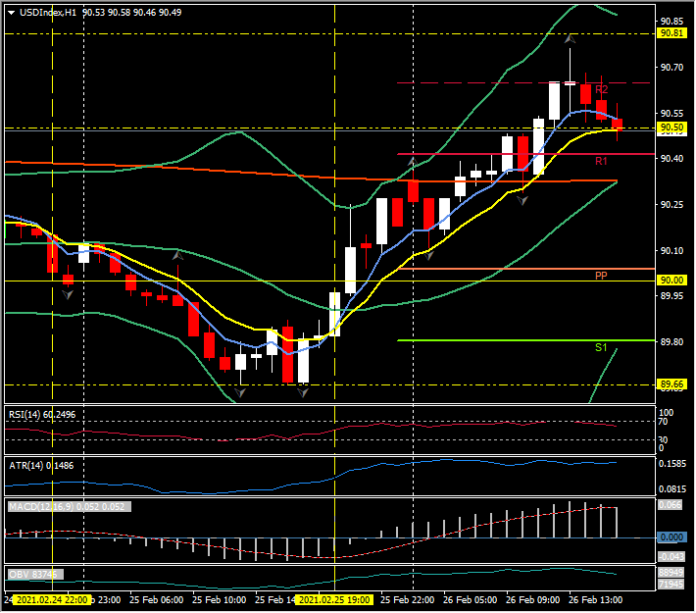

USDIndex, H1

US personal income climbed 10.0% in January and spending increased 2.4%, pretty close to expectations, with much of the strength a function of the $900 bln pandemic relief bill from late December. These follow respective December prints of 0.6% and -0.4%. Compensation increased 0.7% after edging up 0.5% in December, while wage and salary income also rose 0.7% versus the prior 0.5% gain. Disposable income climbed 11.4% from 0.6%. The key savings rate jumped to 20.5%, the highest since May, following December’s 13.4% rate. The PCE deflator was up 0.3% after the 0.4% prior gain. The core rate was 0.3% higher, as it was in December. On a 12-month basis, the headline price index accelerated to a 1.5% y/y versus 1.3% y/y and the core rate rose to a 1.5% y/y pace from 1.4% y/y. “Real” spending bounced 2.0% in January after sliding -0.8% in December.

Yields are lower as the bond market stabilizes and recovers some poise after this week’s big selloff that culminated with a hefty spike in rates yesterday that saw the 10-year test 1.60% and the 30-year challenge 2.39%. Those were the cheapest in over a year and there was little impact from the income and spending data. The 30-year is 7.5 bps lower at 2.199% and the 10-year has fallen 6 bps to 1.46%. The front end also is correcting with the 2-year 3 bps lower at 0.141% after surging to a high of 0.187%. A month-end duration bid may support the rebound in the market as Barclays estimates its Treasury index extends 0.14 years, up from the 0.12 year average since new 10-, 20-, and 30-year maturities were auctioned.

US equity market futures rebounded from lows, cheered by the firm personal income/consumption reports, and the USA500 opened at 3,842 up 13 points from yesterday’s close at 3829 following the 2.45% decline. USA30 trades at 31,306 (down 95 points) and the tech heavy USA100, which lost over 3.5% yesterday to close at 13,119, opened up over 1.10% at 13,265.

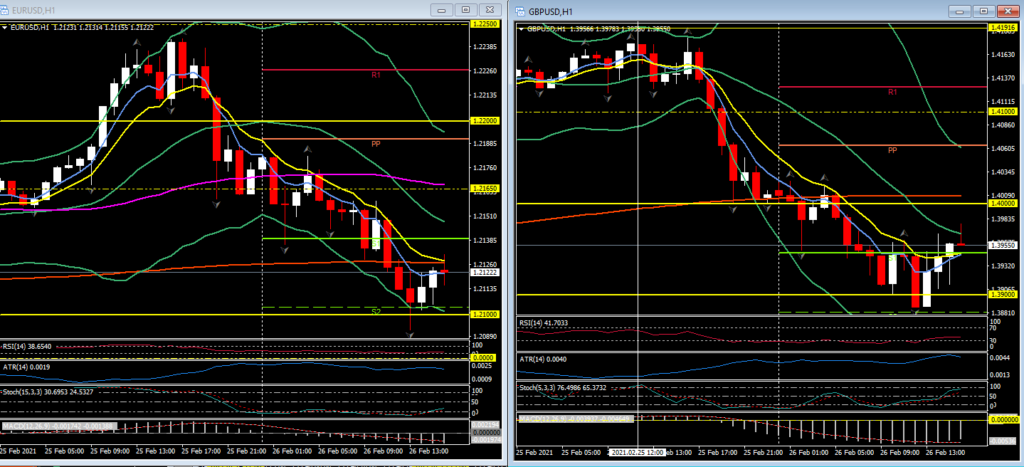

The USD continues to recover with the USDIndex testing the R2 level at 90.65, EURUSD trading under S2 and 1.2100 earlier before recovering to 1.2120 and Cable is currently down 0.38% today having been under 1.3900 earlier.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.