $100, underpinned by demand stimulation caused by the upcoming massive stimulus in the US and EU. The anticipation of a return to societal norms on the back of Covid vaccination programs, and the lifting of travel restrictions, go hand-in-hand with this view. We harbor doubts about this, but for now it is likely to remain in the ascendant. Rising US supply and potential for a weakening in discipline amid the OPEC+ group to maintain supply quotas may offset rising demand. The ‘known unknown’ risks, to use epistemological phraseology, include new more transmissible SARS-Cov2 coronavirus variants that prove resistant to current vaccinations, or perhaps another clash between Saudi Arabia and Russia on oil production quotas. The OPEC+ group meet on March 3rd-4th to decide on April quotas, with Moscow reportedly calling for a relaxation.

Technical Analysis

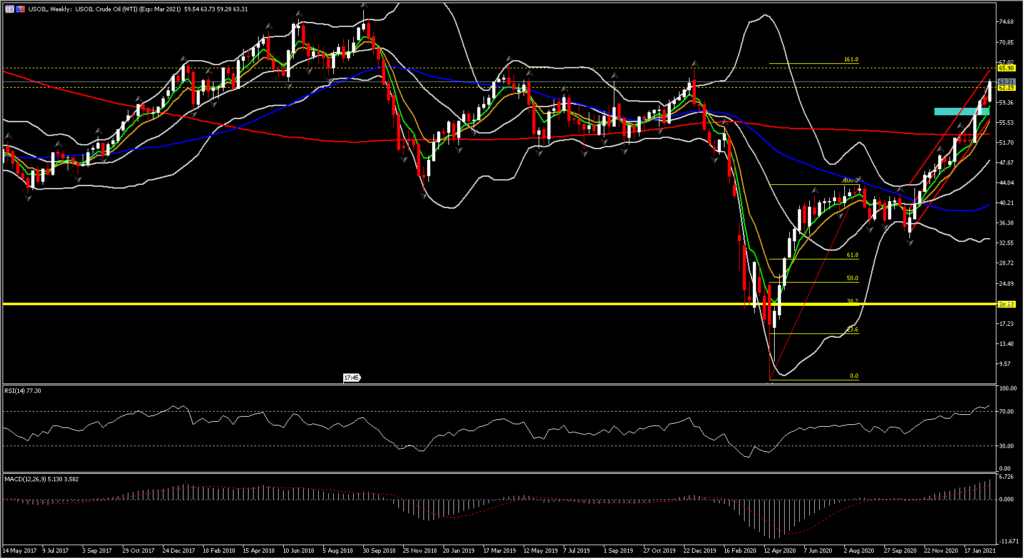

The USOIL holds firm so far above the $63 level after closing yesterday above our latest daily up fractal and 7-day Resistance at $62.20. The momentum indicators are flashing green, unable to spoil the 5-month rally. The MACD lines have been extending northwards with an increasing slope since October and the RSI is posting higher lows, suggesting that momentum remains in the bulls’ favour and any pullback is a correction of the trend.

The intraday outlook at the same time is mixed, as RSI, MACD and Stochastics are aligned lower. This however is likely just an indication of intraday pullbacks before another attempt higher. Key resistance will be the 2020 high at 63.60, which could strengthen the possibility of a return to 2- or even 3-year highs (next Resistance from 2019 at 66.60). A fall will not fear bulls as long as the asset sustains above the 20-day SMA which coincides with the bottom line of the 5-month channel, at the $57-58.60 area.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.